Yes, Medicaid can help pay for assisted living—but it’s not as simple as cutting a check for the entire monthly bill. This is one of the most common points of confusion for families.

Medicaid will not pay for room and board in an assisted living community. Instead, it’s designed to cover the specific care services a person receives, like help with personal care or medication management. This is done through state-specific programs, leaving you or your loved one to cover the cost of rent.

Understanding How Medicaid Supports Assisted Living

When families ask if Medicaid pays for assisted living, they're usually thinking about how it covers nursing home costs—a single payment that includes both medical care and the living space. But the approach for assisted living is entirely different, and it's a critical distinction.

Medicaid views assisted living as a residential setting, not a medical institution. Because of that fundamental difference, federal rules strictly prohibit it from paying for "room and board." This means the costs for the apartment itself, utilities, and raw food expenses are not covered.

What Medicaid Actually Covers

So, where does the help come in? Medicaid directs its funding toward the services a resident needs within the community. Think of it as support that helps a person stay as independent as possible and avoid moving to a more restrictive nursing home.

Services that Medicaid typically covers in assisted living include:

- Personal Care: Hands-on assistance with Activities of Daily Living (ADLs) like bathing, dressing, and grooming.

- Medication Management: Reminders or direct help to ensure residents take their prescriptions correctly.

- Health-Related Services: General nursing oversight and help coordinating with doctors and other healthcare providers.

- Supportive Services: Things like transportation to medical appointments or help with laundry and housekeeping.

To get a clearer picture of this split, here’s a simple breakdown of how the coverage differs between assisted living and a nursing home.

Medicaid Coverage Breakdown: Assisted Living vs. Nursing Home

| Service Type | Assisted Living Coverage (Typical) | Nursing Home Coverage (Typical) |

|---|---|---|

| Room & Board | Not Covered (Rent/Apartment Costs) | Covered |

| Personal Care | Covered (Help with bathing, dressing, etc.) | Covered |

| Medication Mgmt. | Covered | Covered |

| Skilled Nursing | Covered (Oversight/Coordination) | Covered (Comprehensive Medical Care) |

| Meals | Partially Covered (Labor for prep, not raw food) | Covered |

This table highlights the main takeaway: in assisted living, the resident pays for the "roof over their head," while Medicaid helps pay for the care they receive under that roof.

This model allows states to support seniors in a more homelike, less institutional environment. And while it doesn’t pay the rent, getting financial help with daily care can make an otherwise unaffordable option suddenly feel within reach. Understanding the core philosophy of what is assisted living helps explain why Medicaid structures its payments this way.

Medicaid acts as a crucial partner in paying for the care services delivered in assisted living, even if it doesn't cover the rent. In fact, national data shows that nearly one in five assisted living residents gets help from Medicaid to pay for their daily care needs.

Think of it as a partnership. The resident or their family handles the housing portion, and Medicaid steps in to help with the essential care that makes living there successful. For a closer look at the financial details and how much Medicaid pays for assisted living, some resources break down the numbers by state. Grasping this separation between "rent" and "care" is the single most important concept as you explore your options.

Why Assisted Living and Nursing Homes Are Funded Differently

To get why Medicaid treats assisted living and nursing homes so differently, you have to stop seeing them as just different types of buildings. It’s better to think of them as two completely different philosophies of care. This fundamental difference in their purpose is the real reason behind the funding rules.

An assisted living community is basically a supportive apartment complex. Its main goal is to help a resident stay as independent as possible in a home-like, residential setting. It provides a safety net—help with daily tasks, medication reminders, and meals—but it's all built around personal freedom.

A nursing home, on the other hand, is a medical facility, plain and simple. It's set up to provide 24/7 skilled nursing care for people with complex health conditions who can't be safely cared for anywhere else. The entire operation is built around constant medical supervision.

The Medical Model vs. The Residential Model

This distinction is everything because Medicaid was originally designed to pay for medical services, not for housing. A nursing home fits perfectly into this "medical model" of care.

Because a nursing home provides non-stop medical services, Medicaid views it as a place where room, board, and care are all tangled up together as part of one essential medical treatment. This is why it covers the entire bill for those who qualify.

Assisted living works on a "residential model." It separates the cost of housing (your room and board) from the cost of the care services you receive. You’re essentially renting an apartment and then getting supportive services delivered to you in that home. Medicaid is only set up to pay for the services part of that deal, not the rent.

A Tale of Two Philosophies

Let's imagine you're trying to help someone who has trouble cooking for themselves anymore.

