To apply for VA Aid and Attendance, you'll need to clearly show a medical need, meet specific financial limits, and have the right military service history. The whole process boils down to submitting the correct VA forms along with supporting documents, like a doctor's statement and your financial records, for the VA's review. Think of this tax-free benefit as a pension supplement for wartime veterans and surviving spouses who need a hand with daily activities.

Understanding the VA Aid and Attendance Benefit

The VA Aid and Attendance (A&A) benefit is a critical financial lifeline designed to help cover the costs of long-term care. It's not a standalone payment; rather, it’s an increased monthly pension amount for those who already qualify for a basic VA pension but now have greater medical needs. The money is specifically for veterans and their surviving spouses who require regular help with everyday tasks.

These tasks, often called Activities of Daily Living (ADLs), are the basic things we do to care for ourselves. They include:

- Bathing and dressing

- Eating or preparing meals

- Using the restroom

- Getting in and out of a bed or chair

Essentially, if a veteran's health—whether physical or cognitive—prevents them from managing these personal functions safely without help, they could be eligible. The funds are completely tax-free and can be used for care in different settings, which is a huge relief for families exploring their options. For instance, many use these funds to help pay for care in a community setting, which you can learn more about in our guide explaining what is assisted living.

How Much Financial Support Can You Receive?

The exact benefit amount isn't one-size-fits-all. It depends on things like your marital status, how many dependents you have, and your total countable income. The VA calculates the final payment by subtracting your income from a Maximum Annual Pension Rate (MAPR) set by Congress. These rates get a cost-of-living adjustment each year, so the support keeps up with inflation.

Take a look at the table below for a clearer picture of the maximum monthly amounts.

VA Aid and Attendance Maximum Monthly Benefit Rates

| Applicant Category | Maximum Monthly Benefit | Maximum Annual Benefit |

|---|---|---|

| Single Veteran | $2,358 | $28,296 |

| Veteran with a Spouse | $2,795 | $33,540 |

| Two Veterans Married to Each Other | $3,723 | $44,676 |

| Surviving Spouse | $1,515 | $18,180 |

These rates reflect the latest adjustments and show the highest possible tax-free pension a person in that category can receive. Just remember, your final amount will depend on your specific financial situation.

A common misconception is that you must be completely helpless to qualify. In reality, needing regular—but not necessarily constant—assistance with just a few ADLs can be enough to meet the medical requirement.

