For veterans who have served our country, the VA offers a lifeline of financial and healthcare support in their later years. These benefits aren't just a safety net; they're an earned right, providing crucial resources like monthly pension payments, allowances for in-home care or assisted living, and full access to medical services. The goal is to tackle the unique challenges of aging, helping to cover long-term care costs and ensuring a better quality of life for those who served.

Understanding Your Core VA Benefits as a Senior Veteran

Trying to figure out VA benefits can feel like learning a new language, but at its heart, the system is built on a promise of support you've already earned. For senior veterans, this support becomes especially meaningful as it offers real-world solutions for healthcare, financial stability, and long-term care.

Think of these benefits less like complicated government programs and more like a set of tools you can use to build a secure and comfortable future. The system is designed to provide layers of support that adapt to your needs as you age, covering everything from routine medical appointments to the significant costs of daily assistance. Understanding what's available is the first real step toward unlocking the peace of mind and financial relief these programs offer.

Key Pillars of Support

The VA’s offerings for seniors fall into a few key categories, with each one addressing a different part of the aging journey.

- Financial Assistance: These programs offer direct monetary support, often through a monthly payment. They're designed to supplement your income, particularly if you're facing financial hardship or have high medical bills.

- Healthcare Services: This is a big one. It covers everything from primary care and prescriptions to specialized geriatric services and long-term care, either in VA facilities or in your local community.

- Support for Daily Living: These benefits help pay for assistance with daily activities like bathing, dressing, and preparing meals, whether you receive that help at home or in a facility.

- Family and Survivor Support: The VA also provides resources for spouses, dependents, and caregivers, acknowledging that a veteran’s well-being is tied to their family’s stability.

These pillars are meant to work together. For instance, you could use VA healthcare for your medical needs while a VA pension helps pay for different senior living options in your community.

The real goal here is to provide tangible resources that directly improve your quality of life. Whether it’s helping to pay for assisted living or ensuring you have access to top-tier medical specialists, these benefits are practical tools for a better life.

To make things a bit clearer, here’s a quick snapshot of the most impactful programs for elderly veterans. We’ll dive much deeper into each of these throughout this guide.

Key VA Benefits for Elderly Veterans at a Glance

| Benefit Program | Primary Purpose | Ideal For Veterans Needing |

|---|---|---|

| VA Health Care | Provides comprehensive medical services through VA hospitals and clinics. | Access to affordable medical care, prescriptions, and specialized geriatric services. |

| Veterans Pension | Offers a monthly, tax-free payment to wartime veterans with limited income. | A stable financial supplement to help cover basic living expenses. |

| Aid & Attendance | An increased monthly pension amount for veterans who need help with daily activities. | Help paying for in-home caregivers, nursing homes, or assisted living facilities. |

| Homebound Allowance | An increased pension for veterans who are largely confined to their homes. | Additional financial support for veterans with significant mobility challenges. |

Each of these programs has its own set of rules and application processes, but understanding the basics gives you a solid foundation to build on.

VA Pension and Aid & Attendance Explained

Of all the financial tools available to senior veterans, the VA Pension and the Aid & Attendance allowance are two of the most powerful. But they’re also some of the most misunderstood. These programs can make a world of difference when it comes to affording long-term care.

Think of it like this: The Veterans Pension is the foundation. It’s a tax-free benefit for wartime veterans who meet certain age or disability rules and have an income below a limit set by Congress. It's not for everyone; it's a needs-based program designed to be a financial safety net.

Then, you can build on that foundation with allowances like Aid & Attendance (A&A) or the Housebound benefit. These aren't separate pensions. Instead, they're extra monthly payments for those who have greater medical needs, making them some of the most important VA benefits for elderly veterans who need assisted living.

The Foundation: The Veterans Pension

Before you can get the more substantial allowances, you first have to qualify for the basic VA Pension. This means meeting specific service, age, and financial requirements.

Key Eligibility Requirements:

- Service: You must have served at least 90 days of active duty, with at least one of those days falling during a recognized wartime period.

