Yes, in almost every case, long-term care insurance (LTCI) does cover assisted living. You can think of this insurance as a financial safety net, specifically designed to pay for care in places like an assisted living community when you need help with daily life. Its main job is to protect your hard-earned savings from the high costs of care.

Understanding How Long Term Care Insurance Covers Assisted Living

Long-term care insurance was created to pay for services that your regular health insurance or Medicare won't touch. Its core purpose is to help with what's known as "custodial care"—which is just a technical term for assistance with personal tasks, not medical treatment. Assisted living communities are one of the main places people use these benefits.

Having this financial protection is more important than ever. The national median cost for assisted living hit $70,800 annually in 2024, which was a huge 10% jump from the year before. An LTCI policy can be the difference-maker, allowing you to afford this level of care without derailing your finances. For a closer look at local expenses, check out our guide on the assisted living cost per month.

How LTCI Covers Assisted Living At a Glance

Let's break down the key components of how these policies work with assisted living. This table simplifies what each part of your policy means for you.

| Coverage Aspect | What It Means for You |

|---|---|

| Benefit Triggers | These are the conditions that "turn on" your policy, like needing help with daily activities or having a cognitive diagnosis. |

| Elimination Period | Think of this as a deductible measured in time, not money. It's the number of days you pay for care before the insurance starts paying. |

| Daily/Monthly Benefit | This is the maximum amount your policy will pay per day or month for your care expenses. |

| Benefit Period | The total length of time (e.g., 3 years, 5 years, lifetime) that your policy will continue to pay out benefits. |

| Comprehensive Coverage | This feature ensures your policy covers different types of care settings, including assisted living, in-home care, and nursing homes. |

Understanding these terms is the first step in seeing how your specific policy can be put to work at a community like Forest Cottage.

When Does Coverage Kick In?

To start using your LTCI benefits, certain conditions have to be met. These are often called "benefit triggers," and they're in place to make sure the policy is used when there's a genuine need for care. While the specifics can vary, the most common triggers are:

- Needing help with Activities of Daily Living (ADLs): This is the most common trigger by far. To qualify, a doctor or nurse must certify that you can't perform at least two of the six main ADLs on your own. These include bathing, dressing, eating, toileting, continence, and transferring (like getting out of a bed or chair).

- Cognitive Impairment: If you're diagnosed with a condition like Alzheimer's disease or another form of dementia, that can also trigger your benefits. This is true even if you don't need physical help with ADLs, and it's a major reason why older adults need long-term care.

On average, a long-term care insurance policy covers about 2.6 years of assisted living expenses. That provides a significant buffer against rising care costs and gives families a lot more certainty when planning for the future.

Thankfully, most policies sold today are "comprehensive." This means they're built to cover various care settings, including your own home, nursing homes, and—most importantly for many families—assisted living facilities. This flexibility is key, as it lets you choose the environment that’s right for you as your needs change over time. You can see how LTCI policies provide significant coverage in recent industry reports.

How Your Long Term Care Insurance Policy Actually Works

Trying to make sense of a long-term care insurance (LTCI) policy can feel like you're reading a foreign language. But once you break it down, the core parts are surprisingly straightforward. It helps to think of it like the car or home insurance you already have—it’s just a tool for managing financial risk. Instead of a fender bender, it's designed to cover the cost of care when you need it most.

The first term you'll run into is the elimination period. This is basically a deductible, but it’s measured in time, not dollars. It’s a waiting period—often 30, 60, or 90 days—where you pay for your own care out-of-pocket before the insurance company starts to pay.

After that waiting period is over, your policy kicks in based on its daily benefit amount. This is the maximum amount of money the insurer will pay each day for your care. So, if your assisted living community costs $180 a day and your daily benefit is $200, you’re all set. If the cost is $220, you’d be responsible for that extra $20.

The Big Picture Your Benefit Pool

All those daily payments are pulled from your total benefit period or benefit pool. This is the total reservoir of money your policy holds for your lifetime. Some policies define this as a certain number of years (like three years), while others set it as a total dollar amount (say, $300,000).

