Yes, Medicaid can help pay for assisted living, but it’s not as straightforward as covering the monthly rent. The key thing to understand is this: while traditional Medicaid doesn’t pay for room and board, it can cover the cost of care services through special state programs. For Texas families, this can make quality senior living much more affordable.

How Medicaid Can Bridge The Financial Gap For Assisted Living

The cost of long-term care can feel like a mountain to climb, but getting a handle on how Medicaid works is the first big step toward finding a path forward.

Think of it this way: Medicaid acts like a specific grant for your loved one's care, not their apartment. It’s designed to pay for the essential services that help them live safely and comfortably day-to-day.

This distinction is crucial. While a resident or their family is still responsible for the monthly fees for their room and meals, Medicaid assisted living programs step in to cover the costs of all that hands-on support.

What Care Services Can Medicaid Cover?

In Texas, this support is delivered through programs like the STAR+PLUS waiver. These waivers provide what are known as Home and Community-Based Services (HCBS), allowing seniors to get the care they need in a more homelike setting, like assisted living, instead of a nursing home.

Services often include:

- Personal Care: Hands-on help with Activities of Daily Living (ADLs) like bathing, dressing, grooming, and moving around safely.

- Medication Management: Making sure medications are taken correctly and on time, as prescribed by a doctor.

- Skilled Nursing Services: Occasional medical care from licensed nurses right in the community.

- Therapy Services: Access to physical, occupational, or speech therapy to maintain strength and function.

This is a lifeline for so many families. In fact, data shows that nearly 1 in 5 residents in assisted living communities nationwide rely on Medicaid to help pay for these daily services.

By covering the service portion of the bill, Medicaid waivers significantly reduce the overall out-of-pocket expense, making a high-quality community like Forest Cottage Senior Care a viable option for more families.

Medicaid Assisted Living Coverage at a Glance

To make it clearer, here’s a quick breakdown of what Medicaid waiver programs in Texas typically cover versus what they don’t in an assisted living community.

| Service Category | Typically Covered by Medicaid Waiver | Typically Not Covered (Private Pay) |

|---|---|---|

| Housing & Utilities | Private or semi-private room, utilities (electric, water), cable, internet. | |

| Meals & Dining | Three daily meals, snacks, special dietary plans. | |

| Personal Care Assistance | Assistance with bathing, dressing, grooming, mobility. | |

| Medication Management | Administering or reminding residents to take medications. | |

| Skilled Nursing | Intermittent nursing care, health monitoring. | |

| Therapies | Physical, occupational, and speech therapy sessions. | |

| Social Activities | Community events, outings, and life enrichment programs. | |

| Housekeeping & Laundry | Routine cleaning of resident's room and personal laundry services. | |

| Transportation | Scheduled transportation for errands or non-medical appointments. |

This table shows how the costs are split, creating a partnership between the family and the state program to ensure your loved one gets comprehensive support.

Understanding The Financial Partnership

This model creates a partnership. Your family covers the cost of living—the private apartment, meals, and utilities—while the state's Medicaid program covers the cost of care. It's an approach that ensures seniors get the professional support they need without facing the full financial burden alone. To see how these principles apply elsewhere, you can look at a general guide on Medicaid for Assisted Living.

Ultimately, the goal is to create a clear and accessible path to affordable, high-quality care. You can find out more about what this means for Texas families in our detailed guide right here: https://www.forestcottageseniorcare.com/does-medicaid-pay-for-assisted-living/

Understanding Texas Medicaid Eligibility Rules

Getting approved for Medicaid to help pay for assisted living in Texas is a bit like solving a two-part puzzle. It’s not just about your finances; you also have to show a real, documented need for daily care. Both pieces have to click into place perfectly to qualify for programs like the STAR+PLUS waiver.

Think of it like getting into a special club. First, you need a "medical ticket" that proves you need the kind of help the club offers. Then, you need a "financial ticket" to show you meet the income and asset rules. Let's break down exactly what each of these tickets involves.

