The average assisted living cost per month in the United States usually falls between $4,000 and $6,000. In Willis, TX, prices tend to be a bit kinder on the wallet—typically $3,800 to $5,200.

Quick Answer On Assisted Living Cost Per Month

When you need figures at a glance, here’s how national and Willis, TX rates compare:

| Location | Median Monthly Cost |

|---|---|

| National | $5,475 |

| Willis, TX | $4,500 |

That national median pulls in numbers from bustling cities to small towns.

Meanwhile, Willis benefits from lower everyday costs and strong local competition.

- Private suites and higher care tiers can push your rate above the local average.

- Bundled plans—meals, housekeeping, medication management—make budgeting simpler.

- Add-on options like transportation or physical therapy adjust the total bill.

Key Cost Influences

- Staffing Ratios: More caregivers per resident usually mean higher fees.

- Memory Care: Specialized programming carries a premium.

- Amenities: Features such as salons or fitness rooms add to monthly costs.

- Local Regulations: Licensing requirements and local fees cause small regional shifts.

Lining up these factors sheds light on budgets before you set foot in a community.

“Understanding these baseline figures lets families set realistic budgets before touring communities.”

Learn more about assisted living fundamentals in our guide on what assisted living is.

Next, we’ll dive into detailed cost components and care levels so you can plan with confidence.

Rates can shift with seasonal promotions or move-in specials at Forest Cottage Senior Care.

Always confirm current pricing and available discounts before making decisions.

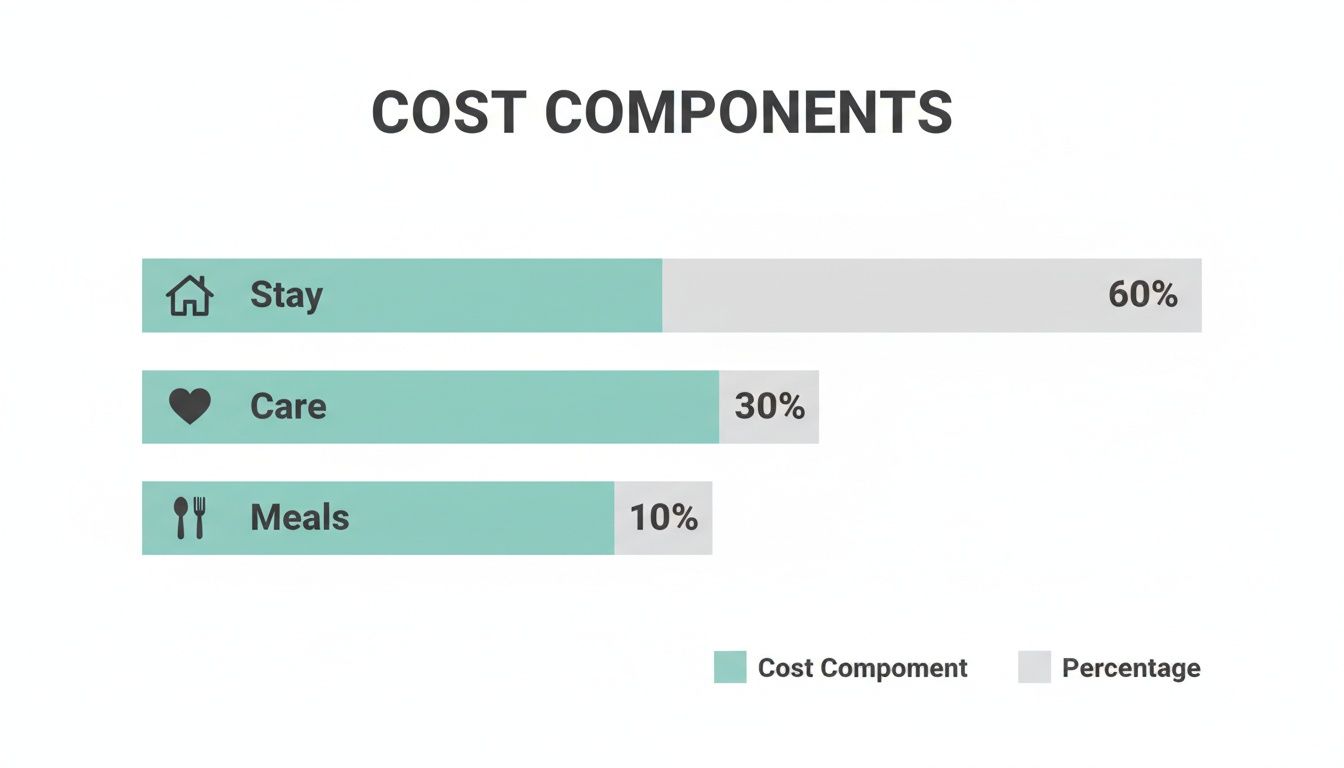

Break Down Assisted Living Cost Components

Getting a clear picture of your monthly assisted living expenses starts with unpacking each piece of the puzzle. When you see exactly where your dollars go, planning becomes a lot less stressful.

