When you start looking into senior care for a loved one, one of the first questions that comes to mind is almost always, "What is this going to cost?" Getting a handle on the average cost of assisted living in Texas is the first step to creating a realistic financial plan.

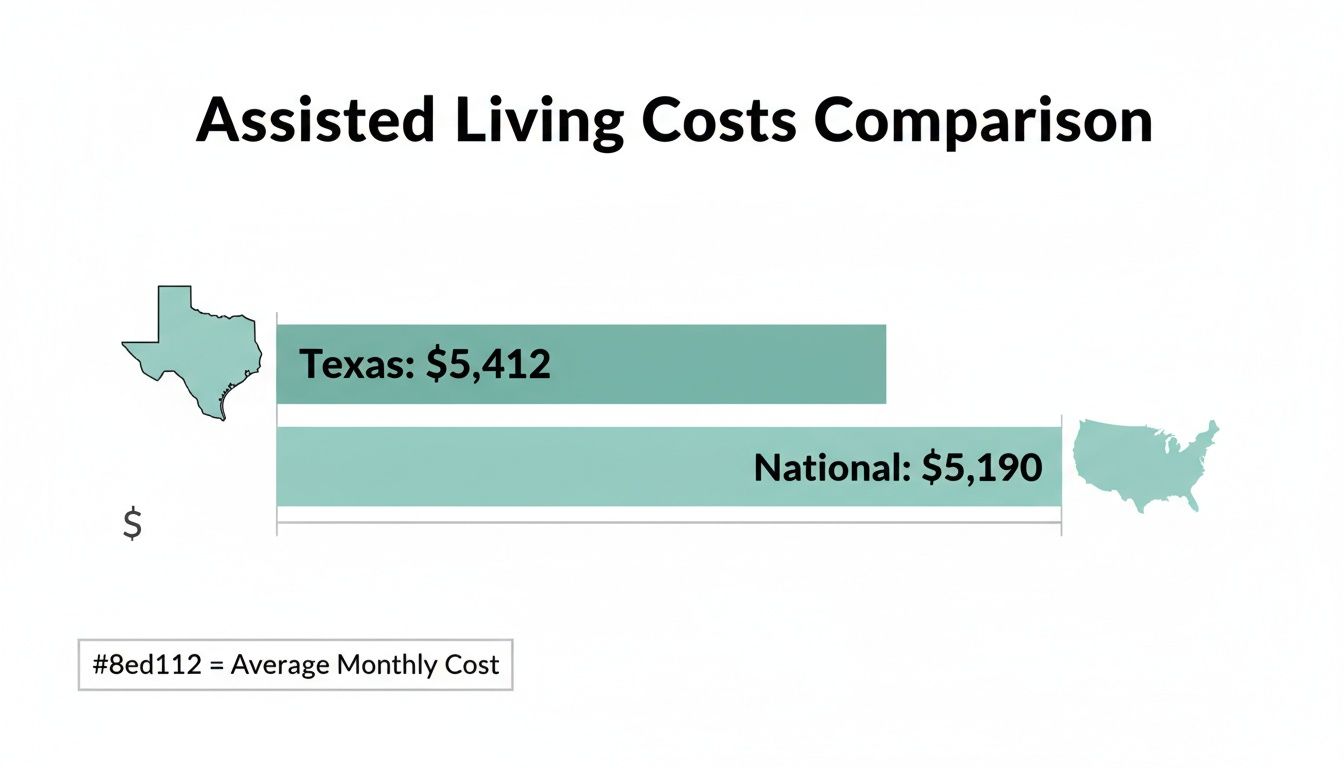

In Texas, the median monthly cost for assisted living is about $5,412. That’s a little bit higher than the national median, which sits around $5,190. Think of this number as a starting point—a helpful benchmark as you begin your search.

Setting A Financial Baseline For Your Search

Knowing that initial number helps you avoid sticker shock and lets you focus on communities that actually fit within your family's budget. It’s like having a landmark on a map; it gives you a point of reference to evaluate what different communities are offering and whether their pricing is above, below, or right around the state average.