The First Hurdle: Functional Eligibility

Before Texas Medicaid even glances at your bank statements, they need to know if you medically qualify for care. This is what's known in the system as establishing a "medical necessity" or meeting the required "level of care."

This isn't as simple as getting a doctor's note. A state-contracted nurse or assessor conducts a thorough evaluation to see how well a senior can handle everyday tasks on their own. The focus is squarely on what are called Activities of Daily Living (ADLs). To learn more, you can read about what Activities of Daily Living are and see why they're so central to care assessments.

These core activities include:

- Bathing: Can they wash themselves without help?

- Dressing: Are they able to pick out clothes and get dressed?

- Eating: Can they feed themselves? (This doesn't necessarily mean cooking the meal).

- Toileting: Can they get to and from the bathroom and manage hygiene?

- Transferring: Are they able to move from a bed to a chair or wheelchair?

If someone needs hands-on help with several of these ADLs, they've usually met the functional bar for Medicaid assisted living. The assessment confirms they need the kind of personal care services that an assisted living community is designed to provide.

Navigating The Financial Eligibility Maze

Once the need for care is confirmed, the spotlight shifts to finances. Texas has very specific, strict limits on both an applicant's monthly income and their total assets to qualify for long-term care Medicaid. While the numbers can change from year to year, the basic rules stay the same.

For a single person applying in 2024, the general limits are:

- Income Limit: No more than $2,829 per month.

- Asset Limit: No more than $2,000 in countable assets.

Seeing those numbers can be discouraging, I know. But it's absolutely crucial to understand what "countable" really means. Not everything a person owns is actually counted toward that $2,000 limit.

Key Takeaway: The difference between "countable" and "non-countable" assets is the most important concept to grasp in this entire process. So many families assume they won't qualify, not realizing their most valuable assets are often protected.

Countable Vs. Non-Countable Assets

Medicaid sorts everything a person owns into two buckets. Knowing what goes where is the key to successful planning.

| Countable Assets (Included in Limit) | Non-Countable Assets (Excluded from Limit) |

|---|---|

| Checking & Savings Accounts | Your Primary Residence (up to a certain equity value) |

| Stocks & Bonds | One Personal Vehicle |

| Second Properties or Vacation Homes | Household Furnishings & Personal Effects |

| Cash Value of Life Insurance Policies | Pre-paid Funeral or Burial Plots |

That's right—a senior can own their home and a car and still be eligible for Medicaid assisted living. But it’s also important for families to understand all the financial angles, such as how selling a home affects Medicaid eligibility down the road.

The Five-Year Look-Back Period

There’s one last, critical rule to know about: the five-year look-back period. To keep people from just giving away all their money to get under the $2,000 limit, Medicaid reviews every financial transaction for the 60 months right before the application is submitted.

If they find that large sums of money were gifted or that property was sold for far less than it was worth, Medicaid will impose a penalty. This penalty isn't a fine; it's a period of ineligibility where Medicaid won't pay for care for a certain number of months. This rule is exactly why planning ahead, thoughtfully and carefully, is so incredibly important.

The STAR+PLUS Waiver Program Explained

If you’re looking into Medicaid for assisted living in Texas, you're going to hear one name over and over again: STAR+PLUS. This isn't just another government program; it's the main road most families travel to make quality, community-based care a real possibility for their loved ones. Getting a handle on how it works is the key to unlocking affordable long-term care.

Think of STAR+PLUS less like a simple payment voucher and more like a specialized, managed care system. Instead of Medicaid just paying bills one by one, a senior enrolls in a specific health plan—almost like a dedicated insurance plan for long-term care. This plan then takes on the job of coordinating all of that person’s care.

This managed approach is all about providing better, more connected support. It makes sure that services like personal care, doctor visits, and physical therapy all work together seamlessly. The best part? It’s all overseen by a dedicated service coordinator who becomes the family's single point of contact.

More Than Just Funding a Room

The STAR+PLUS program really shifts the whole model of care from being reactive to proactive. It’s built to deliver services in a less restrictive, more homelike setting—like an assisted living community—to help prevent or delay the need for a nursing home. The ultimate goal is to help seniors stay as independent as possible, for as long as possible, while still getting the support they need.

