Figuring out if you qualify for VA Aid and Attendance can feel like a maze, but it really comes down to three main things: your wartime service, your current medical needs, and your financial situation. This isn't a handout; it's a pension benefit you've earned, designed to help senior veterans pay for the daily care they need to live with dignity.

Demystifying VA Aid and Attendance

Think of the VA Aid and Attendance benefit as a supplement to your pension. It was created specifically to give a financial boost to wartime veterans and their surviving spouses who now need a hand with everyday activities. This extra money makes quality care, whether it's at home or in a community like Forest Cottage Senior Care, a lot more affordable.

The whole point is to take some of the financial pressure off families dealing with the high cost of long-term care.

This benefit can be a game-changer. Maximum monthly payments can reach up to $2,424 for a single veteran—that's $29,091 a year—which goes a long way toward covering assisted living costs right here at Forest Cottage Senior Care in Willis, Texas. For the most current numbers, you can always check the latest VA pension rates online.

The Three Pillars of Eligibility

Getting a handle on VA Aid and Attendance eligibility is much easier when you break it down into its three core requirements. Each one is a checkpoint you have to pass, and you'll need to meet all three to get approved.

Let’s take a quick look at these "three pillars" to see what the VA is looking for. This table gives you the big picture at a glance.

The Three Pillars of VA Aid and Attendance Eligibility

| Eligibility Pillar | What It Means | Quick Summary |

|---|---|---|

| Military Service | You served on active duty during a recognized wartime period. | At least 90 days active duty, with 1 day during wartime. Your discharge must be other than dishonorable. |

| Medical Need | You require help from another person for daily activities. | A doctor must confirm you need assistance with tasks like bathing, dressing, eating, or managing medications. |

| Financial Qualification | Your income and net worth fall within VA limits. | The VA has specific limits, but you can deduct medical expenses (like assisted living costs!) from your income. |

Meeting these three requirements is the key to unlocking the benefit. It's a process, but understanding these pillars is the first and most important step.

At its heart, this benefit is about a simple promise: veterans who served our country shouldn't have to face the challenges of aging or disability without the financial means to get the care they need. It acknowledges that needing daily help is a major life change that comes with a significant price tag.

Throughout this guide, we'll dive deep into each of these pillars, using clear examples and practical steps. We'll clear up common myths and confusing rules to give you a straightforward path to figuring out if you qualify. For more on how this benefit fits into the broader picture of senior care, you can learn more about VA benefits for elderly veterans.

Meeting the Military Service Requirements

First things first, let's talk about the military service part of the VA Aid and Attendance eligibility. This is the first major checkpoint, and it's where a lot of veterans get tripped up by myths. Many assume they won't qualify because they never saw combat, but that's one of the biggest misconceptions out there. The VA’s definition of a "wartime veteran" for this specific benefit is much broader than you might imagine.

To get your foot in the door, a veteran needs to have served at least 90 days of active duty. And here’s the crucial part: at least one single day of that service had to fall during a VA-recognized wartime period. This is the absolute starting point for figuring out if you're eligible.

Of course, the way you left the service matters, too. Your discharge has to be anything other than dishonorable. This includes honorable, general under honorable conditions, and other similar classifications.

What Is a Wartime Period?

The VA has very specific date ranges that it considers "wartime." It doesn't matter if you were stationed in Kansas or Korea—what matters is that your active service dates overlap with one of these official periods. Serving just one day within these windows, as part of your total 90 days of service, is enough to check this box.

Here are the wartime periods the VA uses for pension benefits like Aid and Attendance:

- World War II: December 7, 1941, to December 31, 1946

- Korean Conflict: June 27, 1950, to January 31, 1955

- Vietnam War Era: This one's a bit different. For veterans who served in the Republic of Vietnam, the period is November 1, 1955, to May 7, 1975. For everyone else, it's August 5, 1964, to May 7, 1975.

- Gulf War: August 2, 1990, through a future date that will be set by law.

Think about what that last one means: any veteran who served on active duty for 90 days or more since August 2, 1990, automatically meets the wartime service requirement.

Understanding the Service Details

It’s good to know that the 90-day active duty minimum is your total time served, it doesn't have to be consecutive. For Gulf War veterans, the rule is a little different: you generally need to have completed 24 months of continuous active duty or the full period you were called up for.