- The Nursing Home Approach: This would be like moving the person into a hospital cafeteria where every single meal is prepared and served by staff around the clock. The whole environment is designed to manage the medical need, bundling food, shelter, and supervision into one all-inclusive package.

- The Assisted Living Approach: This is more like getting a meal delivery service or a personal chef to come to the person’s apartment. They still live in their own space but get the specific help they need—in this case, meals—to stay independent. Medicaid pays for the "chef," but the resident is still on the hook for their apartment rent.

This little story gets to the heart of the split. Medicaid's traditional rules are built to cover the all-in-one medical solution (the nursing home). But it needs special programs, called waivers, to fund the à la carte services you find in a residential setting (assisted living). For a deeper dive into the kind of comprehensive care you'd find in a skilled nursing facility, check out our guide on what is a nursing home.

Understanding this core difference—medical institution versus a residential community that offers services—is the key to grasping why Medicaid does not pay for assisted living room and board. The system was built to fund necessary medical care, and it considers housing a personal expense unless it's a non-negotiable part of an intensive, institutional medical plan. This is why families have to learn about state-specific waiver programs to get help with care costs while also figuring out how to cover the rent on their own.

How HCBS Waivers Make Assisted Living Possible

So, if federal rules say Medicaid can't pay for room and board, how does it end up helping with assisted living costs? The key is a clever set of state-level programs called Home and Community-Based Services (HCBS) Waivers. These are the main tools states use to help seniors get care outside of a nursing home.

Think of a waiver as a special permission slip. It lets a state "waive" the usual Medicaid rules, giving it the flexibility to use funds for care in places like an assisted living community. Instead of paying for an all-inclusive stay in a medical institution, the waiver pays for specific services that help someone stay independent in a community setting.

This reflects a huge shift in long-term care philosophy, moving away from institutionalization and toward helping seniors age with dignity in their community. You can see this change in the national spending numbers. Back in fiscal year 2016, a whopping 57% of Medicaid long-term care spending—around $94 billion—went toward HCBS instead of nursing homes. It shows just how committed the system is to community-based options, even though residents are still responsible for their own room and board. You can read more about how Medicaid finances senior care to see these trends for yourself.

What Do HCBS Waivers Actually Cover?

An HCBS Waiver isn't a blank check. It’s used to build a personalized care plan that only funds the specific services a person actually needs, based on a professional assessment. This makes care much more tailored and, frankly, more cost-effective.

Common services covered by waivers often include:

- Personal Care Assistance: Hands-on help with daily activities like bathing, dressing, and eating.

- Medication Management: Making sure medications are taken correctly and on time, which is critical for anyone managing chronic conditions.

- Case Management: A professional who helps coordinate all the different health and social services to ensure nothing falls through the cracks.

- Transportation Services: Getting to and from doctor's appointments, a lifeline for seniors who can no longer drive.

- Emergency Response Systems: Funding for those personal alert buttons that can call for help in an emergency.

This is what makes assisted living affordable for so many people. The waiver picks up the tab for the essential care services, while the individual uses their Social Security or other income to cover the apartment and meals.

The Catch: Waiting Lists and Enrollment Caps

While HCBS waivers are a lifeline, they aren't an entitlement like standard Medicaid. This is a critical point. If you qualify for nursing home care, Medicaid has to cover it. But with waivers, states can put a cap on how many people they enroll.

Because funding is limited, most states have enrollment caps on their HCBS waiver programs. This almost always leads to long waiting lists that can stretch on for months, and sometimes even years.

This reality means you absolutely have to plan ahead. Getting your loved one’s name on a waiting list as soon as you think they might need it can be the difference between getting care when it's needed and facing a crisis. The application process alone can be a marathon, so starting before you're in an emergency is always the best move. Families often need a temporary solution, and understanding what is respite care can be a great way to bridge the gap while waiting for a waiver slot to become available.

So, does Medicaid pay for assisted living? Yes—but primarily through these powerful, yet limited, waiver programs. They represent a fundamental change in how we approach long-term care, prioritizing independence and community. Success just depends on navigating your state’s specific rules, meeting the eligibility requirements, and preparing for a potential wait.

