When you get down to it, the real difference between a guardianship and a power of attorney is all about timing and who’s in control. A Power of Attorney (POA) is a proactive choice someone makes while they are still sharp, giving decision-making power to a person they trust. On the flip side, guardianship is a reactive, court-ordered solution that comes into play only after a person can no longer make decisions for themselves.

Understanding The Core Difference In Senior Care Planning

As you start planning for long-term senior care in Texas, getting this distinction right is absolutely critical. One of these legal tools lets a person map out their own future, while the other acts as a last-resort safety net when there's no plan in place. The path a family takes in managing a loved one's care often comes down to this single choice. If you want a quick, clear breakdown, you can learn more about the difference between a Power of Attorney and a Guardianship.

A High-Level Comparison

To make it easier to see the differences at a glance, I've put together a simple table. It breaks down the most important factors for families who are thinking about senior care options.

Core Differences Guardianship Vs Power Of Attorney

| Key Factor | Power Of Attorney (POA) | Guardianship |

|---|---|---|

| Origin of Authority | Granted by the individual (principal) while mentally capable. | Ordered by a court after a finding of incapacity. |

| Timing | Proactive—created before incapacity occurs. | Reactive—established after incapacity is proven. |

| Decision-Maker | The individual chooses their own trusted agent. | The court appoints a guardian, who may or may not be a family member. |

| Autonomy | Preserves the individual's choice and control. | Removes the individual's (ward's) legal right to make decisions. |

| Oversight | Private document with no routine court supervision. | Public process with ongoing court reporting and oversight. |

This table shows just how different these two paths are. A POA is a private decision made ahead of time, while a guardianship is a public, court-supervised process that takes control away from the individual.

A Power of Attorney is a tool you grant; a guardianship is a status the court imposes. This simple distinction highlights the POA's role in preserving personal freedom and the guardianship's function as a last resort.

It's a serious step. In the United States, there are an estimated 1.3 million active adult guardianship cases, with courts overseeing at least $50 billion in assets. Because guardianship is so restrictive, Texas courts now view a POA as a "less restrictive alternative" that must be considered first. This really drives home the importance of planning ahead.

How A Power Of Attorney Works For Senior Care Planning

A Power of Attorney (POA) is really the foundation of proactive senior care planning. It allows a person to choose a trusted individual to make decisions for them later on. This legal document is a powerful tool for keeping control because it’s created while the person still has full mental capacity. It's a choice you make for yourself, not a solution forced on you by a court.

There are two key people involved in a POA: the principal, who is the person granting the authority, and the agent (sometimes called an attorney-in-fact), who is the trusted person appointed to act. The principal gets to carefully define exactly what the agent can and can't do, from managing bank accounts to making critical healthcare choices.

The Role Of A Durable Power Of Attorney

When it comes to long-term senior care, the Durable Power of Attorney is the one you need. Unlike a standard POA, a durable one stays valid even if the principal becomes incapacitated from an illness or injury down the road. This durability is what makes it so indispensable—it ensures the person you hand-picked can step in and help right when you need them most, without any gaps.

Without that "durable" language, the document becomes useless the moment the principal is incapacitated, which defeats the whole purpose in elder care. This one small but critical detail prevents the need for a stressful and public court intervention, like a guardianship hearing.

Think of a Durable Power of Attorney as a private contract you create for your future. It empowers your chosen representative to manage your affairs without the public, expensive, and time-consuming process of going to court.

Choosing the right agent is probably the most critical part of this whole process. This person must be completely trustworthy, capable of handling complex financial or medical details, and absolutely committed to honoring your wishes.

Defining The Agent's Scope Of Authority

When you set up a POA, you can give your agent very broad authority or spell out very specific, limited powers. This flexibility is great because it lets you tailor the document to your exact needs and comfort level.

- Financial Power of Attorney: This gives the agent the power to handle money matters—things like paying bills, managing investments, filing taxes, or dealing with real estate.