The core idea here is simple. This benefit was created to honor the commitment of those who answered the call during critical times in our nation's history, no matter what their job was or where they were sent. Your DD-214 is the golden ticket here—it’s the document that proves your service dates and discharge status.

Think of this military service requirement as the foundation. Once you've confirmed your service history lines up with these VA guidelines, you can move forward with confidence to look at the next piece of the puzzle: your medical needs. The time you spent in uniform has opened a door to this incredible benefit, designed to give you the support you've earned.

Understanding the Medical and Daily Care Needs

Once you’ve confirmed that your military service record checks the box for the VA’s wartime criteria, the next piece of the VA Aid and Attendance eligibility puzzle is your current health. This part is less about specific medical diagnoses and more about how your health actually impacts your ability to get through the day safely on your own.

What the VA really wants to know is this: do you genuinely need the regular help of another person? Think of it this way—the benefit isn't for a particular illness, but for the effect that illness has on your life. It’s designed to kick in right when you need it most, helping pay for the kind of hands-on care you’d find in an assisted living community.

Defining the Need for Assistance

At the heart of the medical qualification is the need for help with Activities of Daily Living, or ADLs. These aren't complicated medical tasks; they are the basic, fundamental acts of self-care that most of us don't think twice about until they become a struggle.

A doctor's statement is absolutely essential here. The physician can't just list your medical conditions. They need to connect the dots and clearly explain why you require another person's assistance for your own health and safety. This letter is one of the most critical pieces of evidence in your application. For a closer look at this topic, our guide on what Activities of Daily Living are can be a huge help.

To qualify, a veteran generally needs assistance with at least two of these ADLs. Some common examples include:

- Bathing and Showering: Trouble getting into or out of the tub safely, or needing someone to help with washing.

- Dressing: Finding it difficult to put on clothes, manage zippers and buttons, or even get socks and shoes on.

- Eating: This is about the physical act of eating—like needing help cutting food or lifting a cup—not just preparing meals.

- Toileting: Requiring help to get on or off the toilet, or with personal hygiene afterward.

- Mobility: Needing support to move from a bed to a chair or simply to walk safely within your home.

It's important to know that this need for help doesn't have to be a 24/7 requirement. Even if you only need assistance at various points throughout the day, that can be enough to establish your medical eligibility.

Other Qualifying Medical Conditions

While needing help with ADLs is the most common way to qualify, it's not the only way. The VA also recognizes several other situations that automatically establish a veteran’s need for Aid and Attendance.

These conditions are considered so impactful that the need for daily support is just assumed. They serve as a direct path to meeting the medical side of the VA Aid and Attendance eligibility requirements.

The VA’s goal is to ensure this benefit reaches those who are most vulnerable. If a veteran's condition puts them at risk without supervision or leaves them confined to their home, the program is designed to step in.

Here are the other specific conditions that check the medical box:

- Being Bedridden: This means your condition is severe enough that it forces you to stay in bed.

- Significant Cognitive Impairment: If a veteran requires supervision to stay safe from everyday hazards due to conditions like dementia or Alzheimer's, they can qualify.

- Severe Vision Loss: A veteran who is legally blind (with corrected vision of 5/200 or less in both eyes) or has a visual field of 5 degrees or less also meets the criteria.

These health requirements are what make Aid and Attendance the highest tier of VA pension, reserved for veterans who need a significant level of care. With payouts reaching as high as $2,424 monthly ($29,091 yearly) for single veterans, this benefit can be a lifeline, helping to cover the costs of quality assisted living. For families exploring ways to enhance daily life and independence, understanding tools like assistive devices like lift chairs can also be incredibly useful.

Navigating the Financial Eligibility Rules

Once you've confirmed the military service and medical need, the last piece of the puzzle for VA aid and attendance eligibility is the financial side. For a lot of families, this is the most daunting part. It's easy to get lost in the numbers and rules, but once you break it down, it's much easier to see where you stand.

The VA essentially looks at two things: your income and your net worth. The whole point is to make sure the benefit gets to the veterans who genuinely need a hand paying for their care. So, don't think of it as a barrier, but as a system designed to channel support where it's needed most.

It’s a common myth that having any savings or income automatically kicks you out of the running. The truth is much more flexible, and the rules have some important details that can help you qualify, especially if you're already paying for care.