The Three Pillars of Your Application

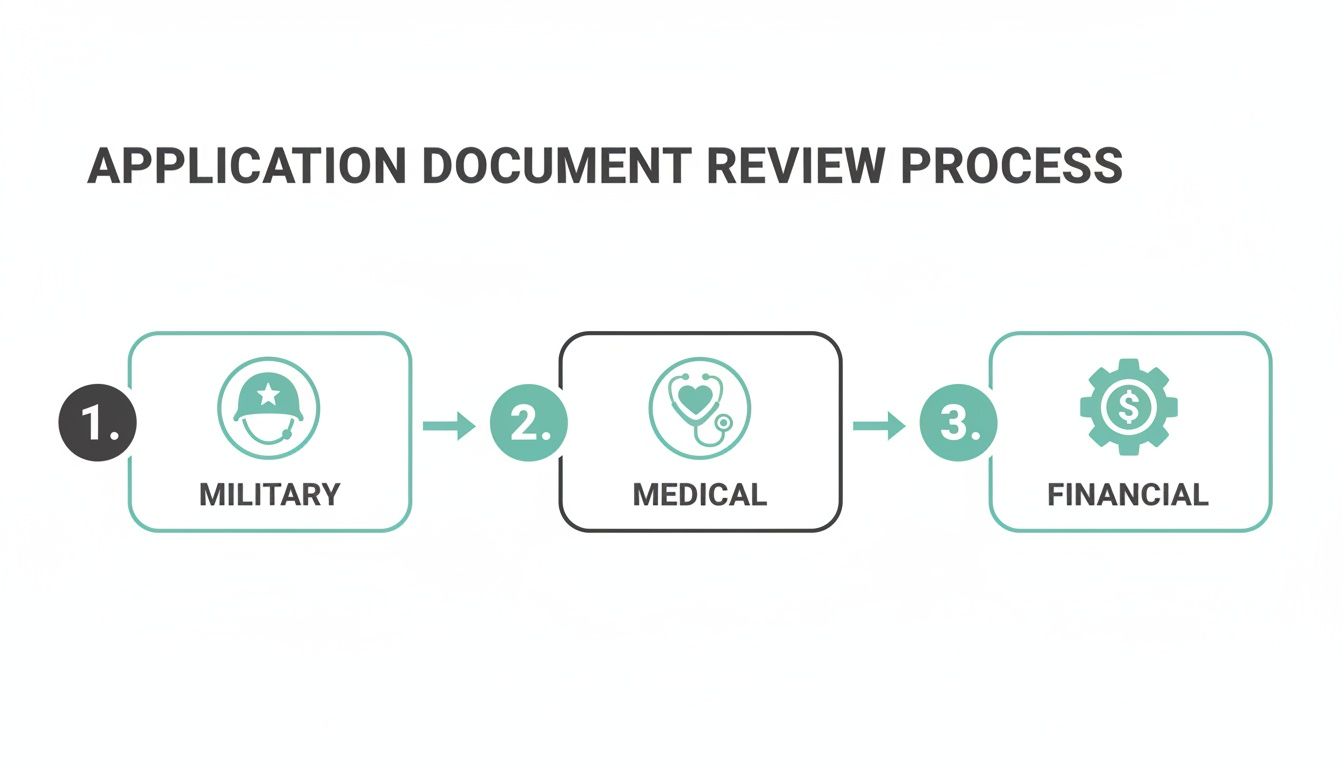

Successfully navigating how to apply for VA Aid and Attendance really comes down to proving your case in three key areas. The VA looks at each one very closely, and a strong application provides clear documentation for all of them.

- Military Service: You must have served at least 90 days of active duty, with at least one day during a recognized wartime period.

- Medical Need: A physician has to confirm that you need help with daily activities. This is non-negotiable.

- Financial Standing: Your net worth and income must fall below a specific limit set by the VA.

This guide will serve as your roadmap, breaking down each of these pillars. We'll walk you through the entire process, from understanding the core rules to gathering your documents and finally submitting your claim. Our goal is to give you the confidence to secure the benefits you or your loved one has earned.

First, Let's See If You're Eligible for Aid and Attendance

Before you even touch a single piece of paperwork, let's make sure you're on the right track. The VA looks at three core things for every Aid and Attendance claim: your military service, your medical situation, and your finances.

Think of these as the three legs of a stool. If one is missing, the whole thing falls over. Nailing these down from the start will save you a world of time and frustration later. We'll walk through each one with real-world examples, so you can feel confident about where you stand.

Your Military Service Record

First things first, let’s look at your service history. The VA has some very specific, non-negotiable rules here. It's not just about whether you served, but when and for how long.

The baseline requirement is that a veteran must have served at least 90 consecutive days on active duty. Here's the kicker: at least one of those days must fall within a VA-recognized wartime period. It’s a common misconception that you needed to be in a combat zone. You didn't. You just had to be on active duty during one of these times.

Recognized Wartime Periods

- World War II: December 7, 1941, to December 31, 1946

- Korean Conflict: June 27, 1950, to January 31, 1955

- Vietnam War Era: November 1, 1955, to May 7, 1975 (for veterans in the Republic of Vietnam) or August 5, 1964, to May 7, 1975 (for all others)

- Gulf War: August 2, 1990, through a future date to be set by law

Finally, the veteran’s discharge must be anything other than dishonorable. An honorable or general discharge is perfect.

Showing a Clear Medical Need

This is where the "Aid and Attendance" part of the name comes from. You have to show that a medical condition—physical or cognitive—makes it necessary for you to have regular help from another person for everyday tasks. The VA will want to see a clear statement from a doctor confirming this.

This doesn't mean you need to be bedridden. Needing help with just a couple of what they call Activities of Daily Living (ADLs) can be enough to qualify.

So, what does this actually look like?

- A veteran with painful arthritis who can't button his shirt anymore or safely step into the shower alone.

- Someone with dementia who needs prompting to take her medication and help making meals so she doesn't forget to eat.

- A person whose eyesight is so poor they can't navigate their own home or read prescription labels without someone's help.

The key isn't that you need a little help now and then. The VA is looking for proof that you need consistent, ongoing assistance to stay safe and healthy.

Making Sense of the Financial Rules

This is often the trickiest part for families. The VA looks at both your income and your total net worth to see if you have a financial need for the pension.

For 2024, the VA has set the net worth limit at $155,356. This number includes your assets and your annual income. But here's the good news: the VA doesn't count everything you own.

What doesn't count toward the limit?