By joining a STAR+PLUS health plan, your loved one gets access to a whole menu of services delivered right where they live. This turns an abstract program name into real, tangible benefits that make a difference in their daily life and well-being.

What Services Are Covered Under STAR+PLUS

The support provided through the STAR+PLUS waiver is surprisingly broad and is always tailored to what your loved one actually needs, based on a care assessment. This goes way beyond basic medical attention and really looks at the whole person.

Here are the key services available in an assisted living setting:

- Personal Attendant Services (PAS): This is the heart of the program. It covers hands-on help with Activities of Daily Living (ADLs) like bathing, dressing, grooming, eating, and getting around safely.

- Nursing Services: Provides access to skilled nursing care for things like wound care, injections, or health monitoring, all without having to leave the community.

- Therapy Services: Covers physical, occupational, and speech therapies to help residents keep or even regain their strength and abilities.

- Emergency Response Services: Funds personal emergency response systems (like a medical alert button) to make sure help is just a push of a button away, 24/7.

The STAR+PLUS waiver empowers seniors by creating a coordinated care plan that brings vital health and personal support services directly to them. This integrated model is what truly makes aging in place successfully possible within an assisted living community.

On top of these core services, the program can also cover other critical supports.

- Durable Medical Equipment: Helps pay for necessary equipment like walkers, wheelchairs, or hospital beds.

- Adaptive Aids: This includes devices that make daily life easier, such as grab bars or special utensils for eating.

- Minor Home Modifications: Even in assisted living, this can apply to small changes that make a resident's apartment safer, like installing grab bars in the bathroom.

This collection of services ensures that care is never a one-size-fits-all solution. It's a personalized plan that can change as your loved one's needs evolve, all managed under one coordinated program.

How Managed Care Works in Practice

That term "managed care" can sound a little corporate and confusing, but it’s actually meant to make life simpler for families. Once a senior is approved for STAR+PLUS, they'll choose a health plan from the ones available in their part of Texas.

From that day forward, this health plan is their main partner. A service coordinator from the plan will work directly with the senior, the family, and the team at their chosen community, like us here at Forest Cottage Senior Care.

This coordinator takes care of all the heavy lifting:

- Developing a Service Plan: They create a custom care plan that spells out exactly which services will be provided and how often.

- Authorizing Services: They give the official green light for these services so the assisted living community can provide them and get paid by the plan.

- Coordinating Care: They act as the central hub, making sure doctors, therapists, and caregivers are all on the same page.

- Regular Follow-Ups: They check in regularly to see if the care plan is still working well and make any necessary adjustments.

This structure lifts a huge weight off families' shoulders. Instead of you having to track down and schedule different providers, the STAR+PLUS coordinator handles the logistics. It frees you up to focus on what matters most: your loved one’s happiness and well-being. This is the system that makes Medicaid assisted living a supportive, practical choice for so many in Texas.

A Step-by-Step Guide to the Application Process

Trying to apply for Medicaid assisted living benefits can feel like putting together a puzzle without the picture on the box. But once you have a clear roadmap, it all starts to make sense. This guide will walk you through the journey one step at a time, turning what seems like a huge task into a clear path forward.

The whole point of the application is to confirm two things: that your loved one has a real medical need for care and that they meet the financial rules. Think of it as a verification process where each step provides another piece of the puzzle for the state.