Understanding Countable Income

The VA starts by adding up your household's gross income from every source—Social Security, pensions, retirement funds, interest, you name it. But they don't stop there. What they’re really interested in is a figure called your "countable income."

This is where the most important strategy for qualifying comes into play. The VA lets you subtract certain recurring, unreimbursed medical expenses from your total income. This is a game-changer that so many families miss.

These deductible expenses are simply the healthcare costs you pay out-of-pocket that insurance doesn't cover. This can include things like:

- Assisted living community fees, like those at Forest Cottage Senior Care

- Costs for an in-home caregiver

- Health insurance premiums (including Medicare)

- Co-pays for prescription drugs

- The cost of medical supplies and equipment

When you subtract these legitimate medical expenses, your countable income can drop dramatically, often falling right below the VA's limit and making you eligible for the pension.

Example: Let's say a veteran has a monthly income of $4,000. On paper, that seems high. But he also pays $4,500 a month for his assisted living care. After deducting that huge medical expense, his countable income for VA purposes is actually $0. This makes him financially eligible for the maximum benefit.

The Net Worth Limit Explained

On top of income, the VA also looks at your net worth. This is the total value of your assets—think savings accounts, stocks, bonds, mutual funds, and any property you own besides your primary home. For 2026, the VA has a strict net worth limit of $163,699.

It’s crucial to know what the VA counts and what it doesn't.

- What Counts: Bank accounts, stocks, bonds, mutual funds, vacation homes, and other real estate.

- What Doesn’t Count: Your primary home, your car, and your basic home furnishings.

The VA's calculation is pretty direct: they take your total assets and add your annual countable income. If that final number is below the current limit, you've cleared the net worth hurdle. For families trying to figure out how to structure their finances for long-term care, our complete guide to VA benefits for assisted living in Texas offers more detailed strategies.

Trying to figure all this out on your own can be tough, and one small mistake could lead to a denial or long delays. It's always a good idea to get some guidance to make sure your application is set up for success. And as you map out the financial side of VA benefits, don't forget to look into other resources like Military and Healthcare Savings programs that can offer additional support. Knowing all your options is the key to building a secure future.

Your Step-By-Step Application Guide

Okay, now that you have a solid grasp of the service, medical, and financial rules, it's time to tackle the application itself. I know it can look intimidating, but breaking it down into a series of manageable steps makes it much less overwhelming.

The absolute key to a smooth process is preparation. Getting all of your documentation lined up before you even start filling out forms will save you a world of headaches. A complete, accurate application isn't just easier for you—it helps the VA process your claim faster and avoids those frustrating delays or denials that send you back to square one.

Gathering Your Essential Documents

Think of this part as building your case file. You need to give the VA crystal-clear proof that you meet every single requirement we've discussed. Before you even glance at a VA form, your first job is to pull together all your core documents.

Here's a checklist of the foundational paperwork you will absolutely need to get started:

- Proof of Military Service: Your DD-214 (or an equivalent discharge document) is the big one. It's non-negotiable, as it confirms your service dates, active duty, and character of discharge.

- Personal Identification: Get your birth certificate, marriage certificate (if applicable), and Social Security numbers for both you and your spouse ready.

- Medical Evidence: This is where the rubber meets the road. You need a detailed letter from a doctor explaining precisely why you need help every day. This statement must directly link your medical conditions to your need for assistance with those Activities of Daily Living (ADLs).

- Financial Records: Round up documents for all your income sources, like Social Security statements and pension letters. You'll also need to show your assets with bank statements and investment reports.

- Medical Expense Records: This is your secret weapon for meeting the income rules. Keep meticulous records—receipts, invoices, statements—for every out-of-pocket medical cost, especially those big-ticket items like assisted living or in-home care bills.