This baseline provides the context you need to make sense of the quotes you'll receive from different facilities.

Comparing Texas Costs To The National Average

So, where does Texas really stand when you look at the bigger picture? Recent industry data shows the median monthly cost for assisted living in the Lone Star State falls somewhere between $5,200 and $5,600.

Placement data from A Place for Mom, for example, puts the Texas median right at $5,412 per month, while other market reports show an average closer to $5,578. This positions Texas just slightly above the national median of $5,190 a month. While it's not the cheapest state, the costs are very much in line with the country as a whole, which is good news for families trying to budget.

As you can see, the costs in Texas are competitive and not a major outlier, which can be reassuring as you start planning.

Below is a quick look at how the Texas median stacks up against the national average and some of the state's major cities.

Assisted Living Monthly Cost Snapshot Texas Vs National

| Location | Median Monthly Cost |

|---|---|

| Texas (Statewide) | $5,412 |

| Houston Area | $5,625 |

| Dallas-Fort Worth Area | $5,500 |

| Austin Area | $5,850 |

| San Antonio Area | $4,995 |

| National Average | $5,190 |

This snapshot really highlights how much location within Texas can influence the final price tag.

From Averages To Individual Needs

While knowing the state average is a great start, it's just one piece of the puzzle. The price you'll actually pay comes down to the specific needs of your loved one and the community you choose. That average figure blends everything from basic, no-frills accommodations to luxury communities packed with amenities.

Here are a few things to keep in mind:

- Averages are a guide, not a guarantee. They mix costs from bustling metro areas like Dallas with quieter, more rural towns.

- The level of care is a huge factor. Someone who only needs a little help with daily tasks will pay much less than a resident who requires significant, hands-on assistance.

- The type of community matters. It's worth taking time to explore the different types of assisted living facilities to see how their services and pricing models vary.

Understanding these differences is the key to moving from a general cost estimate to a truly personalized financial plan for your family.

Key Factors That Influence Your Final Monthly Bill

That statewide average for assisted living costs? It’s a great starting point, but it really doesn't tell you the whole story.

Think of it like the sticker price on a car. The final cost depends entirely on the features and packages you add. It’s the same with assisted living—several key variables come together to determine what a family actually pays each month.

Getting a handle on these factors is crucial. It explains why one community’s quote might look so different from another’s and shows you where you might have some flexibility to fit your budget. The big three are always the resident's room, their specific care needs, and the community's location.

Apartment Type And Size

Just like renting an apartment anywhere, the size and style of a resident's living space play a huge part in the monthly cost. Most communities get this and offer a few different floor plans to accommodate various budgets and preferences.

- Studio or Companion Suite: These are almost always the most budget-friendly choices. A studio is a single, open-concept room. A companion suite means sharing a larger apartment with a roommate, which can dramatically lower the monthly bill.

- One-Bedroom Apartment: This is the classic option, offering a nice balance of privacy and space with separate living and sleeping areas. It usually falls into the mid-range price point.

- Two-Bedroom Apartment: As the largest and most expensive option, these suites are perfect for couples or for individuals who want extra space for hobbies or a home office.

The price difference can be significant. It’s not uncommon for a private one-bedroom to cost $1,000 to $2,000 more per month than a shared or studio apartment within the very same community.

Level Of Personal Care

This is probably the single most important factor driving the final price. Assisted living is not a one-size-fits-all service. Before anyone moves in, communities perform a detailed assessment to figure out exactly how much support a resident needs with their Activities of Daily Living (ADLs).

Simply put, the more hands-on help someone needs, the higher the cost.

Someone who's pretty independent and just needs a nudge to take their medications will pay much less than a resident who needs daily help with bathing, getting dressed, and moving around safely. Communities often group these needs into different care levels. You can get a better feel for the specific assisted living services available and see how they line up with pricing.