- Discharge: Your discharge from service has to be anything other than dishonorable.

- Financial Need: Your family's "countable income" has to be below the maximum annual pension rate (MAPR) set by the VA each year.

- Age or Disability: You must be 65 or older, OR be permanently and totally disabled, living in a nursing home, or receiving Social Security Disability Insurance.

The financial part is where many people get stuck, but it’s critical to understand. The VA does look at your net worth, but it lets you deduct major medical expenses—like the cost of assisted living—from your income. This deduction is often the key that opens the door to eligibility for seniors. It's also worth looking into how other tools, like long-term care insurance can also cover assisted living, can work alongside these benefits.

Adding Support: Aid & Attendance and Housebound

Once you're approved for the basic pension, the VA then looks at your health to see if you qualify for an additional allowance. This is where the benefits can become truly life-changing for anyone needing daily help.

The Aid & Attendance allowance is for veterans who need another person's help to perform daily activities. This could be anything from bathing and dressing to eating or managing prosthetics. It also applies to veterans who are bedridden, in a nursing home, or have very poor eyesight.

The Housebound allowance is a bit different. It’s for veterans who are pretty much confined to their home because of a permanent disability. You can’t get both Aid & Attendance and Housebound benefits at the same time—the VA simply pays whichever rate is higher.

These allowances are designed to directly tackle the high cost of long-term care. For many families, the monthly payment from Aid & Attendance is the one thing that makes professional, compassionate care in an assisted living community affordable.

Understanding the Financial Impact

The financial support from these programs is significant, and it gets adjusted each year to keep up with the cost of living. The Department of Veterans Affairs applies a Cost-of-Living Adjustment (COLA) to the Maximum Annual Pension Rates (MAPRs), giving a real boost to the support veterans receive.

For a single veteran who qualifies for Aid and Attendance, the annual amount recently rose to $28,300—that's about $2,358 a month. A veteran with one dependent receives $33,548 yearly, or $2,795 per month. Housebound benefits also saw an increase, with single veterans getting $20,732 annually and those with a dependent receiving $25,982. The net worth limit for eligibility was also updated to $155,356.

This consistent, tax-free income provides a reliable way to pay for necessary care, offering huge relief to veterans and their families. It changes the conversation from "Can we afford this?" to "Which care option is best for us?"

Navigating VA Healthcare and Long-Term Care Options

While pensions and financial aid are a massive help, the VA's healthcare system is where many veterans find the most direct support. It's a robust network of services built specifically for the needs of an aging veteran population, covering everything from primary care check-ups to full-time, specialized long-term assistance.

Getting started means enrolling in VA health care. The process is fairly direct, and once you're in, you'll be placed into one of several Priority Groups. This is simply how the VA organizes and manages care for everyone.

Your specific group depends on a few things. Veterans with service-connected disabilities, former POWs, or Medal of Honor recipients usually get the highest priority. Your income level and whether you're eligible for Medicaid also play a role. It’s a system designed to get the most urgent care to those who need it most, first.

Understanding Geriatric and Extended Care

For seniors, the most critical piece of the VA healthcare puzzle is its Geriatric and Extended Care (GEC) services. This isn't one specific building or program. Think of it more like a toolbox filled with different options to support veterans dealing with complex, chronic, or disabling conditions.

This GEC toolkit has everything from in-home medical visits to full-time residential care, giving you and your family the power to pick the level of support that fits your exact situation. This flexibility is a key part of the VA benefits for elderly veterans; the support can change as your health needs evolve.

To access these services, you'll typically need to show an ongoing need for help with daily activities or have a condition requiring skilled nursing. A VA doctor will perform an assessment to confirm your clinical need for this specialized care.

Exploring Your Long-Term Care Options

The VA offers long-term care in a few different environments, and each one has a different feel. Knowing the difference is the key to finding a place that aligns with your health, lifestyle, and what just feels right to you.