- Medical Power of Attorney: This lets the agent make healthcare decisions, such as approving medical treatments, choosing doctors, or selecting a long-term care facility like an assisted living community.

These are often created as two separate documents to keep instructions clear for different areas of your life. You can even appoint different people as your financial and medical agents if that makes sense for your family. The most important thing is that the principal stays in control of these decisions until they are no longer able. Setting up these directives is a core part of any good end-of-life planning and ensures your preferences are respected.

The Process Of Creating A Power Of Attorney

Creating a POA in Texas is a pretty straightforward process, especially when you compare it to the legal maze of guardianship. A POA is a private legal document, while a guardianship involves petitions, court hearings, and a judge's order.

- Select Your Agent: Choose one or more people you trust without reservation to act for you.

- Consult an Attorney: It's best to work with an experienced elder law attorney who can draft the document correctly according to Texas law and your personal wishes.

- Sign and Notarize: To make it legally binding, the principal must sign the document in front of a notary public.

Taking this proactive step saves a huge amount of time and money, but the peace of mind it provides is invaluable. It guarantees that your affairs will be handled by someone you trust, following your own instructions, which preserves your dignity and control no matter what happens.

Navigating The Texas Guardianship Process

When a Power of Attorney wasn't set up in advance, families aren't left without options. The Texas legal system offers a protective, court-supervised process called guardianship. Think of it as a safety net, but it’s a formal legal proceeding that’s only used when a person is legally determined to be "incapacitated" and has no other plans in place.

This is a major difference from a POA, which is a private document. Guardianship is a public court case. The process actually removes an individual's legal right to make their own decisions, transferring that authority to a guardian appointed by a judge.

The Initial Steps Toward Guardianship

The whole thing gets started when someone concerned—usually a family member, but it could be a friend or even a doctor—files an "Application for Appointment of a Guardian" with the local court. This document formally asks a judge to look into the situation of the proposed "ward" (the person who may be incapacitated) and appoint someone to manage their affairs.

Once the application is filed, the court appoints an independent attorney called an attorney ad litem. Their one and only job is to represent the proposed ward and advocate for their best interests and personal wishes. While the court provides this lawyer for your loved one, it’s also a good idea to have your own legal counsel to guide you through the complexities. You can find resources for finding a qualified family lawyer in Austin, Texas, and similar help is available across the state.

A critical piece of the puzzle in any Texas guardianship case is a detailed medical evaluation. A physician has to examine the proposed ward within 120 days of the hearing and file a report with the court that certifies the nature and degree of their incapacity.

This doctor's report is the cornerstone of the case. It gives the judge a professional, objective assessment of the person's ability to handle their own affairs. Without it, the court simply cannot move forward.

The Court Hearing and Guardian Roles

Everything comes to a head in a court hearing. A judge will review all the evidence, from the medical report to the findings of the attorney ad litem. The standard of proof is high: the judge must find "clear and convincing evidence" that the person is incapacitated and that a guardianship is the least restrictive way to keep them safe. If the judge agrees, a guardian is appointed.

In Texas, the court can appoint guardians with very specific jobs:

- Guardian of the Person: This person makes decisions about personal and medical care. They're the one choosing doctors, agreeing to treatments, and deciding on living arrangements—like figuring out the right level of support when comparing memory care vs assisted living.

- Guardian of the Estate: This individual takes over all financial matters. They handle everything from paying bills and managing property to overseeing investments.

It’s common for one person to fill both roles, but a judge can also split the duties between two people if that seems best for the ward. This detailed legal framework exists for a reason. Guardianship is a serious step, and the process can be slow and costly. National data shows how inconsistently it's applied, with the percentage of people under guardianship ranging from just 5.5% in one state to a staggering 89.0% in another. It’s a powerful legal intervention, meant to be used only when there are truly no other alternatives.

A Detailed Comparison For Decisive Family Planning

Choosing between a Power of Attorney and guardianship is about more than just legal definitions. It's about really understanding the practical differences in timing, cost, personal freedom, and control. When you put these two paths side-by-side, it becomes much clearer which one aligns with your loved one's needs and wishes.