- Your primary home

- Your personal car

- Everyday household furniture and items

That means the VA is mainly looking at things like savings accounts, investments, and any second properties. This is a huge relief for many people. Just be aware that the VA has a 36-month look-back period to make sure applicants didn't just give away money or property to sneak under the limit.

Your income is the other big piece of the financial puzzle. The VA calculates your "countable income," but you can subtract ongoing medical expenses from your total income to lower that number. This is a game-changer.

Deductible expenses include things like:

- The cost of an in-home caregiver

- Fees for an assisted living community

- Health insurance premiums

- Out-of-pocket prescription costs

This powerful deduction can make you eligible even if your income seems too high at first. For instance, if you make $30,000 a year but pay $20,000 for assisted living, your countable income for the VA is just $10,000. It's also helpful to see how other programs fit into the financial picture; for instance, understanding if assisted living is covered by Medicaid can provide a broader context. By carefully tracking and reporting these unreimbursed medical expenses, you dramatically improve your chances of meeting the VA's financial criteria.

Gathering the Right Documents for Your Application

A strong VA Aid and Attendance application is built on solid, well-organized paperwork. I can't stress this enough: getting everything you need upfront is the single best way to avoid the frustrating delays and requests for more information that can stall your claim.

Think of it like building a house—if the foundation isn't right, the whole structure is at risk.

To make this feel more manageable, let's break down the paperwork into three distinct piles: military, medical, and financial.

By tackling each category one by one, you’ll end up with a clear and complete package for the VA.

Proof of Military Service

First things first, you'll need the veteran's discharge paper, which is almost always the DD Form 214. This is the non-negotiable proof of service that confirms the veteran's active duty dates and character of discharge.

If you can't find the original, don't panic. You can request a free copy from the National Archives. My advice? Start this process early, as it can sometimes take a few weeks to arrive.

Essential Medical Documentation

This is arguably the most critical part of your entire application. You have to clearly demonstrate that the veteran or surviving spouse needs daily help from another person to be safe. The cornerstone of this proof is VA Form 21-2680, Examination for Housebound Status or Permanent Need for Regular Aid and Attendance.

A doctor, physician assistant, or nurse practitioner has to fill this out. It’s way more than just a signature; the VA is looking for a detailed description of the person's condition and exactly how it impacts their ability to perform daily tasks like bathing, dressing, and eating.

Pro Tip: Don't just hand the form to the doctor's office and hope for the best. Schedule a specific appointment to go over it. Explain what the Aid and Attendance benefit is for and provide a written list of the specific daily struggles you’ve observed. This context helps the doctor provide the detailed, specific answers the VA needs to see.

For example, a doctor simply writing "patient has dementia" isn't going to cut it. A much more effective statement would be, "Due to cognitive decline from dementia, the patient requires daily prompting and supervision to ensure they take medication, prepare meals, and maintain personal hygiene." See the difference? That level of detail directly connects the diagnosis to the need for care.

Compiling Your Financial Records

The final piece of the puzzle is showing your financial eligibility. The VA needs a complete picture of your income, assets, and—most importantly—your medical expenses. Be ready to gather these documents:

- Proof of Income: This includes Social Security award letters, pension statements, and any other regular income sources.

- Asset Information: You'll need recent bank statements for all checking and savings accounts, plus statements for any investments like stocks or bonds.

- Proof of Medical Expenses: This is where you can make a huge impact on your eligibility. Collect receipts and statements for all recurring, unreimbursed medical costs.

Common examples of deductible medical expenses include:

- Monthly fees for assisted living or in-home care. This can even include payments to a family caregiver, as long as there is a formal care agreement in place.

- Health and long-term care insurance premiums.

- Out-of-pocket costs for prescriptions, doctor visits, and medical supplies.

I know the financial documentation can seem complex, especially when you're trying to offset high care costs. Just remember the VA approval process is methodical. It starts with service verification (90+ days active duty, with at least one day during wartime) before moving to the medical and financial reviews. A successful application can make a massive difference when facing care costs that average $5,039 per month for assisted living.

Filling Out and Submitting Your Application

With all your documents in hand, you're ready for the main event: the application itself. This is where your careful preparation pays off, translating all that service, medical, and financial history into a format the VA can process. The key document here is VA Form 21P-534EZ, also known as the Application for Pension.

Now, the name can be a little confusing. Even though it says "pension," this is the right form. Aid and Attendance is technically considered an add-on to the basic VA pension, so this is the application that gets the ball rolling. Getting it right is the most critical part of this whole process.