-

VA Community Living Centers (CLCs): These are essentially nursing homes run directly by the VA. They are designed to feel more like home and provide 24/7 skilled nursing care, therapy, and specialized memory care for conditions like dementia. CLCs are best for veterans with complex medical needs who require around-the-clock supervision.

-

State Veterans Homes: These homes are owned and run by the states, but they get partial funding from the VA. You’ll find a range of services here, from assisted living to full nursing home care. Since they're state-operated, the admission rules can differ, but they are a fantastic option, often allowing veterans to get top-notch care closer to family.

-

Community-Based Programs: The VA also partners with private nursing homes and local care providers right in your own community. This lets you receive care much closer to home while the VA helps with the cost. It’s the most flexible option and lets you stay plugged into your neighborhood and support system. It’s also wise to look into all funding streams; see if assisted living is covered by Medicaid as it could potentially supplement your VA benefits.

The whole point of having these different options is to give veterans a real choice. The VA knows that the "best" care setting is the one that fits a veteran’s medical needs and personal wishes—whether that’s in a dedicated VA facility or a community home just down the road.

Choosing the Right Path for You

Deciding on long-term care is an incredibly personal journey. The VA actually encourages you, your family, and your healthcare team to make the decision together. The first step is simple: talk to your VA primary care provider or a social worker.

They will help you with the application (VA Form 10-10EC) and arrange a geriatric evaluation to get a clear picture of your needs. That evaluation provides a roadmap, showing you which GEC services you're clinically eligible for. From there, you can start exploring the different facilities and programs in your area and find the perfect fit for your next chapter.

Essential Support for Veteran Spouses and Caregivers

The VA gets it: a veteran’s greatest strength is often the family standing right behind them. That’s why many of the best VA benefits for elderly veterans also cover the spouses, survivors, and dedicated caregivers who are part of that support system. These programs are a financial and healthcare lifeline for the whole family.

This approach recognizes a simple but powerful truth—when one person serves, the entire family serves with them. The benefits available are designed to offer stability and real peace of mind, long after the uniform comes off.

Healthcare Coverage for Eligible Family Members

One of the most valuable benefits for families is the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA). It's a comprehensive health insurance plan that helps pay for covered medical services and supplies.

You can think of CHAMPVA as a healthcare partner for your family. It's not the same as TRICARE, which is for military retirees. Instead, it’s a distinct program created specifically for the spouse or widow(er) and children of a veteran who meets some key requirements.

Who is eligible for CHAMPVA?

- The spouse or child of a veteran who the VA has rated as permanently and totally disabled from a service-connected disability.

- The surviving spouse or child of a veteran who passed away from a VA-rated service-connected disability.

- The surviving spouse or child of a veteran who, at the time of their death, was rated permanently and totally disabled due to a service-connected disability.

For seniors on a fixed income, this program can be an absolute lifesaver, especially if they don't qualify for other health insurance. It helps cover the costs of everything from doctor visits and hospital stays to prescription drugs and necessary medical equipment.

Direct Support for Family Caregivers

Taking care of an aging or disabled veteran is an incredible act of love, but let's be honest—it's also a full-time job. The VA’s Program of Comprehensive Assistance for Family Caregivers acknowledges this huge contribution by giving direct, tangible support to the people in this role.

This isn't just a pat on the back; the program delivers real resources to make a caregiver's incredibly demanding life a bit more manageable.

The caregiver program is the VA's way of saying that family caregivers are crucial members of the veteran's healthcare team. By supporting the caregiver, the VA helps ensure the veteran can stay in a comfortable, loving home for as long as possible.

If you qualify, you could receive a package of benefits that often includes:

- A monthly stipend (a direct payment) based on how much care the veteran needs.

- Access to health insurance through CHAMPVA if you don't already have coverage.

- Mental health counseling and other support services.

- Specialized training to help you provide the best possible care.

- At least 30 days of respite care per year to give you a much-needed break. This can be a huge help, and you can learn more about how professional respite care services offer temporary relief and support.