The core of the guardianship vs. power of attorney debate boils down to a simple question: are you planning ahead, or are you reacting to a crisis?

Timing and Personal Choice

A Power of Attorney (POA) is a tool for proactive planning. Your loved one creates this document while they are still mentally capable, allowing them to hand-pick the person who will make decisions for them down the road. This simple act of foresight keeps their autonomy intact and makes sure their voice is heard, even when they can no longer speak for themselves.

Guardianship, on the other hand, is completely reactive. It only comes into play after a person has already lost the capacity to make their own decisions and there's no POA in place. The whole process is started by someone else and leads to a court-appointed decision-maker—who may or may not be the person your loved one would have chosen.

Cost and Complexity

The differences in cost and hassle are night and day. A POA is a private legal document that's relatively inexpensive to create. A Texas attorney can usually draft a durable POA for a flat fee, and it just involves signing and notarization, with no court involvement whatsoever.

Guardianship is a public, formal court proceeding that is much more complex and expensive. You're looking at a pile of costs that can add up fast:

- Court filing fees

- Fees for the attorney representing the person filing the petition

- Fees for the court-appointed attorney who represents your loved one

- Ongoing costs for annual accountings and court reports

The total expense to set up and maintain a guardianship can easily run into thousands of dollars, adding a heavy financial burden during an already stressful time.

