Absolutely. Several veterans benefits for assisted living can make a world of difference, mainly through the VA Pension program and its special monthly allowances. These benefits, especially the well-known Aid & Attendance benefit, can provide thousands of dollars each month to help wartime veterans and their surviving spouses pay for the daily care they need.

Funding Assisted Living with Veterans Benefits

Think of the benefits you earned through service as a dedicated support fund, ready to be accessed when you need a hand with daily life. For many families starting to look at senior care, discovering these financial programs is a complete game-changer. The path to securing these funds might look a little complicated at first, but just getting a handle on the basics is a huge first step toward making assisted living more affordable.

The whole process boils down to a couple of key allowances. These are designed specifically to support veterans who need help with everyday activities like bathing, dressing, and managing medications—exactly the kind of services provided in an assisted living community.

Core Financial Support Programs

The two veterans benefits that have the biggest impact on assisted living costs are actually add-ons to the basic VA Pension. They aren't standalone programs. Instead, think of them as enhancements that increase your monthly payment based on your level of need.

- Aid & Attendance: This is the most common benefit families use for assisted living. It’s for veterans who require another person's help to handle personal tasks and daily functions safely.

- Housebound Allowance: This is for veterans who are mostly confined to their home or immediate surroundings because of a permanent disability.

The real key to navigating VA benefits is matching the veteran's specific care needs with the right financial program. It’s not about finding one single "assisted living benefit," but about unlocking the correct pension enhancement earned through service.

Understanding the Financial Impact

These benefits provide a significant, tax-free income stream every single month. The Department of Veterans Affairs recently increased these amounts. A single veteran who qualifies for Aid and Attendance can now receive up to $28,300 annually, which breaks down to about $2,358 per month. For a veteran with one dependent, that number climbs to $33,548 yearly.

This guide is designed to give you a clear roadmap, covering eligibility, the application steps, and all the financial requirements. While these federal benefits are fantastic, it's also smart to see how they stack up against other ways to pay for care. For example, our guide on long-term care insurance coverage for assisted living offers another perspective on planning for senior care expenses.

To simplify things, here's a quick look at the main VA benefits that can help with assisted living costs.

| Key VA Benefits for Assisted Living at a Glance | ||

|---|---|---|

| VA Benefit Program | Primary Purpose | Ideal Candidate |

| VA Pension | Provides a baseline, needs-based income for wartime veterans with limited finances. | Low-income wartime veterans over 65 or those with a permanent disability. |

| Aid & Attendance | Increases the monthly pension for those needing help with daily activities. | Veterans requiring hands-on help with bathing, dressing, or mobility in an assisted living setting. |

| Housebound | Increases the pension for veterans largely confined to their homes due to disability. | Veterans who are homebound but may not need the full daily assistance required for Aid & Attendance. |

This table helps clarify how each piece of the puzzle fits together, from the foundational VA Pension to the specific add-ons that address higher care needs. Understanding these distinctions is the first step in building a solid financial plan for assisted living.

Understanding Aid and Attendance and Housebound Benefits

When families start looking into veterans benefits for assisted living, they’re almost always talking about two specific allowances that build on top of the basic VA Pension: Aid & Attendance and Housebound. These aren't separate programs you apply for from scratch. Instead, think of them as financial boosts added to an existing pension, triggered by a veteran’s specific health needs.

Imagine the basic VA Pension as the foundation of a house. Aid & Attendance and Housebound are like adding a new wing or a accessibility ramp—they provide extra support right where it's needed most. Figuring out which one fits your loved one's situation is the key to unlocking the right amount of help.

Aid and Attendance Explained

For families considering assisted living, the Aid & Attendance benefit is usually the most relevant—and powerful—tool in the VA toolbox. Its purpose is simple: to give extra financial help to veterans who need another person's assistance to manage their Activities of Daily Living (ADLs). This lines up perfectly with the kind of support an assisted living community provides.

This benefit is specifically for veterans who, because of physical limitations or cognitive decline, need hands-on help with the everyday tasks most of us don't think twice about. The VA has a clear checklist of clinical needs to see if a veteran qualifies for this higher level of support.

To get the Aid & Attendance allowance, a veteran must first be eligible for a VA Pension and then meet at least one of these conditions:

- Needs help with daily activities like bathing, getting dressed, eating, or using the restroom.