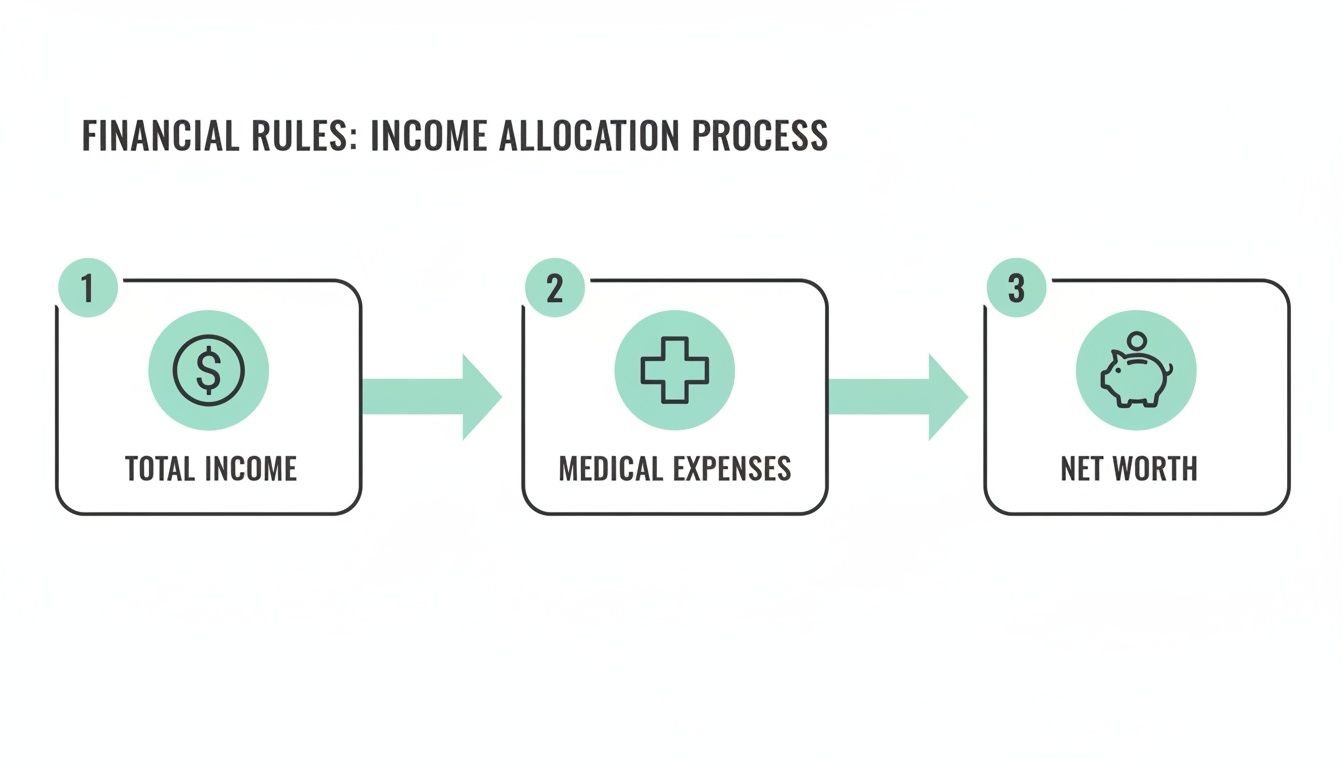

This flowchart shows exactly how the VA looks at your finances, starting with your total income and ending with your net worth after those crucial medical expenses are subtracted.

As you can see, deducting your medical expenses is the critical step that lowers your "countable income," which is what ultimately determines your financial eligibility.

Completing the Right VA Forms

With all your documents organized, it’s time for the official paperwork. The main form for the medical side of your claim is VA Form 21-2680, called the "Examination for Housebound Status or Permanent Need for Regular Aid and Attendance."

Your doctor must complete this form, detailing your daily care needs. Honestly, this is one of the most important pieces of your entire application because it gives the VA the professional medical validation they require for approval.

Along with the medical form, you'll submit the application for the pension benefit itself. A few different forms can be used, and working with someone who knows the ropes can ensure you pick the right one for your unique situation. For a much deeper dive into the specific forms and how to submit them, check out our detailed guide on how to apply for VA Aid and Attendance.

Setting Realistic Expectations and Getting Help

I’ll be straight with you: patience is a virtue here. VA processing times can vary wildly and often take several months. But there's good news—benefits are usually retroactive to the date you first applied. So, if your approval takes nine months, you'll get a lump-sum payment to cover that entire period.

Because one tiny mistake can cause major delays, getting expert help can make all the difference. At Forest Cottage Senior Care, we regularly partner with families to navigate this exact process. We connect you with accredited professionals who will review your application, catch common errors, and make sure everything is filed correctly the first time. It just makes the whole journey to securing these well-deserved benefits that much smoother and less stressful.