Typically, a community’s price includes a base rent for the room, meals, and basic amenities. The cost for personal care is then added on top, creating a final bill that truly reflects what that individual needs.

Geographic Location

Where a community is located has a massive impact on everything, especially the price. It comes down to basic economics. Real estate values, local wages, and property taxes in a big city like Austin or Dallas are just plain higher than in a smaller town.

This creates a surprisingly wide range of assisted living costs across Texas. For example, recent data shows that while Dallas and San Antonio have median costs around $5,150 and $5,180 per month, Houston is a bit higher at nearly $5,994.

Then you have Austin, which can have average fees soaring as high as $6,650 a month. That’s a spread of up to 30% between different Texas cities! It just goes to show why looking right outside a major metro area can be such a powerful way to save money.

Decoding Why Assisted Living Costs Are On The Rise

Seeing the average cost of assisted living in Texas is a solid starting point, but it's just that—a starting point. Those numbers aren't set in stone. Just like almost everything else, the price of senior care feels the squeeze from economic pressures, and that means costs go up over time. To plan effectively for the future, you have to understand why these shifts happen.

Think about your own bills. Have your grocery and utility costs climbed? Assisted living communities are dealing with the exact same thing. These aren't fancy upgrades or luxury add-ons; we're talking about the fundamental costs of keeping the lights on and providing a safe, comfortable, and caring home. When the price of food, electricity, and basic maintenance goes up for them, it eventually has to be reflected in the monthly fees.

The Growing Demand For Quality Care

Another big piece of the puzzle is simple supply and demand. The number of older adults in Texas, and really across the whole country, is growing fast. As more and more seniors need a supportive place to live, the demand for great assisted living communities shoots up, and that puts natural upward pressure on prices.

This demographic wave means more families are competing for the available spots in the most respected communities. This demand is even stronger for specialized services, like memory care for folks living with Alzheimer's or dementia. As you look at your options, it's really helpful to get a handle on what memory care assisted living entails and see why its intensive, specialized nature often comes with a higher cost.

The Rising Cost Of Skilled Labor

But maybe the single biggest driver pushing costs up is what it takes to hire and keep fantastic, skilled caregivers. The real heart of any assisted living community is its people—the nurses, aides, and support staff who are there 24/7. In a tight job market, finding and holding onto compassionate, qualified professionals means offering competitive wages and good benefits.

This is especially true in healthcare. There’s an ongoing shortage of skilled caregivers nationwide, which means communities have to invest more in their teams to make sure residents get the excellent care they absolutely deserve. That investment in people is a direct, non-negotiable part of the monthly cost.

The reality is that labor accounts for the largest portion of an assisted living community's budget. Rising wages are not just a line item; they are a direct investment in the quality of life and safety of every resident.

Recent trends back all of this up. Multiple cost-of-care surveys show how inflation and workforce shortages are pushing prices higher. For example, CareScout's 2024 data found a 10% year-over-year increase nationally. That brought the median annual cost to about $70,800, which breaks down to nearly $5,900 a month. You can see the full report from the CareScout cost of care survey for yourself.

These numbers really drive home the need for families to budget for annual price growth when you're mapping out a financial plan for the next three to five years.

By understanding these forces—everyday inflation, growing demand, and critical labor costs—you can get a much better feel for future rate changes. It helps you build a more realistic and resilient budget, making you a far more informed and prepared consumer in your search for the right community.

Navigating Payment Options For Texas Seniors

Figuring out the cost of assisted living is the first big step. The next, just as critical, is asking, "So, how do we pay for it?" Thankfully, Texas families have a few different paths to explore for funding senior care, running the gamut from personal savings to government programs.

It helps to think of this as putting together a financial toolkit. Not every tool will work for every family, but knowing what's available lets you build a solid, reliable plan. While personal funds often form the foundation, several specialized resources can provide a major boost.

Tapping Into Private Funds

The most straightforward way to cover assisted living costs in Texas is by paying privately. This approach gives you the most freedom and choice because it isn’t tied to the strict eligibility rules that come with government aid.