- Is bedridden, meaning they are mostly confined to their bed because of a disability.

- Is in a nursing home due to mental or physical challenges.

- Has severe vision problems, like corrected vision of 5/200 or less in both eyes, or a very limited field of vision (5 degrees or less).

The whole idea behind Aid & Attendance is straightforward: if a veteran’s condition means they have to depend on someone else for basic personal care, the VA steps in with more funds to help cover that essential support.

Housebound Benefits Explained

The Housebound benefit is a middle ground between the basic pension and the full Aid & Attendance allowance. It’s for veterans whose permanent disability is severe enough to keep them largely confined to their home.

A veteran who qualifies for Housebound benefits might still be able to handle their own personal care, like dressing and bathing. The defining factor is that their condition makes it impossible to leave home without help.

It's crucial to know that a veteran cannot receive both Aid & Attendance and Housebound benefits at the same time. The VA will always grant the one that pays more, which is nearly always Aid & Attendance.

The financial help from these benefits can be a game-changer, making quality care much more affordable. Projections for 2026 show just how significant this can be. A single veteran receiving the VA Pension with Aid & Attendance could get $29,091 per year ($2,424 monthly), and a veteran with a spouse could receive up to $34,486 ($2,873 monthly). These tax-free payments are designed to help wartime veterans who need regular assistance, making the move to an assisted living community much more manageable.

Knowing the difference between these benefits is the first step. The next is understanding how they connect to the care provided in a community like ours. You can see how our assisted living services at Forest Cottage Senior Care are designed to meet the very needs these VA programs cover. This knowledge empowers you to build the strongest possible case for the benefits your loved one has earned through their service.

Comparing VA Pension and Disability Compensation

When you start digging into veterans benefits for assisted living, two big programs always come up: VA Pension and VA Disability Compensation. It’s easy to get them mixed up, but they’re built on completely different foundations. Getting this distinction right is the first, most critical step in finding the financial help your loved one needs.

Here's a simple way to think about it: VA Pension is a financial safety net for wartime vets with limited resources. On the other hand, VA Disability Compensation is more like an insurance payment for injuries that happened during service. One is based on need, the other is based on what happened while they served.

The Needs-Based Safety Net: VA Pension

The VA Pension is the program that opens the door to other benefits like Aid & Attendance and Housebound. It’s entirely needs-based, which is just the VA’s way of saying that eligibility comes down to a veteran’s income and net worth. It was created to make sure wartime veterans don’t slip into poverty as they get older, especially when faced with crushing medical bills from things like assisted living.

To even get in the door for a VA Pension, a veteran has to check three boxes:

- Service: They needed to have served at least 90 days of active duty, with at least one of those days falling during a wartime period.

- Financial Need: Their "countable" income and net worth must be below a limit set by Congress each year.

- Age or Disability: They have to be 65 or older, or be considered permanently and totally disabled.

The most important thing to grasp here is that this pension has nothing to do with a service-connected injury. A veteran could have served during a designated wartime period, come home without a scratch, and still qualify decades later if their finances and health needs line up. For most wartime veterans, this is the main path to getting help paying for assisted living.

A lot of families think you have to be completely broke to qualify for the pension, but that's a huge misconception. The VA lets you subtract unreimbursed medical expenses—and yes, that includes the full cost of assisted living—from your income. This simple calculation is what helps so many families meet the financial requirements.

The Earned Benefit: VA Disability Compensation

Now, let's flip the coin. VA Disability Compensation is a tax-free monthly payment for veterans who got sick or were injured while on active duty. This benefit is not needs-based at all. A veteran’s bank account or income has zero bearing on whether they qualify or how much they receive.

The payment amount is tied directly to a "disability rating" the VA assigns, which can range from 10% to 100%. The higher the rating, the more severe the disability, and the larger the monthly check. These funds are unrestricted, meaning they can be used for anything, including covering the costs of what assisted living is and all the care that comes with it.

Just to give you an idea of how powerful this benefit can be, recent cost-of-living adjustments mean a veteran with a 100% disability rating now gets $3,737.85 every month. Even a 50% rating brings in a helpful $1,075.16 per month, which can absolutely take the pressure off an assisted living bill. You can learn more about how these updated numbers help cover care costs by checking out the 2025 VA benefits update.