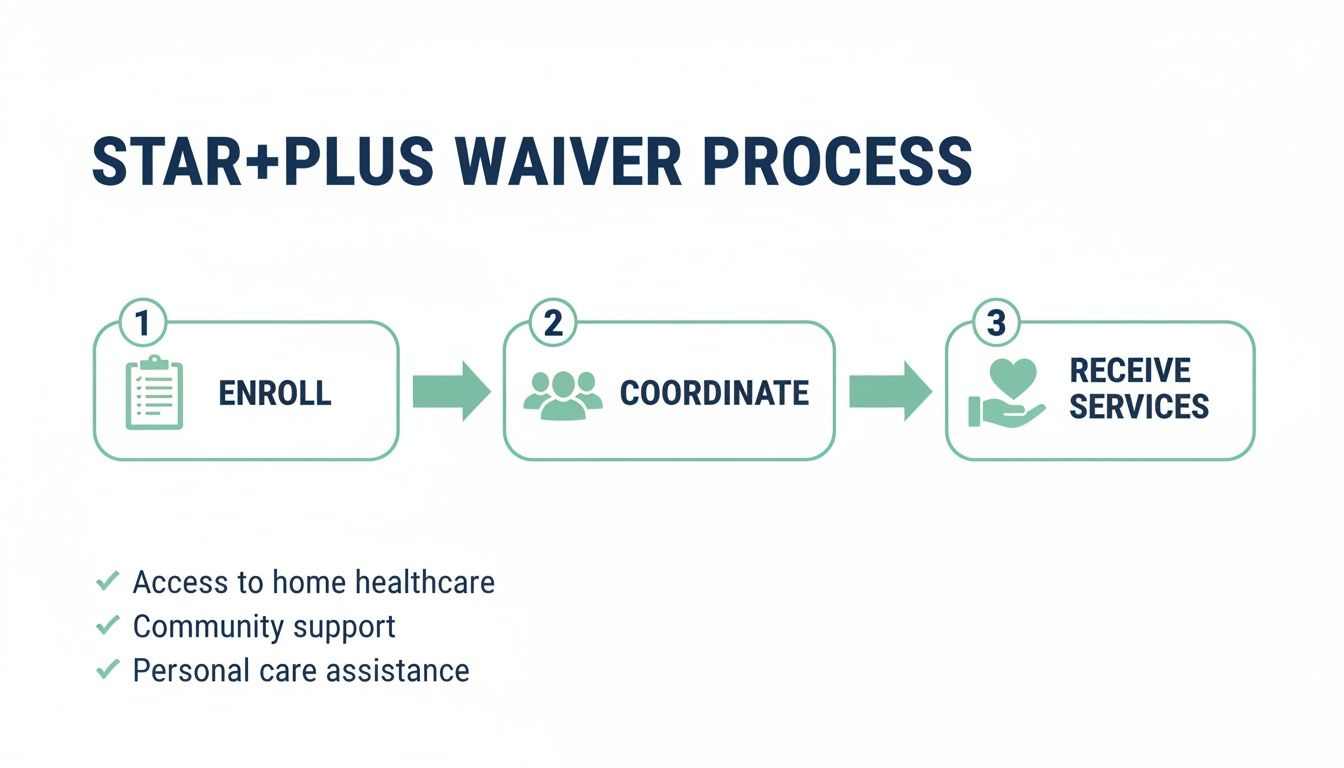

The STAR+PLUS waiver program follows a pretty logical sequence. It starts with getting enrolled, then moves to coordinating care, and finally, getting the services your loved one needs.

This visual shows how the journey flows from application to personalized care, all built around a coordinated approach to a senior's well-being.

Kicking Off the Application

The first official move is to submit Form H1200, Application for Assistance – Your Texas Benefits. This is the big one. It's where you'll lay out all the detailed financial information, from income to assets, that the state needs to determine eligibility.

It’s so important to be thorough here. Any missing detail can cause major delays. My advice is to gather every document you need before you even look at the form. Once you send it to the Texas Health and Human Services Commission (HHSC), the review process begins, which usually takes 45 to 90 days.

Pro Tip: Don't wait for a crisis to start this process. The application and approval timeline can really drag on. Starting early means the funding will be ready to go when the need for assisted living becomes urgent.

The Medical Necessity Assessment

While the HHSC is digging through the financial paperwork, a separate process kicks off to confirm the medical need for care. A nurse or therapist contracted by the state will schedule a visit to conduct a Medical Necessity and Level of Care (MN/LOC) Assessment.