Having this financial buffer is more important now than ever. In 2024, the median cost for assisted living shot up to $70,800 a year, a staggering 10% jump from the year before. With costs like these, a policy that offers a lifetime benefit of over $500,000 brings incredible peace of mind. It’s especially critical when you realize that 45% of seniors mistakenly believe Medicare will foot the bill. You can dig into more of these financial realities in this detailed AHCA report.

Think of your policy this way:

- Elimination Period: The countdown before help arrives.

- Daily Benefit: Your daily allowance for care costs.

- Benefit Pool: Your total safety net of funds.

Getting a handle on these basics is key for smart planning. Knowing your daily benefit helps you pick an assisted living community that won’t break your budget, and understanding the elimination period tells you how much you should have in savings to cover those initial weeks. Learning about what services are included in assisted living will also help you match your policy benefits to the actual care you'll get.

While LTCI is specific to care services, looking at how other long-term support systems work, like in a comprehensive guide to Long Term Disability in Canada, can be insightful. The core ideas of benefit triggers and claims are often quite similar, giving you a broader understanding of how to manage long-term financial needs.

Understanding What Triggers Your Coverage

A long-term care insurance policy isn't like a light switch you can just flip on whenever you want. Before your coverage kicks in, certain specific conditions—known as benefit triggers—have to be met. Think of them as the keys that unlock your policy's financial help, making sure the support is there right when you genuinely need it.

For almost every policy out there, two main paths can start your benefits. Getting a handle on how these work in the real world is the most important step in knowing when your insurance will step up to help pay for assisted living.

Needing Help with Daily Activities

The most common trigger is pretty straightforward: you can no longer handle several Activities of Daily Living (ADLs) on your own. These are the basic, fundamental tasks of self-care that most of us do every day without even thinking about them.

Typically, a licensed healthcare practitioner, like a doctor or nurse, needs to certify that you require hands-on help with at least two of the six standard ADLs. These essential activities include:

- Bathing: Being able to wash yourself in a tub or shower.

- Dressing: The ability to get your clothes on and off.

- Eating: Simply being able to feed yourself.

- Toileting: Getting on and off the toilet and managing personal hygiene.

- Continence: The ability to maintain control over bladder and bowel functions.

- Transferring: Moving from a bed to a chair, or into a wheelchair.

If you want to dive deeper into how these are officially assessed, check out our detailed guide on what are Activities of Daily Living. Just needing help with two of these is often enough to get the claims process rolling.

Cognitive Impairment as a Trigger

The second major way to activate your policy is through a diagnosis of severe cognitive impairment. This is an absolutely critical provision, especially for conditions like Alzheimer’s disease or other forms of dementia.

A cognitive impairment diagnosis can activate your benefits even if you are still physically independent and don’t need help with any ADLs. This trigger acknowledges that supervision and a secure environment are essential forms of care.

What this means is that if a loved one receives a diagnosis that impacts their memory, reasoning, or judgment to the point where they could be a danger to themselves or others, the policy can be triggered. This gives families the financial support needed to move into a safe, supportive community designed for memory care.