How Forest Cottage Supports Your Journey

Figuring out your VA Aid and Attendance eligibility is a huge first step. But the real goal is finding a community where you or your loved one can genuinely feel at home and thrive. At Forest Cottage Senior Care, we're more than just a care provider; we consider ourselves your dedicated partner on this journey.

Our team is here to help you navigate the often-confusing application process. We’ve seen the common pitfalls and paperwork hurdles that trip people up and cause frustrating delays. To make things smoother, we connect veterans with accredited professionals who can manage the entire application—and we can even help cover the associated legal fees.

Your Benefits at Work in Our Community

Once you're approved, those Aid and Attendance benefits go directly toward paying for high-quality, personalized care right here in our warm, homelike environment. The pension was designed for exactly the kind of support we provide every single day.

Here’s a glimpse of how your benefits can be put to work at Forest Cottage:

- 24/7 Personalized Care: Our round-the-clock nursing staff is always here, providing everything from medication management to hands-on assistance with dressing, bathing, and mobility.

- Specialized Memory Support: For residents facing dementia or other cognitive challenges, we offer a secure, compassionate setting with activities and supervision tailored just for them.

- A Dignified Lifestyle: Your benefits cover the essential services that ensure safety and well-being, allowing you to live comfortably without the constant financial strain.

We believe every veteran deserves to live with dignity and respect. Our mission is to bridge the gap between securing your benefits and receiving the exceptional care those benefits are meant to fund.

We invite you to see how we help veterans make the most of their hard-earned support. You can find more information in our overview of veterans benefits for assisted living.

Common Questions About Aid and Attendance

When you start digging into the details of VA Aid and Attendance eligibility, it's natural for a lot of questions to pop up. For veterans and their families, getting straight answers can make all the difference, building confidence as you figure out the program's finer points. Let's tackle some of the most common questions we hear every day.

Can I Receive Social Security and VA Aid and Attendance at the Same Time?

Yes, you absolutely can. Collecting Social Security benefits won’t prevent you from qualifying for the VA Aid and Attendance program. The VA does consider your Social Security payments as part of your total income.

But here’s the crucial part: you can subtract your recurring, unreimbursed medical expenses from that income. Think of costs like assisted living or in-home care. For many veterans, this medical expense deduction is exactly what brings their income below the VA's limit, making them eligible for the pension.

What if My Net Worth Is a Little Too High?

If your assets are just a bit over the VA's net worth limit, don't automatically count yourself out. The rules are surprisingly complex, and there are completely legal and ethical financial strategies that can help you become eligible down the road.

Your best bet is to talk with a VA-accredited attorney or a financial advisor who specializes in elder care planning. They can walk you through options for restructuring assets without running afoul of the VA's look-back period. Here at Forest Cottage, we’re happy to connect you with trusted professionals who can help you explore those options.

This benefit is a monetary pension paid directly to you. This gives you the freedom to choose the care setting that works best for your needs and preferences, empowering you to select a quality environment rather than limiting you to a specific government facility.

This kind of flexibility is one of the program's greatest strengths. It allows you to use your earned benefits to create the best possible living situation for your specific needs.

Do I Have to Live in a VA Facility to Use This Benefit?

No, you don’t, and this is honestly one of the best things about the program. Aid and Attendance is a monetary pension paid directly to you, not to a specific facility. That gives you the freedom to choose the care setting that feels right for you.

You can use the funds to help pay for:

- In-home care services that let you stay comfortably in your own home.

- A licensed nursing home when skilled medical supervision is needed.

- An assisted living community like Forest Cottage Senior Care.

This structure puts you in the driver's seat, empowering you to select a quality, compassionate environment instead of being limited to a specific government facility.

How Long Does the Application Approval Take?

This is a tough one because processing times can really vary depending on the VA's current workload and the details of your application. It’s not uncommon for it to take anywhere from several months to over a year to get an approval.

But the important thing to remember is that benefits are typically paid retroactively all the way back to the date you first submitted your application. So, if your approval takes ten months, you'll receive a lump-sum payment covering those ten months. Making sure your application is complete and accurate right from the start can help you avoid unnecessary delays—which is why working with an expert can be so valuable.

At Forest Cottage Senior Care, we're committed to helping veterans access the benefits they've earned to fund the dignified care they deserve. Schedule a tour to see how we can support your journey. Learn more at https://www.forestcottageseniorcare.com.