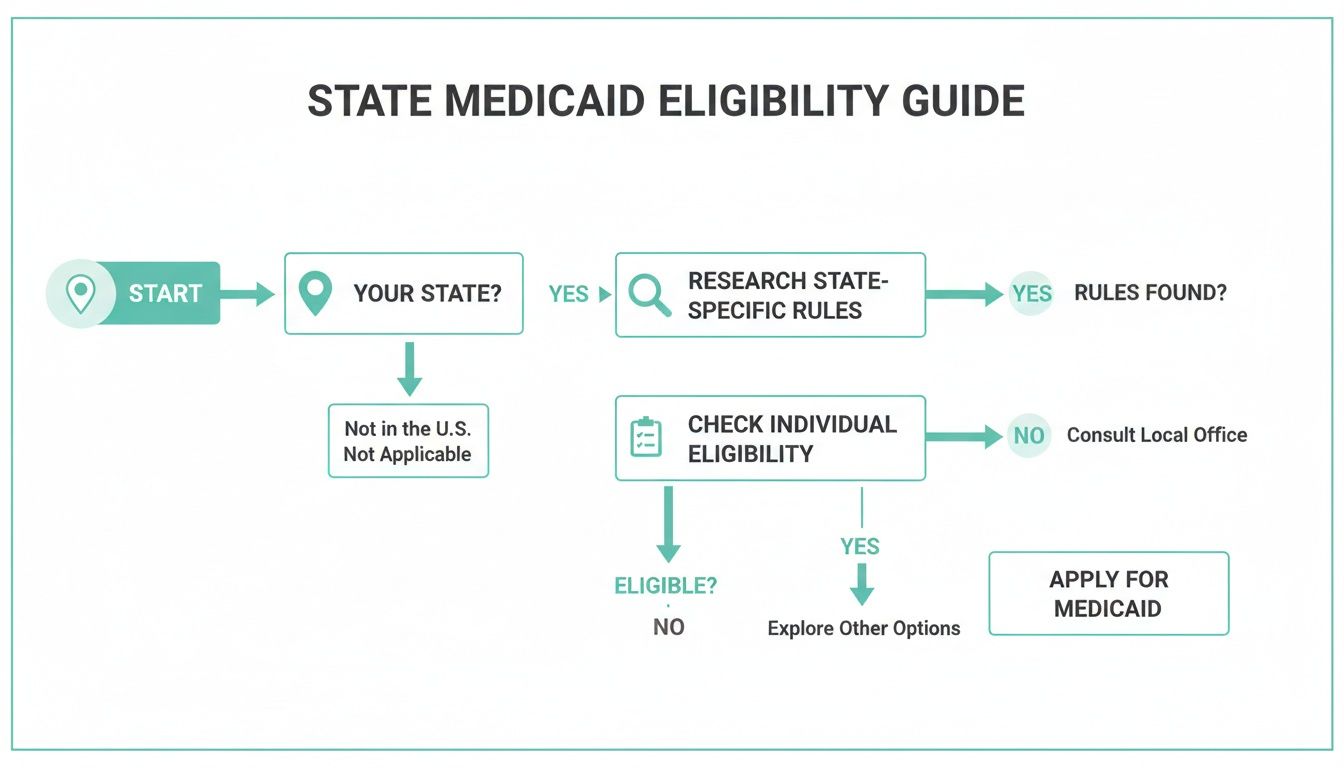

Navigating the Maze of State-by-State Medicaid Rules

One of the biggest hurdles families face is realizing that Medicaid isn't a single, national program with one set of rules. It’s actually a partnership between the federal government and each state, which means the rules for assisted living coverage can change dramatically just by crossing a state line.

Think of it like this: the federal government sets a basic recipe for Medicaid. But then, each state gets to be its own chef, adding unique ingredients. They can set different income limits, create specialized waiver programs, and even cap how many people can enroll. What works for a family in Florida might be completely off the table for someone in Ohio.

This is why your physical address is one of the most significant factors in getting help. It’s not enough to qualify for Medicaid in general; you have to meet the specific, local requirements of your state’s long-term care program.

Why State Rules Differ So Much

States have a surprising amount of freedom in how they use their Medicaid funds, especially when it comes to long-term care. They get to decide which “optional” services to cover—like care in an assisted living community—and who exactly is eligible to receive them.

Some states are more generous, offering higher income caps or a variety of waiver programs for different needs. Others are much stricter, with tight financial limits and long waiting lists for a handful of waiver spots. The result is a patchwork system where access to care can feel wildly inconsistent from one state to the next.

For example, a state has to decide if it will use Medicaid funds to pay for services in an assisted living setting at all. Many do, but they do it through special programs that come with their own unique rules.

Real-World Examples of State Variation

To see just how different this can be, let’s look at a few states. These are just quick snapshots, but they show why you have to do your homework locally.

- Florida: Uses the Statewide Medicaid Managed Care Long-Term Care Program. This program can pay for services in assisted living communities by contracting with managed care organizations that coordinate everything for the senior.

- Ohio: Has a very specific HCBS waiver called the Assisted Living Waiver Program. It’s designed for people who would otherwise need to be in a nursing home but can live safely in a community setting with the right support.