Accommodation, care levels, meals, medication management and add-on services all factor into the final bill. Imagine a bundled package as a monthly subscription—everything under one flat rate. Going à la carte is more like ordering off a menu, paying only for what you need.

- Accommodation covers private or shared suite rent.

- Care Levels range from light personal help to 24/7 clinical support.

- Meal Plans include standard dining, special diets or gourmet options.

- Medication Management can be as simple as reminders or full administration.

- Add-On Services such as transportation, housekeeping, laundry and wellness programs.

Local market conditions—think proximity to hospitals, age of the building and shared amenities—also shape base rent. Some communities tack on a 5–10% premium for top-tier finishes or premier locations.

Key Accommodation Options

Accommodation often represents 20–30% of your monthly bill, influenced heavily by room choice and community setting.

Private suites usually come with an ensuite bathroom and sometimes a kitchenette. Shared rooms cost less but mean giving up a bit of personal space.

Here’s a quick look:

- Private Suite: $3,000 per month (room, utilities, basic furnishings)

- Shared Suite: $2,200 per month (lower rent, built-in companionship)

- Couples Sharing: 10% discount on combined rent for two occupants

“Selecting the right suite lays the groundwork for comfort—and keeps your budget on track.”

Once you’ve settled on your living space, the next step is choosing a care level bundle.

Care Level Bundles

Care level fees typically form the largest slice of your monthly costs. Communities group services into tiers so you can match your needs.

- Basic Assistance: Help with three daily living tasks like bathing or dressing.

- Intermediate Care: Includes basic assist plus medication administration and nurse check-ins.

- Memory Care: Offers higher staff ratios, secure areas and specialized cognitive activities.

| Level Of Care | Estimated Monthly Fee |

|---|---|

| Basic Assistance | $1,500 |

| Intermediate Care | $2,200 |

| Memory Care | $3,500 |

These bundles cover everything from routine wellness checks to around-the-clock nursing oversight. Adjusting your level directly alters the total rate.

Extra Service Add-Ons

If you need more than the core package, you can cherry-pick extras to fine-tune your plan:

- Transportation: $150/month for group outings; $25/private trip

- Housekeeping & Laundry: $300/month for weekly cleanings and linens

- Wellness Programs: $100 for fitness classes; $50 for pet therapy

- Beautician Services: $30–$60 per visit

Bundling these extras can save you money. For instance, packaging transportation, laundry and pet therapy might run $450 instead of $550 if purchased separately.

Tip: Always review the itemized statement. It’s the best way to spot which services drive your highest charges.

Curious about the full range of offerings? See our guide on assisted living services at Forest Cottage Senior Care.

Viewing your bill like a menu gives you control—letting you prioritize services that matter most for your budget and lifestyle.

Compare National And Willis TX Assisted Living Cost Per Month

When families sit down to plan for assisted living, getting a clear view of monthly expenses is a game-changer. Across the U.S., the 2025 national median runs from $5,000 to $5,950 per month. But state averages swing widely—from about $4,000 in Alabama all the way up to $11,000 in Hawaii. For in-depth insights, check out the cost findings on A Place for Mom.

Assisted Living Monthly Cost Comparison

Below is a snapshot of how Willis, TX stacks up against national and state extremes.

Assisted Living Monthly Cost Comparison

| Location | Median Monthly Cost |

|---|---|

| National Median | $5,475 |

| Alabama | $4,000 |

| Hawaii | $11,000 |

| Willis, TX | $4,500 |

In this table, you can see Willis sits roughly 18% below the national median, reflecting more modest local rates.

That sample pricing snapshot highlights how room type and care level shift costs:

- Private suites in Willis average $3,800 per month.

- Shared rooms can bring it down to about $2,700.

- Adding higher care tiers tacks on roughly $1,200 to $3,000 depending on needs.

- Some communities offer bundled services at a flat rate for simplicity.

Regional Cost Drivers

Local factors explain why Willis rates fall below national figures:

- Property Taxes: Lower county and city levies keep rents affordable.

- Workforce Wages: Modest pay scales for caregivers ease operational expenses.

- Licensing & Regulations: Texas fees are mid-range, avoiding the high overhead you see on the coasts.