Private funding is usually a mix of a few different sources:

- Retirement Savings: This is what pensions, 401(k)s, and IRAs were made for—supporting you in this chapter of life.

- Social Security Benefits: Those monthly checks provide a steady, predictable income stream to put toward care.

- Sale of a Home: For many older adults, their home is their biggest financial asset. Selling it can unlock significant equity, often enough to fund care for years.

- Annuities and Investments: Other financial assets can be arranged to create a consistent monthly income to handle expenses.

Using private funds puts you in the driver's seat, letting you pick a community based on what you like—the location, the people, the amenities—not on program limitations.

Using Long-Term Care Insurance

For those who planned ahead, a Long-Term Care (LTC) insurance policy can be a game-changer. These policies are built specifically to cover services like assisted living when a person needs help with a certain number of Activities of Daily Living (ADLs), like getting dressed or bathing.

But here’s the thing: every policy is different. They vary wildly in what they cover, how much they pay out per day, and how long you have to wait before the benefits start (the "elimination period"). You have to read the fine print. To get a better handle on how to use your policy, check out our guide on how long-term care insurance coverage for assisted living works. It’ll walk you through verifying your coverage and getting a claim started the right way.

Exploring Benefits for Veterans

Veterans and their surviving spouses might qualify for some serious financial help through the Department of Veterans Affairs (VA). One of the most impactful benefits for assisted living is the VA Aid and Attendance pension.

This is a special, tax-free monthly payment that comes on top of a basic VA pension. It's designed for veterans who are housebound or need help with their daily activities.

To get it, a veteran has to meet specific service, income, and asset requirements, and they need a doctor to document their need for care. The money from Aid and Attendance can be used to pay for services in an assisted living community, making it an incredibly powerful tool for eligible Texas seniors.

Leveraging Texas Medicaid Waivers

For seniors with limited financial resources, Texas Medicaid has programs that can help pay for the care services they receive in an assisted living community. It's a key distinction—standard Medicaid doesn't cover room and board, but these special "waiver" programs can cover personal care.

The main program here in Texas is the STAR+PLUS waiver. It’s a managed care program that helps pay for support with ADLs, medication reminders, and other crucial services for those who qualify.

Getting approved for a Medicaid waiver isn't easy; the criteria are strict.

- Income Limits: Applicants have to be below a certain monthly income level.

- Asset Limits: There are also tight limits on countable assets, though some things, like a primary home, might be exempt under specific rules.

- Medical Need: A doctor has to certify that the person needs a level of care similar to what’s provided in a nursing home.

For many Texas families, the Medicaid Waiver Program in Texas is an absolute lifeline. The application process can feel like a maze, but the support it offers is often what makes assisted living possible for families without deep pockets.

To help you keep these options straight, here’s a quick overview of the most common funding sources.

Funding Sources For Assisted Living At A Glance

| Funding Option | Best For | Key Consideration |

|---|---|---|

| Private Pay | Families wanting the most flexibility and choice in communities. | Requires significant personal savings, investments, or home equity. |

| Long-Term Care Insurance | Individuals who planned ahead and purchased a policy, typically in their 50s or 60s. | Policies have specific triggers, daily limits, and elimination periods. |

| VA Aid & Attendance | Wartime veterans (and surviving spouses) with a documented medical need for care. | Must meet specific service, income, and asset requirements. |

| Texas Medicaid Waivers | Seniors with very limited income and assets who need a nursing facility level of care. | Does not cover room and board; eligibility rules are strict and complex. |

Each path has its own map, and the best route for your family will depend on your unique financial situation, health needs, and long-term goals.

Creating Your Personalized Cost Estimate

State and city averages for assisted living costs in Texas can give you a great bird's-eye view, but they don't tell the real story—what your family will actually pay. To get a number that truly means something, you have to shift from general data to the personal details of your loved one's life. It's time to build a realistic financial picture you can count on.