Financial Security for Survivors

When a veteran passes on, the VA’s support for their family doesn't just stop. There are critical financial programs designed to provide long-term stability during what is already a very difficult time.

The two main programs are Dependency and Indemnity Compensation (DIC) and the Survivors Pension.

- Dependency and Indemnity Compensation (DIC): This is a tax-free monthly payment that goes to eligible survivors of a veteran whose death was caused by a service-related injury or illness.

- Survivors Pension: This benefit is based on financial need, much like the Veterans Pension. It’s for low-income surviving spouses and unmarried children of deceased veterans who served during a recognized period of war.

These benefits are there to ensure that a veteran’s death doesn’t throw their family into a financial crisis. They provide a steady income that helps cover daily living expenses and offers a sense of security for the road ahead.

How to Prepare and File Your VA Benefits Application

Applying for VA benefits can feel like staring at a mountain of paperwork. It’s easy to get overwhelmed by the complex forms and documentation. But with a bit of prep work and a clear plan, you can navigate the process successfully.

Think of it like building a case. Your job is to give the VA a complete and easy-to-understand picture of your service, health, and financial situation. Every document you gather is a piece of evidence, and a well-filled-out form is your best argument.

Gathering Your Essential Documents

Before you even look at an application form, the first thing you need to do is get all your paperwork in order. Having everything ready from the get-go will make the entire process so much smoother. It’s like gathering your ingredients before you start cooking—it saves a ton of scrambling later.

This one step is the best way to avoid those dreaded "request for more information" letters from the VA, which can tack months onto your wait time.

Your Essential Document Checklist:

- Proof of Service (DD-214): This is non-negotiable. Your Certificate of Release or Discharge from Active Duty (DD-214) is the bedrock of your claim.

- Personal Identification: Make sure you have your Social Security number handy, along with the numbers for your spouse and any dependent children.

- Marriage Certificate: If you're married, this is crucial for spousal benefits or when calculating your household income and assets.

- Medical Records: Pull together all the relevant medical evidence you can find. This means doctor's reports, hospital records, and a list of your current prescriptions that back up the health conditions you're claiming.

- Financial Information: You'll need records of all your income sources (like Social Security or pensions) and your total net worth. Don’t forget to gather proof of recurring medical expenses, such as insurance premiums or assisted living costs, as these can be deducted.

Completing the Application Forms Accurately

Once you've got your documents lined up, you're ready to tackle the forms. For the needs-based Veterans Pension, the main form is VA Form 21P-527EZ, the "Application for Pension." The name of the game here is precision. Every single question needs a full and honest answer.

Believe it or not, an incomplete or inaccurate form is the number one reason claims get denied or delayed. Double-check everything, from Social Security numbers to income figures. If a question doesn't apply, write "N/A" instead of leaving it blank. It shows the reviewer you didn’t just skip it by accident.

A well-prepared application tells the VA a clear story. When you're thorough and accurate, you remove any guesswork and make it easier for the claims processor to give you a fast, favorable decision. It's truly your best strategy for getting approved.