Budgeting Benchmarks

Having these numbers in hand stops sticker shock before it starts. Bookmark the medians above and use them to steer initial conversations with communities.

Using This Comparison

If you’re planning for $4,200 a month in Willis, for instance, you might zero in on shared accommodations with basic care bundles. Need more support? Adjust your target closer to $5,000 to cover intermediate care levels.

Steps to put this into action:

- Identify the room style (private suite vs. shared) and level of care needed.

- Line up rates from multiple facilities against the median table to spot good fits.

- Request a detailed breakdown: housing, meals, care tier, plus any extras.

- Ask about move-in specials, seasonal discounts or long-term deals to trim your costs.

Beyond the numbers, weigh local perks like pet-friendly policies or on-site programs. Willis communities often feature dog therapy sessions and daily enrichment classes that lift spirits. At Forest Cottage Senior Care, private rooms start near $3,800 per month with three support levels tailored to your budget and care profile.

Explore availability and schedule a tour today at https://www.forestcottageseniorcare.com/assisted-living-in-my-area/ to see how these figures translate into real-life comfort—and to lock in any seasonal incentives before rates change.

Assisted Living Cost Per Month Trends

Families often underestimate how modest annual hikes can snowball over time. A boost of 3% per year might feel manageable today, but let it compound over a decade and the difference becomes staggering.

Recent reports show most markets averaging 3% year-over-year increases, with some regions spiking as high as 10%. Learn more about these findings on The Senior List.

“Planning for rising rates now can save families tens of thousands of dollars over time.”

Key Drivers of Monthly Fee Rises

- Labor Costs: Wages have climbed faster than general inflation.

- Utilities & Maintenance: Aging facilities demand more upkeep and higher energy bills.

- Clinical Care Needs: Specialized staff and equipment carry premium price tags.

Projecting Future Costs

Building a realistic forecast lets you budget for the long haul. If you assume a 3%–5% annual rise, you can:

- Factor inflation into your yearly living expenses.

- Set aside a contingency fund for unexpected spikes.

- Review contract terms for fixed-rate or escalation clauses.

Regional Case Study

In Willis, TX, assisted living rates climbed roughly 4% per year over the last five years. Forest Cottage Senior Care countered that by:

- Installing LED lighting and high-efficiency HVAC systems

- Staggering staff schedules to curb overtime costs

- Renegotiating vendor contracts annually

These moves helped cap local increases at about 2% yearly.

Planning With Insurance

Blending coverage sources can smooth out future rate hikes:

- Long-Term Care Insurance: Eases the burden of daily care expenses.

- VA Aid & Attendance: Apply early to secure veterans’ benefits.

- Medicaid Waivers: Check income limits and renewal rules each year.

Tips To Protect Your Budget

Locking in predictable rates today gives real peace of mind tomorrow:

- Secure multi-year rate agreements.

- Explore move-in promotions or seasonal incentives.

- Compare fixed-rate plans across nearby communities.

- Monitor local pricing trends every quarter.

By tackling cost trends now, you’ll avoid budget surprises and safeguard your savings. A clear, long-term strategy brings real confidence to families evaluating Forest Cottage Senior Care.

Estimate Assisted Living Cost Per Month By Care Level

Think of choosing an assisted living tier like picking a streaming bundle—you balance features against price.

At Forest Cottage Senior Care, Basic Support handles everyday tasks. Intermediate Care layers in medical check-ins. Memory Care wraps in specialized programs for dementia and Alzheimer’s.

Below, you’ll find real-life scenarios and median monthly costs to help families pair their loved one’s needs with a budget that feels right.

Profiles And Pricing Estimate

To make the numbers more human, let’s look at three residents:

Mrs. Jones

She needs help with dressing, bathing and meal prep—three daily tasks. That puts her in Basic Support at about $4,500 per month.

Mr. Miller

He requires twice-daily medication administration and nurse visits. He fits Intermediate Care, which runs around $5,700 monthly.

Mrs. Davis

Living with Alzheimer’s, she benefits from tailored memory programs and higher staff ratios. Her cost lands at roughly $7,200 each month under Memory Care.

These snapshots turn abstract figures into familiar stories.

Sample Monthly Cost By Care Level

Here’s a quick look at estimated median costs for each tier:

| Level Of Care | Estimated Monthly Cost |

|---|---|

| Basic Support | $4,500 |

| Intermediate Care | $5,700 |

| Memory Care | $7,200 |

By breaking down costs this way, you’ll see how each level stacks up before digging into the details below.