This isn't a test your loved one can pass or fail. It’s really just a conversation and observation to get a clear picture of their abilities. The assessor will look at how well they can perform Activities of Daily Living (ADLs) to figure out the exact level of support they need. This assessment is what officially confirms they require the kind of care an assisted living community provides.

Choosing Your Health Plan and Community

Once your loved one is approved both financially and medically, you’ll get a notice to enroll in a STAR+PLUS managed care health plan. You'll have a few different plans to choose from in your service area.

This is also the time to lock in your choice of an assisted living community. When you're visiting places, having a list of questions ready to go can make the decision feel much less overwhelming. You can check out our guide on questions to ask assisted living facilities to help you get prepared.

With the senior population growing, the demand for quality care is only going up. Baby boomers are expected to contribute to a 111% growth in the 85+ age group by 2040. This means the need for communities offering 24/7 nursing, personalized care plans, and supportive amenities like pet therapy is more critical than ever.

After you've picked a health plan and a community that accepts the STAR+PLUS waiver, the plan's service coordinator will work directly with the community to authorize services and get the care plan finalized. From there, your loved one can move in and start getting the support they need, with Medicaid picking up the tab for their care services.

Exploring Other Ways to Pay for Assisted Living

While Medicaid programs like STAR+PLUS are a lifeline for many Texas families, it’s smart to look at the whole financial picture. It's not the only way to cover costs. Other funding sources are out there, and knowing about them helps you build a more flexible and solid plan for your loved one's care.

The most straightforward path is private pay. This simply means using personal savings, retirement accounts, or other assets to cover the cost of care directly. This route gives you the most freedom and choice.

The Private Pay Advantage

When you pay privately, you're in the driver's seat. You aren’t restricted to only the communities that accept Medicaid, and the move-in process is almost always faster since you skip the lengthy eligibility applications. Of course, that flexibility comes with a high price tag, and without careful budgeting, those funds can run out quickly.

For a lot of families, the best approach is to blend a few different funding streams together. One of the most powerful—and most often overlooked—options is a special benefit for wartime veterans and their surviving spouses.

Tapping into VA Benefits for Care

Veterans who meet certain service and health criteria can get a pension benefit from the Department of Veterans Affairs (VA) called Aid and Attendance. This isn't just for service-related injuries. It’s a monthly, tax-free payment specifically designed to help veterans afford the kind of help they'd get in an assisted living community.

Think of it as an earned benefit that can work alongside Social Security or other retirement income. The money can go toward a wide range of support services, including personal care and medication management at a community like Forest Cottage Senior Care.

To qualify for Aid and Attendance, a veteran typically needs to meet these conditions:

- Service Requirement: They served at least 90 days of active duty, with at least one day during a wartime period.

- Medical Need: A doctor has confirmed they need help with Activities of Daily Living (ADLs), like bathing, getting dressed, or eating.

- Financial Need: They meet income and asset limits set by the VA, though medical expenses can be deducted to help them qualify.

This benefit can provide a substantial monthly stipend that makes a significant difference in a family’s ability to afford quality care. For a qualifying single veteran in 2024, the maximum annual pension rate can exceed $27,000, while a surviving spouse may receive over $17,000.

These funds can be a true game-changer, closing the gap between what a family can afford and the actual cost of care. The application can be detailed, but the financial relief it provides is well worth the effort. To get a better sense of how this works, you can learn more about how veterans benefits for assisted living can be applied right here in Texas.

By looking into private pay and investigating powerful resources like the VA Aid and Attendance pension, you build a much stronger financial foundation. Combining these with potential Medicaid support down the road creates a complete strategy, ensuring your loved one gets consistent, high-quality care no matter what financial changes come your way.

How Forest Cottage Senior Care Can Help

Understanding the rules of Medicaid for assisted living is one thing, but actually going through the process with a loved one is something else entirely. This is where knowing what to do meets doing it, and our team at Forest Cottage Senior Care is here to be your partner every step of the way. We don't just offer exceptional care; we actively help families right here in Willis, Texas, untangle the complex applications for both Medicaid and VA benefits.