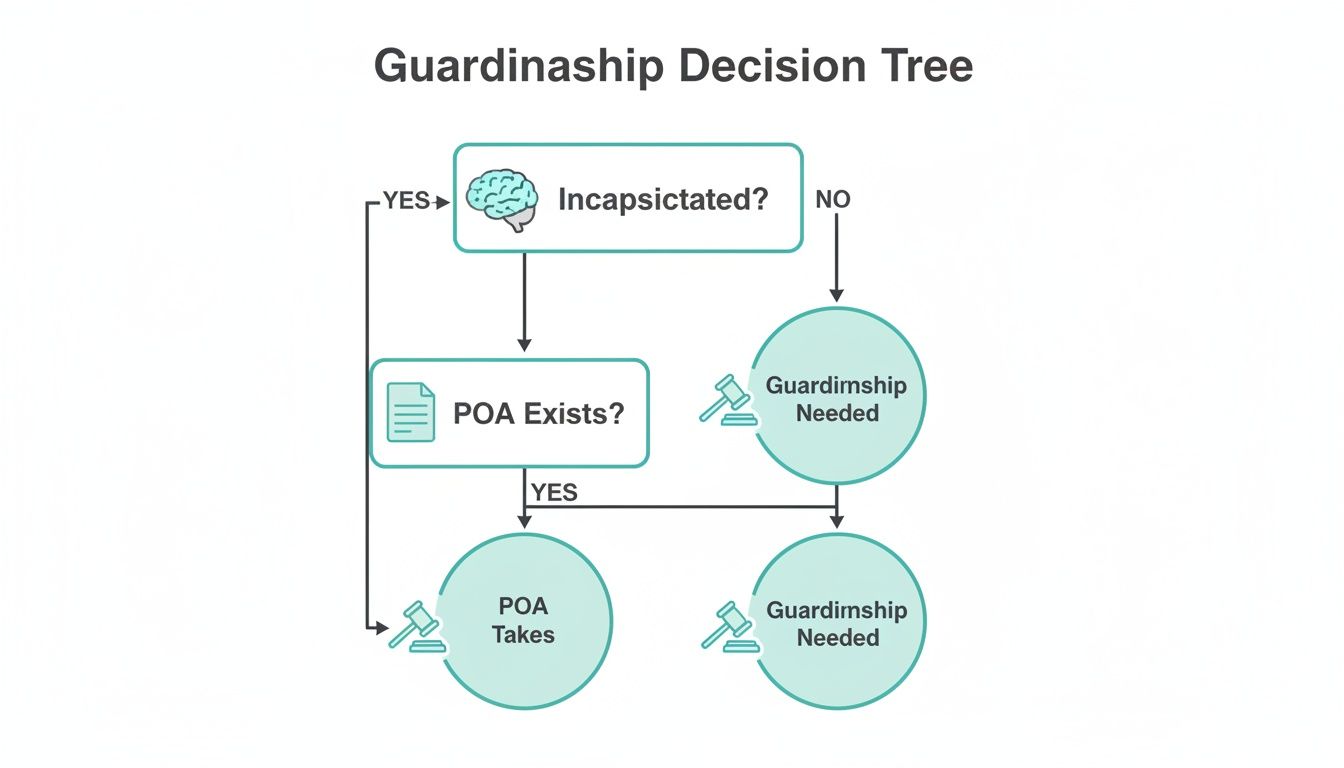

This flowchart shows the typical path that forces a family into guardianship when proactive planning, like creating a POA, hasn't happened.

As you can see, the absence of a Power of Attorney is the direct trigger for needing a court-ordered guardianship once a person is determined to be incapacitated.

Decision Framework Guardianship Vs Power Of Attorney

When you're weighing these options, it helps to see a direct comparison of the key factors that will impact your family's life. This table breaks down the practical realities of choosing a POA versus going through a guardianship proceeding.

| Consideration | Power Of Attorney (POA) | Guardianship |

|---|---|---|

| When it's created | Before incapacity, as proactive planning. | After incapacity is legally determined; it's a reactive measure. |

| Who decides | The individual chooses their own trusted agent. | A judge appoints a guardian based on legal proceedings. |

| Cost | Relatively low, often a one-time flat fee to an attorney. | High, involving multiple attorney fees, court costs, and ongoing reporting expenses. |

| Process | Private, simple signing and notarization. | Public court proceeding, complex and lengthy. |

| Personal Freedom | The individual retains all their legal rights and can revoke the POA. | The individual's legal rights are transferred to the guardian by court order. |

| Scope of Authority | The individual defines the agent’s powers, which can be broad or limited. | A judge defines the guardian's authority, which is rigid and requires court approval for major decisions. |

| Privacy | A private document between the individual and their agent. | A public record, with court hearings and filings open to the public. |

| Oversight | The agent has a fiduciary duty to the principal, but there is no court supervision. | The guardian is under constant court supervision and must file annual reports. |

This framework isn't just about legal technicalities; it's about the real-world impact on your loved one’s dignity, your family's finances, and the level of stress involved.

Individual Autonomy

This is probably the most profound difference. A POA empowers your loved one. It’s a legal tool that extends their own decision-making authority to a trusted agent. The person who creates it (the principal) keeps all their rights and can cancel the POA at any time, as long as they are still competent.

Guardianship, by its very nature, removes an individual's legal rights. A judge's order literally transfers the person's right to make fundamental life decisions over to the guardian. While this is a protective measure, it comes at the cost of personal freedom and is legally considered the most restrictive option available in Texas.

A Power of Attorney is a tool you grant; a guardianship is a status the court imposes. This distinction highlights the POA's role in preserving personal freedom and the guardianship's function as a necessary, but last-resort, legal intervention.

Scope of Authority

With a Power of Attorney, your loved one is in the driver's seat. They have complete control to define what the agent can and can't do. They can grant broad authority for all financial and medical matters or limit the agent to very specific, narrow tasks. This ability to customize ensures the agent's actions are perfectly aligned with their wishes.

Under a guardianship, the court defines the guardian's authority. The judge determines the scope of the guardian's powers, and the guardian often has to go back to the court to get permission for significant actions. For example, a guardian might need a judge's sign-off to sell the ward's house or make key decisions about their personal care, like managing the support needed for their activities of daily living. The authority is rigid and comes with constant judicial oversight.

Ultimately, a Power of Attorney represents personal choice and foresight, while guardianship acts as a critical legal safety net when no plan exists. Getting a handle on these deep-seated differences is the first step toward building a secure and respectful care plan for the future.