Real Cases And Insights

A closer look shows:

- Upgrading from Basic to Intermediate Care typically adds about 25% more each month.

- Memory Care can top out at 60% above basic support, thanks to extra staffing and secure programming.

- Special offers and bundled wellness perks might shave off up to 5%, but those deals often expire.

Seeing these percentage shifts helps families forecast how costs rise alongside services.

Factors That Influence Care Tiers

Several moving parts affect pricing as you move up the ladder:

- Staff Ratios: More hands on deck for higher-need residents.

- Specialized Training: Dementia workshops and safety certifications add to expenses.

- Facility Upgrades: Secure locks, therapy rooms and sensory gardens increase capital costs.

- Activity Programs: From simple group games to music and art therapy, offerings grow richer—and pricier.

An easy analogy: Basic Support is economy class, Intermediate Care feels like business, and Memory Care is first-class service. Each upgrade brings more comfort and oversight.

Case Study: The Smith Family

After Dad’s hospital stay, they moved him from Basic to Intermediate. Their monthly fee jumped from $4,500 to $6,000, but daily nurse checks and on-site therapy cut readmissions in half.

Budgeting Tips And Tricks

Think of your budget buffer like extra miles in your car’s tank—always keep a little in reserve. A 10% cushion above quoted rates usually covers surprise increases.

- Track yearly rate hikes and compare past invoices.

- Bundle core services to avoid individual add-on fees.

- Ask about multi-year rate locks or guaranteed pricing plans.

- Look for seasonal move-in specials that include free trial weeks or wellness credits.

These strategies help stabilize your spending over time.

Next Steps To Choose Level

- Write down your loved one’s daily care and medical supervision needs.

- Match those requirements to the feature sets in each tier.

- Request detailed quotes for any custom add-ons beyond the core package.

“By tying real scenarios to clear numbers, families can budget confidently and sidestep sticker-shock down the road.”

Contact Forest Cottage Senior Care today to compare care-level costs and arrange a tour.

Explore Financing Options For Assisted Living Cost Per Month

When you’re planning for assisted living, you’re really piecing together a handful of funding sources. Picture each one as a puzzle piece snapping into your monthly budget. Fit them all together and you turn a scary bill into a steady, predictable expense.

Overview Of Key Payors

Combined, these streams usually cover 70% to 80% of the average assisted living cost per month:

- Medicaid – State-run program with income and asset caps.

- VA Aid & Attendance – Extra monthly stipend for eligible veterans and spouses.

- Long-Term Care Insurance – Best when set up early; review benefit limits and waiting periods.

- Home Equity / Personal Savings – Your fallback to bridge any remaining gap.

Each source has its own paperwork, approval timeline, and fine print.

Medicaid Eligibility Simplified

Medicaid often behaves like a co-pay once you meet eligibility. You’ll need to watch state-specific income and asset limits and demonstrate a care need.

- Approval takes about 30 to 60 days, so start early.

- Gather bank statements, tax returns, and residency proof.

- File online or in person—and follow up if you haven’t heard back.

VA Aid And Attendance Basics

Aid & Attendance tacks onto your existing VA pension, covering things like personal care and daily support. Typical awards range from $1,400 to $2,200 per month.

- Verify your discharge papers and service history.

- Have a medical professional complete VA Form 21-2680.

- Plan for a 6 to 12-week review period.

Long Term Care Insurance Claims

Think of your policy as prepaid coverage for future care. Once you submit everything, insurers usually take 30 to 45 days to process your claim.

- Confirm you have any inflation-protection riders you selected.

- Compile doctor’s statements and care-need assessments.

- Follow the insurer’s claim checklist closely to avoid denials.

Check out our guide on long-term care insurance coverage for assisted living to dive deeper.

Personal Savings And Equity

When other benefits lag, your savings or home equity can fill in the blanks. A reverse mortgage, for instance, taps into home value like a safety net.

Aim to use these last—preserving other sources helps you maintain eligibility.

“Combining these options ensures a balanced plan without draining resources too fast.”

Most families follow a three-step process, much like a recipe:

- Layer in each funding source by expected payout and approval time.

- Total up the projected benefits and spot any shortfalls.

- Reorder or swap sources if one takes longer than planned.

Real-World Example: The Lopez family blended Medicaid, VA benefits, and a small insurance payout to cover 85% of their $5,000 monthly bill. Their secret? Early planning and an organized document folder.

Avoid Approval Delays

A missing form can bring everything to a halt. A friendly check-in every two weeks keeps things moving.

- Track deadlines on a shared calendar.

- Keep digital and paper copies of every submission.

- Ask each agency how they prefer to be contacted.