- Indiana: Recently rolled out its PathWays for Aging program. This combines several older waivers into one system to make it easier for people to get services at home or in communities like assisted living.

For families in Ohio, getting the details right is crucial. A dedicated guide to Medicaid for Assisted Living in Ohio can provide the specific eligibility and application info needed for their waiver. This really highlights how vital local resources are.

Key Takeaway: You can't rely on general advice you read online or what a friend in another state experienced. Your first and most critical step is to find out the specific Home and Community-Based Services (HCBS) waiver programs offered in your state.

This is exactly why local knowledge is power. A great first step is often to simply see what’s available in your own community. Our guide on finding assisted living in my area can help you start that process. Remember, the program names, the rules, and the applications are all handled at the state level, so understanding your local landscape is essential.

Meeting the Financial and Functional Eligibility Rules

Getting approved for Medicaid long-term care is a bit like having a two-part security check. You can't get through the door without passing both: one for your financial situation and another for your physical care needs. Your state’s Medicaid program needs to see that both requirements are met before they'll approve any funding for assisted living.

This dual-assessment system makes sure that Medicaid's resources are reserved for those who truly have a medical need for care and don't have the money to pay for it themselves. To get through this process successfully, you have to be prepared for both evaluations.

The Financial Eligibility Key

The first key is all about your finances. State Medicaid agencies take a very close look at an applicant's income and assets to see if they are financially in need. This isn't just a quick glance at a recent bank statement; it’s a thorough review of your entire financial picture.

- Income Limits: Every state has a maximum monthly income a person can earn and still qualify. This income includes things like Social Security checks, pensions, and any other regular payments. If you're just a little bit over the limit, some states have tools like a Miller Trust that can help you become eligible.

- Asset Limits: This is where it often gets tricky. Medicaid has a very firm cap on what they call “countable assets,” which is usually around $2,000 for one person. These are things like cash in the bank, stocks, bonds, and any property you own besides your main home.

The good news is that many of your most significant assets are often considered non-countable, meaning they won't stand in your way. These typically include your primary residence (up to a certain value), one car, your personal belongings, and any pre-paid funeral arrangements.

To help you get a clearer picture of what's what, here's a simple breakdown of how assets are usually categorized.

Common Countable vs Non-Countable Assets for Medicaid

| Asset Type | Typically Countable? | Common Exemptions/Notes |

|---|---|---|

| Checking & Savings Accounts | Yes | All funds are typically counted toward the asset limit. |

| Stocks, Bonds, Mutual Funds | Yes | The market value of these investments is considered countable. |

| Primary Home | No | Exempt up to a certain equity value, which varies by state. |

| Second Home/Rental Property | Yes | Any real estate other than your primary residence is counted. |

| Personal Vehicle | No | One vehicle is usually exempt, regardless of its value. |

| Life Insurance Policies | Depends | Policies with a cash value over a certain amount (e.g., $1,500) are often counted. |

| Personal Belongings | No | Household goods, furniture, and personal items are not counted. |

| Pre-Paid Funeral Plans | No | Irrevocable funeral trusts are typically exempt up to a state-specific limit. |

Understanding these distinctions is a huge step in preparing your application and knowing where you stand financially.

A really critical piece of this financial puzzle is the five-year look-back period. When you apply, Medicaid will scrutinize every financial transaction you’ve made for the last five years. They're looking for any signs that you might have given away assets or sold them for cheap just to get under the asset limit.

This rule is there to prevent people from shifting their money to family members right before applying for benefits. If they find any transfers that weren't for fair market value, you could face a penalty period, meaning you'll be ineligible for Medicaid for a set amount of time.

Trying to figure out this financial maze is a big reason why many families start looking into options like long-term care insurance coverage for assisted living years before needing to apply for Medicaid. This guide can also give you a head start on understanding your state's rules.

As the chart shows, it all starts with identifying your state, digging into its specific requirements, and then seeing how your situation lines up.

The Functional Eligibility Key

The second key is proving you medically need the care. Even if your finances meet the criteria, you won't be approved unless a formal assessment shows you require a certain level of daily support.

This standard is often called a “nursing home level of care” (NHLOC). Now, that phrase can be scary, but it doesn't mean you have to go to a nursing home. It’s just the benchmark states use to measure how much help someone needs with their Activities of Daily Living (ADLs), which include tasks like:

- Bathing and getting dressed

- Eating and preparing meals

- Using the toilet and managing continence

- Getting around and transferring (like moving from a bed to a chair)

Typically, a nurse or social worker from a state agency will visit to do this assessment. They’ll look at how well you can handle these tasks on your own and also consider any cognitive challenges from conditions like dementia. Once you pass both the financial and functional evaluations, you've finally unlocked the door to getting Medicaid's help with assisted living.