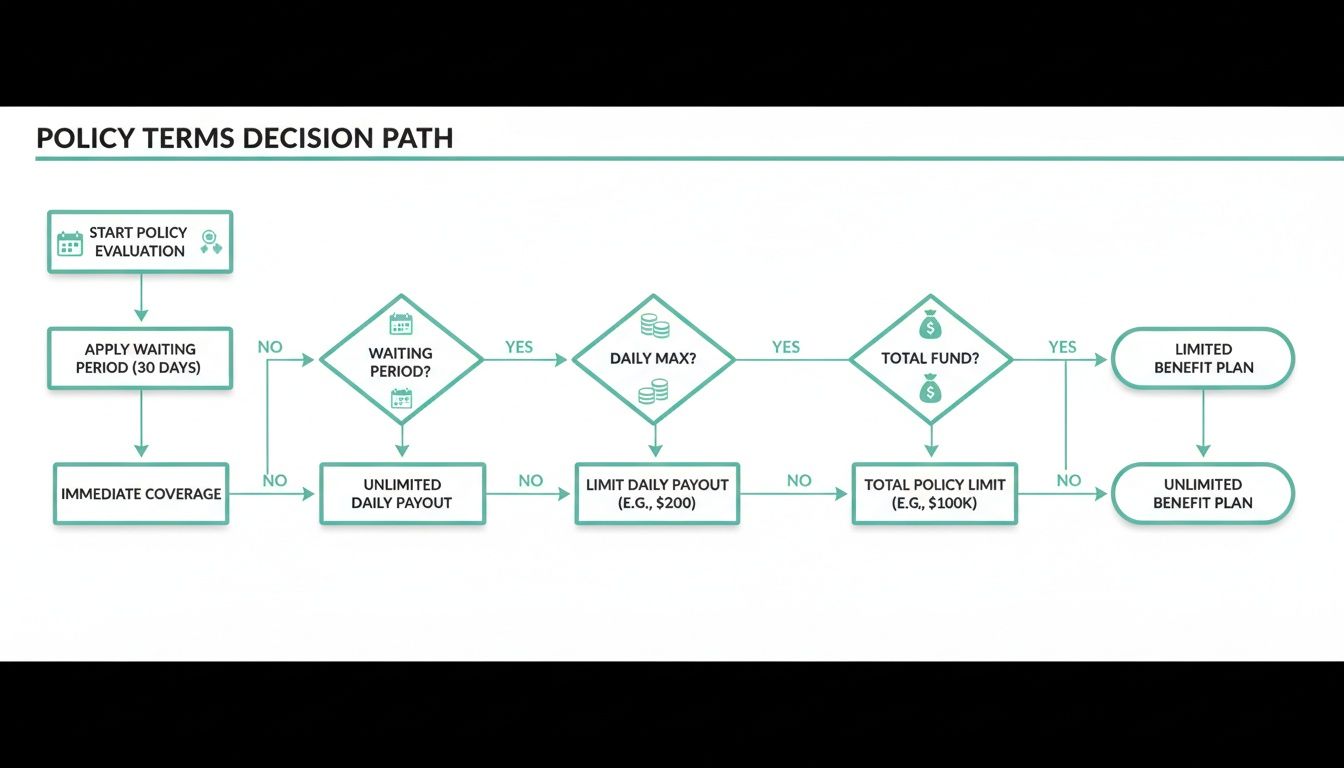

Once your coverage is triggered by one of these conditions, other parts of your policy come into play. This visual decision tree shows how key terms like your waiting period, daily payout maximum, and total benefit fund work together.

As the flowchart shows, these elements work in sequence to figure out exactly how much your policy will pay out once you've met the initial benefit triggers.

Decoding Your Policy for Assisted Living Benefits

Just because you have a long-term care insurance policy doesn't mean everything is clear-cut when it comes to assisted living. Every single contract is written in its own unique language, and getting comfortable with the fine print is the key to using your benefits without any hiccups.

Think of your policy as a detailed map. To get where you're going, you first need to understand what all the symbols and lines mean.

The best place to start is your policy document. Flip to the section labeled "Definitions" or "Covered Services." This is where the insurance company lays out exactly what types of care and facilities are on the table. You're looking for specific words that give you the green light.

Key Terms to Find

As you scan your policy, keep an eye out for keywords that directly point to assisted living. The exact phrasing can vary from one company to another, but these are the big ones that tell you you're on the right track:

- Assisted Living Facility: This is the clearest and most direct term. If you see this, it’s a strong confirmation that licensed communities are covered.

- Residential Care Facility: This is another common synonym that many policies use to describe an assisted living environment.

- Custodial Care: This one is crucial. It refers to the non-medical, hands-on help with things like bathing, dressing, and eating—which is the absolute core of what assisted living provides.

- Personal Care Services: Very similar to custodial care, this language confirms that help with the Activities of Daily Living (ADLs) is a covered benefit.

Finding these terms is your first major win. It means your policy was designed to work in a community just like Forest Cottage Senior Care.

A quick but important side note: check for different payout rates. Some older policies might offer a 100% benefit for a nursing home but only cover 50-75% of that daily amount for assisted living. Knowing this number upfront is essential for accurate budgeting.