Timeline Overview

Coordinating approvals typically takes 8 to 16 weeks in total. Here’s a quick look:

| Funding Source | Typical Timeline |

|---|---|

| Medicaid | 30–60 days |

| VA Aid & Attendance | 45–90 days |

| LTC Insurance | 30–45 days |

| Home Equity | 14–28 days |

Putting It All Together

Once approvals arrive, build a living budget you update regularly:

- Log each benefit as it starts arriving.

- Review your figures monthly with family or an advisor.

- Pivot quickly if a gap appears.

This chart becomes your roadmap to covering assisted living cost per month sustainably. For extra confidence, meet with Forest Cottage Senior Care’s financial counselor.

Next Steps And Resources

Gather bank statements, service estimates, and application packets in one folder. Then:

- Call to schedule an application review.

- Download our benefits checklist from the website.

- Sign up for a financial planning workshop at Forest Cottage.

Start your funding journey now and secure peace of mind for your loved one.

FAQs And Financing Considerations

Before you wrap up, keep these pointers in mind:

- Watch out for overlapping benefits—duplicate claims can trigger penalties.

- Remember annual recertifications for Medicaid and VA programs.

- Check if your facility has extra co-pay rules or lifetime caps.

- For complex estates, an elder law attorney can offer clarity.

Stay informed. Let’s get started today.

Next Steps For Families Choosing Assisted Living

Now that you’ve broken down assisted living cost per month, it’s time to set a game plan. Treat your search like plotting a route on a map: each step brings you closer to the right destination.

Research And Compare Facilities

First off, jot down every community in Willis, TX and nearby towns. You’ll quickly see patterns in fees, floor plans, and services that matter most to your family.

- Check online ratings and read recent reviews.

- Compare meal options, housekeeping schedules, and fitness or wellness classes.

- Look for specialized offerings, like memory care programs or on-site therapy.

“Seeing multiple communities side by side helps families clarify their priorities.”

Putting facilities side by side keeps surprises at bay and sets your budget expectations for assisted living cost per month.

Prepare In-Person Tours

Numbers and photos can only tell you so much. A hands-on visit sparks real insight into daily life and staff-resident dynamics.

- Reach out to each community to book tours at different times of day.

- Request a brief chat with administrators, caregivers, and current residents.

- Pay attention to small details: are hallways tidy, and do residents seem at ease?

Use A Personalized Question Checklist

Think of this list as your travel itinerary—it ensures you don’t miss a turn. Focus on contract details, fee add-ons, and room choices before signing on.

- What services are included in the monthly rate?

- Do they offer move-in specials or trial stays?

- How does the facility handle unexpected care upgrades?

- Can I adjust services as needs change?

| Question Category | Key Points To Ask |

|---|---|

| Accommodation | Room layouts, view, privacy options |

| Care Services | Support levels, licensed staff oversight |

| Charges And Fees | Package deals vs. à la carte pricing |

For more guidance, read our article on how to know when your parents need assisted living.

Negotiate Incentives And Review Agreements

You’ve found a handful of contenders—now it’s time to see where there’s room to save. Like haggling at a farmers’ market, a friendly ask can yield real discounts.

- Request a discount for longer stays or upfront payments.

- Inquire about seasonal promos or community introductions.

- Ask for a written summary of all terms and any waived fees.

Keeping a simple calendar helps you track deposit deadlines, incentive expirations, and benefit approvals. Feel free to copy and tweak this template:

| Task | Deadline | Status |

|---|---|---|

| Tour Community A | April 10, 2025 | Completed |

| Deposit for Community B | April 20, 2025 | Pending |

| Medicaid Application Review | April 15, 2025 | In Progress |

Involve Loved Ones And Make Decisions Together

Sharing this journey lightens the load. Invite siblings, close friends, or your loved one to visit and weigh in on their favorite spots.

Finalize Your Choice And Move Forward

Once you’ve compared quotes, walked the halls, and fine-tuned agreements, lock in your pick. Confirm the start date and ensure all paperwork is complete at least two weeks before move-in. Your path forward starts.

Complete Legal And Financial Preparation

Before the packing boxes arrive, get your legal ducks in a row. Finalize power of attorney, healthcare directives, and any VA or insurance paperwork.

- Draft or update a power of attorney and healthcare proxy.

- Review long-term care policies, retirement accounts, and Veterans Affairs forms.

- Arrange transfer of medical records and pharmacy details to the new care team.

Tackling these items early prevents last-minute hurdles—and gives everyone peace of mind as move-in day approaches.

Enjoy the journey.

Forest Cottage Senior Care https://www.forestcottageseniorcare.com