Think of us as your guide. We’ve been down this road with countless families, helping them pull together the right documents and make sense of the timelines. Our whole goal is to take that administrative weight off your shoulders so you can focus on what really matters: your loved one's well-being and the transition ahead.

A Community Built on Compassion

Life at Forest Cottage is all about our person-centered approach. We truly believe every single resident deserves to be known, respected, and cared for as the individual they are. This isn't just a mission statement on a wall—it shapes everything we do, from crafting personalized care plans to creating a warm, welcoming place that feels just like home.

Here's what makes our approach different:

- 24/7 Nursing Staff: This is a big one. Unlike many other communities, we have licensed nursing staff available around the clock. That means a higher level of clinical oversight and an immediate response when needed, which provides invaluable peace of mind for families.

- Homelike Comforts: We’ve gone to great lengths to design our spaces to feel like a real home, not an institution. Our residents enjoy their own private or shared rooms, eat freshly prepared meals, and relax in cozy common areas.

- Goldendoodle Pet Therapy: Our resident Goldendoodles are part of the family, offering unconditional love and comfort. They bring daily smiles and help lower stress—it’s a small touch that makes a huge difference in the spirit of our community.

At Forest Cottage, we are more than just a facility. We are a family and a compassionate resource, fully committed to helping you secure the best possible care for your loved one.

We invite you to come and see this difference for yourself. Learn more about our mission and what makes us unique by exploring our story and values. Get to know us better by reading about our dedicated team at Forest Cottage Senior Care. We are here to support your family through it all, from the very first question to move-in day.

Common Questions About Medicaid for Assisted Living

Even when you start to get a handle on the rules, practical questions always pop up. It’s a complicated system, and it’s completely normal to have lingering concerns. Let’s walk through some of the most common questions we hear from families right here in Texas.

Does My Loved One Have to Sell Their House to Qualify?

This is probably the biggest source of stress for families, but the answer is usually no—at least not right away. In Texas, a primary home is typically considered a non-countable asset up to a certain value. That means its value won’t automatically disqualify your loved one from getting Medicaid benefits.

The catch, however, is something called the "intent to return home." If it becomes clear that the move to assisted living is permanent, the home's status as a protected asset can change. It's so important to talk with an elder law attorney about this. They can help you figure out the best way to protect the home, especially if a spouse is still living there.

What Is the Difference Between Medicare and Medicaid for Assisted Living?

It’s incredibly easy to mix these two up, but they do completely different jobs when it comes to long-term care.

- Medicare is the federal health insurance most people get when they turn 65. Think of it as your regular health insurance for doctor visits, hospital stays, and maybe some short-term skilled nursing after surgery. It does not pay for long-term assisted living—the day-to-day help with bathing, dressing, and meals.

- Medicaid is a program for people with limited income and assets, run jointly by the federal government and the state. Through specific waiver programs like STAR+PLUS in Texas, it can cover the cost of those daily personal care services you get in an assisted living community.

Here’s a simple way to think about it: Medicare is for getting you well, like after an illness or injury. Medicaid is for helping you live, providing ongoing support for daily activities.

How Long Does It Take to Get Approved for the STAR+PLUS Waiver?

This is where you need to take a deep breath and be patient. The approval process isn't quick. Families should plan for it to take anywhere from 45 to 90 days, and sometimes even longer if there are complications.

The reason it takes a while is that there are separate steps that have to happen in order. First, the Texas Health and Human Services department has to review all the financial documents to see if your loved one qualifies. Then, a separate medical assessment has to be done to confirm they need the care. Any missing paperwork or a backlog at the state agency can cause delays. The best advice we can give is to start the application process the moment you think care will be needed. That way, you can avoid a stressful gap where you’re left without coverage.

Trying to figure all this out on your own can be overwhelming. Having an experienced partner makes a world of difference. The team at Forest Cottage Senior Care is here to help your family understand the ins and outs and find the right path forward. Contact us today to learn how we can support you.