Your Policy Review Checklist for Assisted Living

To make this process a bit easier, we've put together a checklist. Use this table to navigate your policy document and pinpoint the exact clauses that apply to assisted living coverage. It helps you focus on what's important and understand why it matters.

| Policy Section | What to Look For | Why It Matters |

|---|---|---|

| Definitions | Terms like "Assisted Living Facility," "Residential Care," "Custodial Care." | This confirms the policy explicitly covers the type of care provided in an assisted living community. |

| Covered Services | A list of services like personal care, medication reminders, and help with ADLs. | Ensures the specific daily support your loved one needs will be paid for by the policy. |

| Benefit Triggers | The criteria for activating benefits (e.g., inability to perform 2 of 6 ADLs, cognitive impairment). | You need to know exactly what conditions must be met to start receiving payments. |

| Elimination Period | The waiting period (e.g., 30, 60, or 90 days) before benefits begin. | This is the initial out-of-pocket period you must cover, so it's a critical budget item. |

| Daily/Monthly Benefit Amount | The maximum dollar amount the policy will pay per day or month. | This tells you how much of the assisted living cost will be covered and how much you'll need to supplement. |

| Benefit Payout Structure | Is it reimbursement (you pay first) or indemnity (direct payment)? Does it pay less for assisted living than a nursing home? | This impacts your cash flow and how you'll manage monthly payments to the community. |

| Exclusions | A list of what the policy will not cover (e.g., room and board, luxury amenities, specific medical care). | Knowing the exclusions helps you avoid surprise bills and plan for out-of-pocket expenses. |

Going through your policy with this checklist in hand can turn a confusing document into a clear roadmap for your financial planning.

Common Inclusions and Exclusions

Once you've confirmed coverage, the next step is to understand its limits. Most policies that cover assisted living are great for services like personal care assistance, medication management, and daily wellness checks. However, they almost always have specific limitations.

For example, your policy probably won't cover the full "room and board" cost if it's billed separately from care services. It also won't foot the bill for things like the on-site beauty salon, luxury amenities, or extensive private nursing that goes beyond what the community normally provides.

When you're ready, having a solid list of questions to ask assisted living facilities can help you perfectly align a community's services with what your policy covers. Taking the time to review these details means no financial surprises down the road, allowing you to plan with confidence.

Exploring Other Ways to Pay for Assisted Living

While long-term care insurance is a fantastic planning tool, it's definitely not the only way to pay for senior care. Understanding all your options is the key to creating a financial strategy that actually works for your family's future. It's quite common for families to mix and match different funding sources to cover the costs of an assisted living community.

The most straightforward path is private pay, which is just a simple way of saying you're using your own money. This could mean dipping into retirement accounts like a 401(k) or an IRA, selling a house or other property, or using income from pensions and Social Security. Thinking through these expenses well in advance is the best way to protect your hard-earned assets.

Beyond just the money, it's also crucial to have the right legal protections in place. Getting a handle on how a Durable Power of Attorney (DPOA) works can be a lifesaver for managing finances, especially if a loved one can no longer make those decisions themselves.

Government and Veterans Programs

For those who meet the financial requirements, government programs can offer a huge helping hand. Medicaid, which is a partnership between the federal government and the states, is a major source of funding for long-term care, but it comes with some very strict rules.

To qualify for Medicaid, an individual has to have very limited income and few assets. The program is really designed to be a safety net for those with the greatest financial need, and the eligibility rules can be complicated and change from state to state.

Because the rules are so particular, it’s worth taking the time to understand them. For a deeper dive on this, you can learn about how Medicaid can pay for assisted living in Texas in our dedicated guide.

Another incredible resource is available for those who have served our country. The Department of Veterans Affairs (VA) offers benefits that can help shoulder the cost of care in an assisted living community.

- VA Aid and Attendance: This is a pension benefit that provides monthly payments to qualified wartime veterans and their surviving spouses. The funds are meant for people who need help with daily activities or are housebound.

- Basic Pension: Even if someone doesn't qualify for the Aid and Attendance add-on, some veterans may be eligible for a basic pension that can be used to help offset assisted living expenses.