Think of it like creating a simple budget worksheet. On one side, you'll list all the potential expenses based on your loved one’s specific needs and preferences. On the other, you'll tally up all the financial resources you have to work with. This simple exercise can transform a vague, stressful question into a clear, manageable plan, pointing you toward communities that are a perfect fit.

Step 1: Itemize Your Loved One's Care Needs

First things first, let's get specific about the support your family member needs every day. The more detailed you are now, the more accurate your cost estimate will be. This isn't the time for guesswork; be completely honest about the level of assistance required.

Start by thinking through these common areas of support:

- Medication Management: Is it just a matter of simple reminders, or does your loved one need a licensed nurse to actually administer medications?

- Mobility Assistance: Do they need a steady hand to help them stand up, walk to the dining room, or transfer from a bed to a chair?

- Personal Care (ADLs): Make a list of any help needed with daily routines like bathing, dressing, grooming, or using the restroom.

- Specialized Care: Is memory care for dementia a necessity? What about incontinence management or support for specific health conditions like diabetes?

- Social and Emotional Needs: Think about their personality. Are they a social butterfly who would thrive with a full calendar of activities, or do they prefer quiet, one-on-one interactions?

This list is your foundation. When you visit a community, you can hand them this list and get a precise quote for that specific level of care, getting you past the generic "base rate" and into the real numbers.

Step 2: Factor in Lifestyle and Location Preferences

Next up is the living environment itself. Just like with the level of care, the choices you make here will have a direct impact on the final monthly bill.

Sit down with your loved one and family to talk through these preferences:

- Apartment Size: A private one-bedroom apartment will naturally cost more than a cozy studio or a shared companion suite.

- Community Location: Are you set on a particular neighborhood in a major city like Houston, or are you open to looking at communities in surrounding areas like Willis? Exploring assisted living in your target area can reveal some surprising price differences just a few miles down the road.

- Amenities: Does your loved one need or want specialized amenities like an on-site therapy gym, a swimming pool, or gourmet dining options? These premium features definitely add to the cost.

Balancing the "must-haves" with the "nice-to-haves" is the key to matching their desires with your budget. If you want to see how different inputs affect the final price, you could even play around with tools that let you create your own online cost estimator.

Step 3: Inventory Your Financial Resources

Once you have a clear picture of the potential expenses, the final step is to build an equally detailed list of all your available financial resources. This will show you exactly what you can comfortably afford each month.

Don't just guess. It’s crucial to gather actual statements and documents to get hard numbers for your monthly income and total assets. This kind of clarity is what makes solid, long-term planning possible.

Your financial resource checklist should include:

- Monthly Income: Add up all the regular income streams, like Social Security benefits, pensions, and any investment dividends.

- Liquid Assets: Tally up what's in savings accounts, checking accounts, stocks, and bonds that can be accessed without a fuss.

- Long-Term Assets: Take note of the value of real estate, especially a primary home, which can often be sold to fund several years of care.

- Potential Benefits: Make a note of any Long-Term Care Insurance policies, VA benefits like Aid and Attendance, or if you might qualify for Texas Medicaid waivers.

By comparing your detailed needs list with your comprehensive financial inventory, you'll have a powerful, personalized estimate. This number becomes your guide, allowing you to confidently search for communities that are a great fit for both your loved one’s care requirements and your family's budget.

Alright, you've got a much better handle on the potential costs and how you might pay for them. Now it's time to put that knowledge to work.

This is where your research starts to feel real. You’ll be shifting from spreadsheets and websites to visiting communities, asking tough questions, and finding the place that feels right for your family's budget and, more importantly, your loved one.

Key Questions To Ask On Every Tour

It's so easy to get caught up in the beautiful lobby or the friendly wave from a resident when you first walk into a community. But to truly understand the financial commitment, you need to dig deeper. Go in prepared with a list of questions to get to the heart of their pricing.

I recommend bringing a notepad for every single tour. This lets you compare apples to apples later.

- What’s actually in the base monthly rent? Ask them to break it down. Does it include all three meals, housekeeping, laundry, transportation, and all the activities on the calendar?