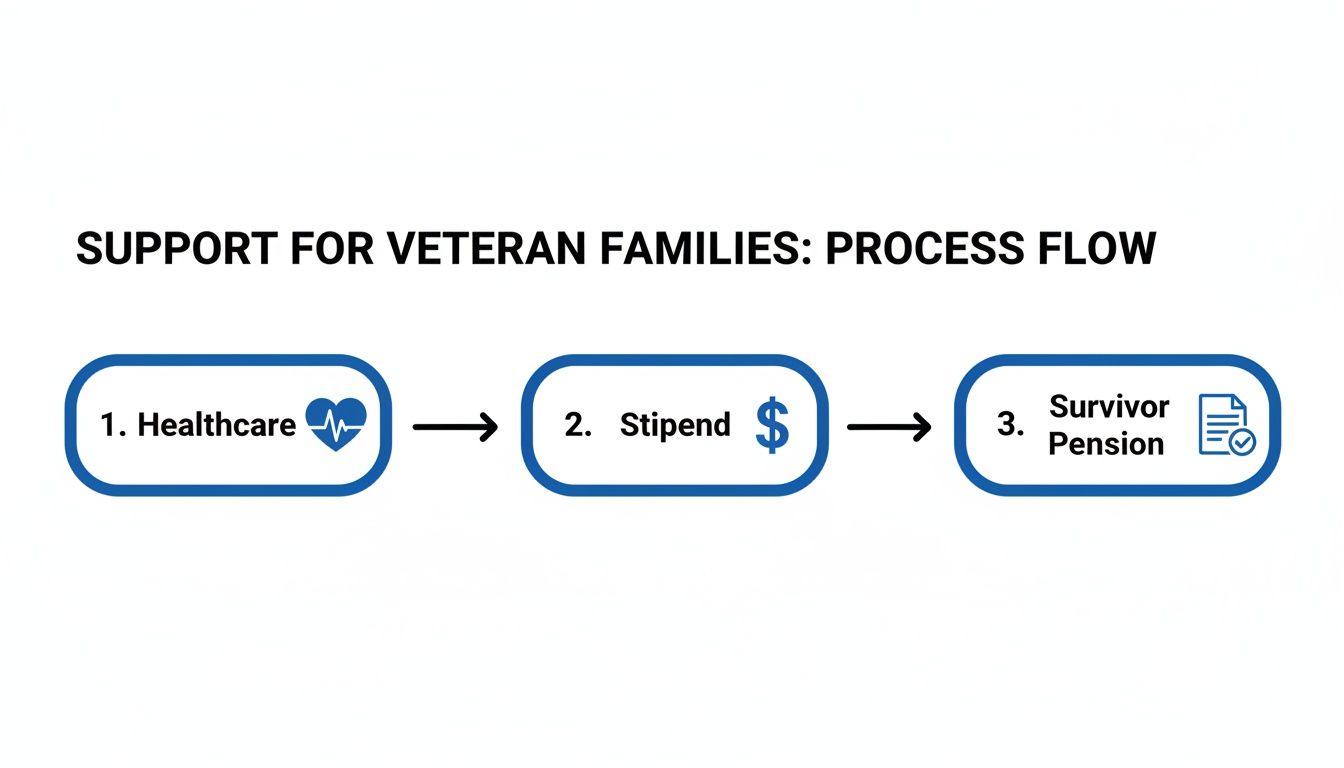

The support available to veteran families is broad, covering everything from healthcare and financial help to survivor pensions.

The VA aims to provide a continuum of care that addresses the health, financial, and long-term needs of the entire family unit.

Finding an Ally in the Process

Here's the good news: you don't have to do this alone. The VA accredits representatives from Veteran Service Organizations (VSOs) like the VFW, American Legion, and Disabled American Veterans. Think of these trained professionals as your advocates, and their services are completely free.

A VSO can help you:

- Figure out all the va benefits for elderly veterans you might be eligible for.

- Help you track down the documents you need.

- Look over your application for accuracy before you send it in.

- Talk to the VA on your behalf while you wait.

Working with a VSO is like having an experienced guide on a tough trail. They know the shortcuts, the pitfalls, and the best way to get you where you need to go. You can also find local resources, like the Harris County Precinct 2 Veteran Services Program, that offer direct help with claims.

Setting Realistic Expectations for Timelines

After you hit "submit," the waiting game begins. It's important to be realistic about how long this can take. Processing times can be all over the map depending on the type of benefit and how complicated your case is.

To help you manage expectations, here are some general estimates for how long it takes the VA to process common claims.

VA Benefit Application Timeline Estimates

| Benefit Type | Average Processing Time | Key Influencing Factors |

|---|---|---|

| Veterans Pension | 4-8 months | Completeness of the application, complexity of financial and medical information. |

| Aid & Attendance | 6-12 months | Requires detailed medical evidence from a physician confirming the need for daily assistance. |

| Disability Comp | 3-6 months | Depends on the number of disabilities claimed and the availability of service medical records. |

These timelines can shift based on the VA's current workload and the specific details of your file.