Completing VA Form 21P-534EZ

This form is thorough, and it's frustratingly easy to make a small error that causes a major delay. The best approach is to be patient and methodical. Answer every single question, even the ones that don't seem to apply. A blank field is one of the most common reasons the VA will send an application right back to you.

Let’s zero in on a couple of sections where I've seen families get tripped up:

- Section IX – Net Worth: This is where you lay out all your assets. Honesty and transparency are crucial. List everything, but remember to exclude the primary home, car, and personal items we talked about earlier.

- Section X – Medical, Legal, or Other Expenses: This part is a game-changer. Here you'll document the ongoing, unreimbursed medical costs that bring your "countable" income down. Get specific. Tally up everything—assisted living fees, home health aide costs, insurance premiums, you name it.

One of the biggest mistakes I see is people underreporting their medical expenses. If your parent is in an assisted living community like Forest Cottage, that entire monthly fee is a deductible medical expense. Documenting this correctly can single-handedly make the difference between denial and approval.

It’s also vital that every number on this form lines up perfectly with your supporting documents. The income you report must match your Social Security award letter and bank statements. Any discrepancy, no matter how small, will almost certainly trigger a request for more information and slow everything down.

Choosing Your Submission Method

Once the packet is complete and you’ve checked it twice, you have a few ways to get it to the VA. Each has its own benefits and potential headaches.

Comparing Submission Options

| Submission Method | Pros | Cons |

|---|---|---|

| Online via VA.gov | The fastest way to get it in the system; you get an instant confirmation receipt. | Can be tricky if you're not tech-savvy; requires scanning and uploading all your documents. |

| By Mail | A traditional, straightforward method that doesn't require a computer. | The slowest option by far; there's always a risk of mail getting lost. We always recommend using certified mail. |

| In-Person | A VA employee can look over your paperwork for completeness right there on the spot. | You have to travel to a VA regional office, and you could be in for a long wait. |

Submitting online is usually the most efficient route, getting your claim logged almost instantly. But if you're not comfortable with the tech side of things, sending it via certified mail with a return receipt is a solid, reliable backup plan.

Should You Get Professional Help?

You can absolutely do this on your own. Many families do. But given how complex the rules are and how much rides on getting every detail right, bringing in a professional is often a smart move.

There are a few types of accredited experts who can guide you:

- Veteran Service Officers (VSOs): These folks work for well-known organizations like the VFW or the American Legion. Their help is completely free, and they are masters at cutting through VA red tape.

- VA-Accredited Agents or Attorneys: These are professionals who specialize in VA benefits. They can offer deeper legal and financial strategy to make sure your application is positioned for the best possible outcome.

These experts know exactly how to apply for VA Aid and Attendance and can catch potential red flags you might miss. They understand how to properly structure your financials and document care costs in a way that makes sense to the VA. For more info on handling common scenarios, you can find helpful answers on the Forest Cottage Senior Care FAQ page.

Working with a pro isn't just about reducing stress—it can seriously boost your chances of getting approved in a timely manner. At Forest Cottage, for example, we're so dedicated to helping veterans that we cover the legal fees to facilitate their access to VA support, ensuring they get top-tier guidance without the upfront cost.

What to Expect After You Submit Your Claim

You’ve sent in your application. Now, the waiting game begins. I know this part can be stressful, but understanding what’s happening on the other side of the curtain can make it a lot more manageable. The VA doesn’t just stamp “approved” or “denied” on a claim overnight—there’s a detailed review process that has to run its course.

Once your claim is received, it gets logged and handed over to a Veterans Service Representative (VSR). The VSR’s first job is to go through the entire package to make sure it’s complete and accurate. They check that every form is signed and all the required documents are there. This is why a well-organized submission is so critical—it helps you avoid delays right from the start.

Understanding VA Processing Times

Patience is probably the hardest part of this process. On average, it takes the VA anywhere from three to six months to process an Aid and Attendance claim. Some cases can take longer, especially if they’re complex or if the VA has to chase down missing information. The timeline really depends on the current workload at your specific Pension Management Center (PMC) and how clear your documentation is.

The good news is you aren't left completely in the dark. The VA gives you a few ways to check on your application's progress:

- Online Tracking: The easiest method is through the VA.gov website. After logging into your account, you can see the current status of your claim, from "Claim Received" all the way to "Preparation for Notification."

- Phone Calls: You can also call the VA’s national toll-free number for an update, but just be ready for some potentially long wait times.