When To Use Each Option: Real-World Scenarios

Knowing the legal definitions of guardianship vs. power of attorney is one thing. Seeing how they actually work in real-life family situations is what makes the right choice click. These tools are meant for very different circumstances, and picking the right one is crucial for protecting your loved one with dignity and respect.

Let's walk through a few practical scenarios that bring these legal documents to life.

Proactive Planning With A Power Of Attorney

Picture Margaret, a sharp and active 68-year-old living in Texas. She saw a friend’s family go through a tough time and decided she wanted to get her own affairs in order. She met with an elder law attorney to create a Durable Power of Attorney.

In the document, Margaret chose her responsible son, David, to be her agent. She gave him the authority to handle her finances and make medical decisions, but only if she ever became unable to manage things herself. For now, she’s still in the driver’s seat.

A few years down the road, Margaret is diagnosed with early-stage Alzheimer's. As her condition progresses, David can step in seamlessly. Using the POA, he pays her bills from her checking account, consults with her doctors, and eventually helps her transition into a supportive senior living community.

This is the textbook case for a Power of Attorney. It was a proactive, private decision that honored Margaret’s wishes, kept the family out of court, and empowered her chosen person to act when it mattered most.

Because Margaret planned ahead, her family avoided a crisis. There was no need for a public court hearing, no fighting over who should be in charge, and no delay in getting her the support she needed.

When Guardianship Becomes The Only Option

Now, let's consider a completely different situation. Robert, a 75-year-old widower, has always been fiercely independent. He never saw the need for a Power of Attorney, convinced he'd always be able to handle his own business.

Tragically, Robert suffers a massive stroke that leaves him incapacitated and unable to communicate. His daughter, Susan, is heartbroken. When she tries to access his bank account to pay his mortgage and mounting medical bills, the bank turns her away. She has no legal authority.

Susan is stuck. She can’t make crucial medical decisions for her father or manage his finances to prevent his home from being foreclosed on. Her only path forward is to petition the court to become his legal guardian.

This process is demanding and involves:

- Hiring an attorney to file the application.

- The court appointing a different attorney just to represent her father.

- A formal medical evaluation to legally prove he is incapacitated.

- A court hearing where a judge makes the final decision.

After several weeks and significant legal fees, the court appoints Susan as Robert's guardian. She can finally take care of him, but the journey was stressful, public, and expensive—all things a simple POA could have avoided. This tough time also led her to research when is it time for assisted living to ensure her dad would get the right level of long-term support.

Navigating Complex Family Dynamics

Guardianship can also become necessary when family conflicts get in the way. Take the story of Helen, an 80-year-old with dementia who signed a POA years ago naming her eldest son, Tom, as her agent.

Unfortunately, Tom and his sister, Maria, have a very strained relationship. Maria is convinced Tom isn’t giving their mother proper care and might be mismanaging her money. She’s worried he isn’t acting in Helen’s best interest.

In a complicated and emotional mess like this, the POA isn't enough to protect Helen. Maria can petition the court for guardianship. A judge will then investigate her claims, and a court-appointed attorney for Helen will look at the situation from a completely unbiased point of view.

If the court finds Tom failed in his duties, it can revoke the POA and appoint a neutral third party, like a professional guardian, to manage Helen's affairs. This provides a layer of impartial oversight that a private POA can't offer, ensuring Helen's health and finances are protected from the family feud.

Taking Proactive Steps In Your Care Journey

When you dig into the details of guardianship versus power of attorney, one thing becomes crystal clear: proactive planning is the best gift you can give your family and yourself. Taking control of your future now means swapping potential chaos for confidence. This journey doesn't start with stacks of legal papers; it starts with honest family conversations about your wishes, fears, and hopes for the future.

Those conversations lay the groundwork for everything else. The next move is to talk with a qualified Texas elder law attorney. They are the experts who can help you draft a Durable Power of Attorney, giving your chosen agent the explicit legal authority to step in if you ever become incapacitated. Honestly, this one document is the key to protecting your independence and avoiding a court-supervised guardianship down the road.