While you wait, make sure you respond immediately to any requests for more information from the VA. At Forest Cottage Senior Care, we know how daunting this process is. That's why we stand by our veterans, often covering the legal fees needed to help them access the benefits they've rightfully earned. We want to make this complicated journey just a little bit easier.

Common Questions About VA Benefits for Seniors

Even after you get a handle on the major programs, it's natural to have more specific questions. The world of VA benefits has a lot of little details, and getting clear, direct answers is the only way to make confident decisions for your family's future.

Let's tackle some of the most common questions we hear from veterans and their families. Our goal is to give you straightforward answers that make sense in the real world, especially when you're planning for senior long-term care.

Can I Use VA Benefits to Pay for Assisted Living?

Yes, absolutely. This is one of the most powerful ways VA benefits help elderly veterans. The VA Pension, especially with the Aid & Attendance allowance added on, is designed specifically for this purpose—to help veterans afford the high cost of long-term care like assisted living.

The monthly, tax-free check you receive can go directly toward room and board, help with daily tasks, and medication management. To get approved, you'll need to show the VA documentation from the assisted living community detailing these costs and confirming your need for that daily support. The key is proving that these medical expenses bring your "countable income" below the VA's annual limit.

What Is the Difference Between VA Disability and VA Pension?

This is a huge point of confusion, and it's vital to understand the distinction. Both programs provide monthly payments, but they serve completely different purposes and have their own set of rules.

-

VA Disability Compensation: Think of this as a benefit earned because of an injury or illness that was caused or worsened by your military service. It is not based on your income. The payment amount is tied to a disability rating (from 10% to 100%) that the VA assigns based on how severe your condition is.

-

VA Pension: This is a needs-based benefit. It's for wartime veterans with limited income who are either over 65 or have a permanent and total disability. You don't need a service-connected disability to qualify, but you absolutely have to meet the strict financial requirements.

In most cases, a veteran can't receive both benefits at once. If you happen to qualify for both, the VA will pay you whichever one gives you the higher monthly amount.

Will My Savings Disqualify Me from the VA Pension?

Not necessarily. It's a common fear that a lifetime of careful saving will prevent a veteran from getting this needs-based help, but the rules are more forgiving than you might think. The VA does look at your annual income and your total assets (what they call "net worth").

Here's the important part: the VA lets you subtract your unreimbursed medical expenses from your gross income. For seniors, these costs—assisted living fees, prescription co-pays, in-home care—can be massive. Subtracting these expenses often brings your "countable income" down low enough to meet the VA's threshold, even if your retirement income seems high at first. This is why tracking every single medical expense is critical for a successful application.

What Happens to VA Benefits After a Veteran Passes Away?

When a veteran passes on, the VA's support doesn't always stop. Certain benefits can continue for their surviving spouse or dependent children, providing a crucial safety net during an incredibly difficult time.

The two main financial programs for survivors are:

- Dependency and Indemnity Compensation (DIC): A tax-free monthly benefit for eligible survivors of a veteran whose death was related to their service.

- Survivors Pension: A needs-based program for low-income surviving spouses and dependent children of deceased wartime veterans.

Beyond financial help, the VA also provides burial and memorial benefits to honor the veteran's service. This can include a burial allowance for funeral costs, a plot in a VA national cemetery, a government headstone or marker, and a Presidential Memorial Certificate. It's so important for families to contact the VA quickly to see what support they're eligible for. If you have more questions, our team has also compiled answers to other common inquiries, which you can find by reviewing our frequently asked questions page.

At Forest Cottage Senior Care, we are deeply committed to helping our nation's heroes access the support they have earned. We understand that navigating the application process can be challenging, which is why we often cover the legal fees required to help our resident veterans secure their VA benefits. Let us help you and your family begin a brighter, more supported chapter. Learn more at https://www.forestcottageseniorcare.com.