If the VA needs more information to make a decision, they'll mail you a "development letter." Don't panic if you get one! This isn't a bad sign at all; it’s just a request for specific documents or a bit of clarification. The best thing you can do is respond as quickly and completely as possible to keep your claim moving forward.

Demystifying Payments and Denials

Getting the news that your benefits have been approved is a huge relief. And for many families, there’s a welcome surprise that comes with it: payments are often retroactive.

The VA typically pays benefits starting from the month after they received your initial application. So, if your claim takes five months to process, your first payment will likely include a lump-sum amount covering those five months of retroactive benefits.

This initial payment can provide a significant financial cushion, helping to cover the care costs you’ve been paying out-of-pocket while you waited for the decision.

Of course, not every claim gets approved on the first try. If you receive a denial letter, it’s not the end of the road. The letter will explain the specific reason for the denial, which gives you a clear roadmap for what to do next. You absolutely have the right to appeal the decision.

The appeals process has a few different paths, like filing a Supplemental Claim with new evidence or requesting a Higher-Level Review. The first step is to understand exactly why you were denied—was it a financial reason, not enough medical proof, or an issue with a service record? Knowing the "why" is the key to building a successful appeal and finally securing the benefits you've earned.

Common Questions About Aid and Attendance

Even after you get a handle on the main steps, questions always pop up. That’s completely normal. The Aid and Attendance application has a lot of moving parts, and let's be honest, every family’s situation is a little different. This section is all about tackling the most common uncertainties we hear from Veterans and their loved ones.

Think of it as a practical FAQ. We'll get into those specific situations that don't always fit neatly into a step-by-step list, clearing up confusion and helping you sidestep potential roadblocks.

Can I Receive Other VA Benefits at the Same Time?

This is a big one, and the answer is yes, but with a few important rules.

Aid and Attendance is what the VA calls a pension benefit, which means it’s based on your income. You can't get this pension at the same time as VA disability compensation (the benefit for a service-connected injury). If you happen to qualify for both, the VA will have you choose whichever one pays you more each month. You can't double-dip.

On the other hand, you can absolutely receive Aid and Attendance while also using other benefits like VA health care or your burial benefits. Those are separate programs and won't get in the way of your pension eligibility.

What if I Live in an Assisted Living Community?

This is one of the most common reasons people apply for Aid and Attendance in the first place. When you live in an assisted living community like Forest Cottage, the VA considers the entire monthly cost a deductible medical expense.

This is a game-changer for so many applicants. Your monthly income from Social Security might look too high at first glance, but once you subtract the huge cost of your care, your "countable income" often drops low enough to meet the financial requirements. This is why getting those costs documented perfectly on your application is so critical. As families make this move, it helps to recognize the signs that more support is needed; our guide on how to know when your parents need assisted living offers some really practical insights.

How Does the VA Define Net Worth?

The VA’s financial test is a crucial hurdle. They look at a “net worth” limit that includes both your annual income and your assets—things like savings accounts, stocks, and other investments. The good news? Your primary home and personal car don't count against this limit.

This threshold is in place to make sure the benefit goes to those who truly need the extra income to afford their care. For example, a single Veteran’s maximum pension can be up to $28,300 a year ($2,358 per month), which is then reduced by their countable income. The key is that medical expenses, like assisted living costs, are subtracted from your income first. You can get a better sense of how the VA calculates these financial numbers to see where you stand.

A critical piece of advice: Be aware of the VA's 36-month "look-back" period. This rule is designed to prevent people from giving away assets to family members right before they apply just to get under the net worth limit. Any transfers like that made within three years of applying can trigger a penalty period, which will delay your benefits.

What Happens if My Situation Changes After Approval?

Life is unpredictable, and the VA gets that. If your income, assets, or medical expenses change in a big way after you’re approved, you are required to report it.

For instance, if you move into a more expensive care facility or your medical needs increase, you should let the VA know. It could mean you're eligible for a higher benefit amount. By the same token, if you get an inheritance that pushes you over the net worth limit, you have to report that, too. Keeping the VA updated is the best way to make sure your benefits continue smoothly.

At Forest Cottage Senior Care, we’re dedicated to helping Veterans and their families get the support they’ve rightfully earned. We know this process can feel like a maze, which is why we cover the legal fees to help our residents navigate the application, making sure you have an expert in your corner from start to finish.

To learn more about our community and how we support our Veterans, visit us at https://www.forestcottageseniorcare.com.