How Forest Cottage Senior Care Can Be Your Guide

Figuring out how to pay for senior care, especially untangling the answer to "does Medicaid pay for assisted living," can leave you feeling completely overwhelmed. The endless paperwork, confusing eligibility rules, and state-specific programs are enough to make any family feel stressed and alone.

You don’t have to go through this by yourself.

At Forest Cottage Senior Care, our team is here to walk alongside your family as a trusted guide. We believe in replacing confusion with clarity and stress with genuine support. Our goal is simple: to partner with you and help you find the right path forward with confidence.

Starting with a Personal Assessment

Every journey should start with a clear map. That’s why we begin with a personal needs assessment to understand your loved one’s unique situation. This helps pinpoint the exact level of care they require, ensuring you don’t pay for services that aren’t necessary or, just as importantly, overlook support that is essential.

From there, we invite you to come and see our community for yourself. We offer personalized tours of Forest Cottage Senior Care so you can get a feel for the environment, meet our caring staff, and truly envision what life could be like here.

Guidance on Local Benefits

Understanding the local benefits landscape is key. Nationally, about 18% of assisted living residents get help from Medicaid for their daily services. That number jumps to 56% for nursing home residents. These figures show just how much state policies, waiver waiting lists, and enrollment caps can impact a family's access to affordable care. You can explore more about Medicaid's role in long-term care to see these dynamics up close.

Our team has the local knowledge to help you make sense of all this. We can connect you with the right resources to understand:

- Local Waiver Programs: We'll help you learn which HCBS waivers are available in our area and what services they typically cover.

- Application Steps: We can offer insights into the general application process so you know what to expect.

- Connecting with Experts: We can direct you to local elder law attorneys or financial planners who specialize in Medicaid planning.

At Forest Cottage Senior Care, our commitment is to be more than just a provider; we are your partner. We are here to help you navigate this process with compassion, ensuring your family finds the best possible solution for a brighter, more supported future.

Frequently Asked Questions About Medicaid and Assisted Living

Even with a good grasp of the basics, families often run into very specific, practical questions when trying to figure out how Medicaid and assisted living fit together. Getting straight answers can help you sidestep common frustrations and feel more secure in your decisions.

Let's walk through some of the most common questions we hear from families during the planning process.

Can a Facility Evict a Resident Who Switches to Medicaid?

This is a huge source of anxiety, and for good reason. The answer is a bit complex, but the short version is: probably not. Federal regulations for Home and Community-Based Services (HCBS) waivers offer some real protections here.

If a community accepts Medicaid waiver payments, they have to follow rules similar to local landlord-tenant laws. That means they can't just kick someone out the day they switch from private pay to Medicaid. There has to be a formal, legal process, including written notice. Still, it's absolutely critical to ask about a community's specific policies on accepting Medicaid before your loved one moves in.

What if My Income Is Just Over the Limit?

It's incredibly frustrating to find out you're just slightly over the income or asset limit for Medicaid. But don't give up—it’s not always a deal-breaker. Many states have financial tools designed for this exact situation.

A common one is a Qualified Income Trust (QIT), which you might also hear called a Miller Trust. It's a special legal account where you deposit the income that’s over the Medicaid limit. The money in the trust is then used to help pay for care, and—here's the key part—it's no longer counted against you for eligibility.

Does Medicare Help Pay for Assisted Living?

This is easily one of the biggest points of confusion. The answer is a clear no: Medicare does not pay for long-term assisted living.

Medicare is your health insurance. It covers short-term, doctor-ordered medical care—things like a hospital stay or a few weeks in a skilled nursing facility after you've been in the hospital. It doesn't cover the day-to-day personal care, meals, or housing that make up the core of assisted living costs. While a resident might use their Medicare to cover a doctor's visit or physical therapy, it won't touch the monthly bill from the community.

Key Distinction: Think of it like this: Medicare is for when you're sick and need a doctor. Medicaid is the program that can help with long-term daily support, like getting help with bathing or managing medications.

Getting these details right is essential. The system can feel complicated, but asking these questions upfront will give you a clearer picture of your options and help you build a care plan that lasts.

Navigating senior care options can feel overwhelming, but you don't have to figure it all out on your own. The compassionate team at Forest Cottage Senior Care is here to bring clarity and support to your journey. We can help with personal assessments, tours of the community, and guidance on making sense of local benefits. Start the conversation today, and let us help you find the right path forward.