Building Your Comprehensive Care Plan

A POA is a crucial first step, but it's just one piece of a bigger strategy. This is the perfect time to think through every angle of your future, from your healthcare preferences to how your finances will be managed. Getting a handle on your options now makes any future transitions so much easier for everyone involved. For example, many families we work with find it incredibly helpful to understand what financial assistance might be available, which is why looking into whether Medicaid pays for assisted living in Texas can offer real peace of mind.

This kind of forward-thinking isn't just a good idea; it's becoming a global standard for responsible aging. The World Health Organization even tracks which countries have guidelines for advance directives like POAs, because they see them as essential tools for preserving a person's autonomy. It shows that signing a POA in your 60s or 70s is a normal, healthy part of preparing for what’s next. You can discover more about these international perspectives on guardianship practices and proactive planning.

The most compassionate care plans are built on foresight, not fear. By establishing a Power of Attorney and discussing your wishes openly, you empower your family to honor your legacy with confidence, ensuring your care journey unfolds according to your own design.

Here at Forest Cottage Senior Care, we see the positive impact of this planning every single day. It smooths the path into assisted living and lets families concentrate on what really matters: supporting their loved one with dignity. By taking these decisive steps today, you ensure your voice and your choices guide every moment that follows.

Frequently Asked Questions

When you're trying to figure out the difference between guardianship and power of attorney, a lot of specific questions pop up. It can feel complicated, but it doesn't have to be. Here are some straightforward answers to the questions we hear most often from Texas families.

Can Someone Have Both A Power Of Attorney And A Guardian

The short answer is generally no. In Texas, the law sees a valid Durable Power of Attorney as a "less restrictive alternative" to guardianship. Think of it this way: the law wants to honor the choices a person made for themselves when they were able to.

If a solid POA is already in place, a court is very unlikely to step in and appoint a guardian. The only real exception is if there’s proof that the person named as agent isn't acting in the best interest of your loved one. A POA is specifically designed to make guardianship unnecessary.

What Happens If A Parent Becomes Incapacitated Without A POA In Texas

This is a situation many families find themselves in. If your parent becomes incapacitated and there's no Durable Power of Attorney, you'll almost certainly need to go to court to establish a guardianship.

Without that legal authority, your hands are tied. You can't make medical decisions, step in to manage their finances, or even pay their bills from their accounts. The court has to hold a formal hearing to legally determine they are incapacitated and then appoint a guardian. It's the only way to get the legal right to manage their affairs.

When someone becomes incapacitated without a Power of Attorney, a guardianship proceeding is almost always the next step. It’s the legal system's built-in safety net for when no personal plan was made ahead of time.

What Is The Cost Difference Between A POA And Guardianship

The financial gap between the two is huge. Setting up a Power of Attorney is a proactive step. An attorney can usually draft the necessary documents for a relatively low, flat fee, making it a very affordable planning tool.

Guardianship, on the other hand, is a reactive and far more complex court process. You’re looking at court filing fees, fees for your own attorney, and fees for the court-appointed attorney who is required to represent your loved one. The total cost to get a guardianship started can easily run into thousands of dollars, and that’s before the ongoing costs of court oversight and required reporting.

Is A Power Of Attorney From Another State Valid In Texas

Generally, a Power of Attorney that was legally created in another state will be recognized in Texas. But there’s a practical catch. Local banks, hospitals, and other institutions here are used to seeing documents written with specific Texas statutory language.

To avoid frustrating delays or an outright refusal to accept the document when you need it most, it’s a smart move to have a Texas attorney review any out-of-state POA. Creating a new one that follows Texas law can save you a world of trouble down the road.

Planning for the future ensures your loved one's care is handled with dignity and clarity. The team at Forest Cottage Senior Care is here to support your family every step of the way. Schedule a visit to see how our compassionate, person-first approach can make a difference. Learn more at https://www.forestcottageseniorcare.com.