- How do you charge for personal care? Do they use different levels or tiers? Is it an "a la carte" menu where you pay for each service? Or is it all-inclusive? Don't be shy—ask to see the actual price sheet for each care level.

- What are the most common extra fees people see? You'll want to know about potential add-ons for things like medication management, incontinence supplies, pet fees, or special meals.

- Can you tell me how much the rent has gone up each year for the past three years? This gives you a real-world idea of what to expect for future rate increases so you can budget accordingly.

Getting these answers, preferably in writing, is the only way to accurately compare the true assisted living costs in Texas from one place to the next.

Practical Tips For Managing Costs

While you never want to compromise on quality care, being smart about the financial side of things is a huge piece of the puzzle. The good news is there are several ways to make assisted living more affordable without sacrificing the quality of life your loved one deserves.

Smart financial planning isn't about finding the cheapest option. It’s about finding the best value—a community that meets all your loved one’s needs at a price your family can sustain long-term.

As you start to narrow down your options, think about these cost-saving strategies:

- Explore Companion Suites: Sharing an apartment with a well-matched roommate can dramatically lower the monthly rent, sometimes by $1,000 or more. It also offers a wonderful, built-in source of companionship.

- Look Just Outside Major Metro Areas: It’s no secret that communities right in the middle of Houston or Austin come with a premium price tag. By expanding your search to welcoming suburbs or towns like Willis, you can often find fantastic communities at a much more manageable cost.

- Negotiate Move-In Fees: Many communities have a one-time community fee. It never hurts to ask if they're running any specials or if that fee can be reduced or even waived.

Each of these small adjustments can lead to big savings over time, potentially putting a community that felt just out of reach right within your budget. Your final decision will be a thoughtful balance of care, community, and cost.

Common Questions About Texas Assisted Living Costs

Trying to make sense of the financial side of senior care always brings up a lot of important questions. Let's walk through some of the most common concerns we hear from families who are just starting to explore assisted living costs in Texas.

Does Medicare Cover Assisted Living in Texas?

This is easily one of the first questions on everyone's mind, and the simple answer is, unfortunately, no. It's a common misconception, but Medicare is a health insurance program, not a long-term care plan. It’s designed to cover medical needs—think doctor’s appointments, hospital stays, or short-term skilled nursing care after a hospital visit.

Assisted living, on the other hand, is considered custodial care. This is a crucial distinction. It means the focus is on helping with Activities of Daily Living (ADLs) like bathing, getting dressed, and managing meals, rather than direct medical treatment. Medicare simply wasn't set up to pay for this kind of day-to-day, non-medical support or the room and board that comes with it.

Is Memory Care More Expensive Than Standard Assisted Living?

Yes, you can almost always expect memory care to have a higher price tag. The cost difference is significant, often running 10% to 20% higher than what you'd see for standard assisted living. That extra cost directly reflects the highly specialized nature of the care required.

Memory care communities are built differently from the ground up. They require:

- Higher Staffing Ratios: You need more caregivers on hand to provide safe, round-the-clock supervision and support for residents living with dementia or Alzheimer's.

- Specialized Training: The staff isn't just bigger; they're better trained. They learn specific dementia care techniques to manage behavioral symptoms with real compassion and expertise.

- Enhanced Security: These communities are designed as secure environments with features that prevent wandering and ensure every resident is safe.

So, that higher cost isn't arbitrary—it directly funds the extra people, training, and security needed to create an environment where residents can thrive safely.

What happens if a resident runs out of money? This is a tough but essential question to ask. If a resident's private funds are used up, the most common next step is to apply for Texas Medicaid through a program like the STAR+PLUS waiver. While it's not a guaranteed solution, it can provide a pathway for your loved one to continue receiving care.

At Forest Cottage Senior Care, we know that getting clear, honest answers is the first step in planning for the future. We're here to help you sort through these questions and understand all your options. Contact us today to schedule a personalized assessment and tour to see how we can support your family on this journey.