Each of these avenues—private pay, Medicaid, and VA benefits—has its own set of hoops to jump through. Looking into each one helps you see the whole picture and put together a financial plan that ensures you or your loved one gets the care they need without adding unnecessary financial stress. It’s a holistic approach that brings peace of mind to the entire family.

How Forest Cottage Helps You Use Your Benefits

Moving from planning to action can feel like a huge leap, but you don't have to navigate the process of using your long-term care insurance alone. At Forest Cottage Senior Care, we simplify this journey by partnering with you every step of the way. Our dedicated care advisors are here to help you make sense of it all.

We start by helping you understand how your specific policy aligns with the services we provide. Think of us as your coordination partners; we can assist in communicating with your insurance provider to ensure a smooth and transparent process. We know that activating your benefits depends on meeting certain care requirements.

Personalizing Care to Meet Policy Triggers

That’s why our approach is built around personalized care plans. We carefully document how our support meets the specific triggers your policy requires, whether it's assistance with two or more Activities of Daily Living (ADLs) or providing a secure environment for cognitive impairment. This documentation is key to a successful claim.

At Forest Cottage, we ensure your benefits are used effectively to enhance your quality of life. Our goal is to create a seamless transition where your insurance provides the financial security it was meant to, allowing you to focus on living well.

Here's how we help:

- Policy Review: We'll help you identify the key clauses related to assisted living coverage in your LTCI contract.

- Care Assessment: Our team conducts a thorough assessment to match your needs directly to policy requirements for benefit activation.

- Ongoing Coordination: We provide the necessary information and updates to your insurer to maintain your benefit eligibility.

By combining our compassionate, all-inclusive care with this practical support, we ensure your benefits create a secure and fulfilling future. We invite you to speak with us to see how we can put your plan into action.

Common Questions About Long-Term Care Insurance

Even after you've done your homework, some practical questions always pop up when it's time to actually use a long-term care policy. Let's tackle a few of the most common concerns we hear from families.

Will My Long-Term Care Insurance Premium Increase Over Time?

It's a definite possibility. Unlike some insurance policies that have locked-in rates, LTCI premiums are generally not guaranteed for life. If an insurance company finds that its claims are higher than originally projected, it can request a rate increase.

But they can't just raise your rate on a whim. Any increase has to be approved by state insurance regulators, and it applies to an entire class of policyholders, not just you individually. When you're shopping for a policy, it's smart to ask about the company's track record with rate hikes.

What if Assisted Living Costs More Than My Daily Benefit?

This happens quite often, and it's a crucial part of planning. If the daily cost of your assisted living community is higher than your policy's daily benefit amount, you'll be responsible for paying the difference out-of-pocket.

For instance, if the community costs $225 per day and your LTCI policy pays out $175, you would cover the remaining $50. This is exactly why it's so important to choose a realistic daily benefit when you buy the policy and strongly consider adding an inflation protection rider to help your benefit grow over time.

Can I Use My Insurance for a Short-Term Respite Stay?

Yes, many modern long-term care insurance plans do cover short-term respite stays in an assisted living community. Respite care is designed to give a family caregiver a much-needed break, and insurers have recognized how valuable it is.

To use this benefit, you'll typically need to meet the same eligibility triggers as you would for a permanent move, like needing help with at least two ADLs or having a cognitive impairment. It can also be a fantastic way to try out a community before making a long-term commitment.

Does Medicare or Medigap Cover Assisted Living?

This is probably the biggest point of confusion for families, and the answer is a firm no. Medicare and Medigap policies do not pay for long-term custodial care in an assisted living setting. "Custodial care" is the non-medical help with daily activities like bathing, dressing, and eating, which is the core of assisted living.

Medicare's benefits are limited to short-term, skilled nursing care following a qualifying hospital stay. It's designed for rehabilitation, not ongoing support. This gap in coverage is the entire reason long-term care insurance was created—to pay for the type of care that Medicare was never intended to cover.

Trying to make sense of your benefits can feel like a puzzle, but you don't have to figure it out alone. The team at Forest Cottage Senior Care has experience helping families understand their policies and how they can be used for excellent care. We invite you to schedule a tour and talk with us by visiting https://www.forestcottageseniorcare.com.