One final, crucial point: a veteran typically can't get both VA Pension and Disability Compensation at the same time. If they happen to qualify for both, the VA will pay out whichever benefit is higher. For veterans with serious service-connected disabilities, that’s almost always going to be the disability compensation.

Your Step-by-Step Guide to the VA Application Process

Trying to figure out the paperwork for veterans benefits for assisted living can feel like a mountain of a task. I get it. But you can absolutely get through it by taking it one step at a time. Think of it like putting together a puzzle—each document you find is another piece that gets you closer to the full picture and the support your loved one has earned.

The best advice I can give is to be organized right from the start. Taking a methodical approach will save you headaches down the road and can actually speed things up once the VA starts reviewing your application. Giving them a complete, clean package makes their job easier, which is good for everyone.

Gathering Your Essential Documents

Before you even think about filling out a single form, the first job is to gather all the necessary paperwork. This is the foundation of your entire claim. Having everything ready to go will make all the other steps feel much less intimidating.

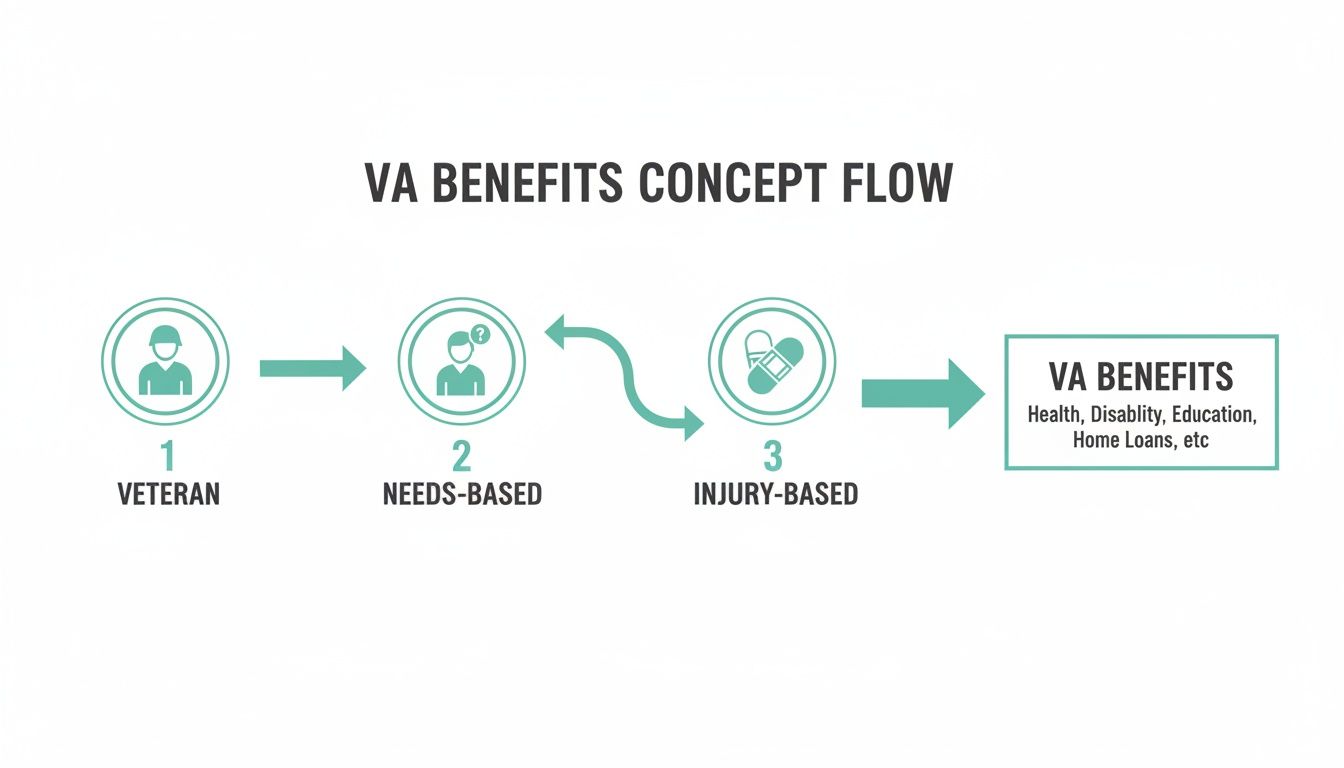

This flowchart shows how a veteran's journey splits into either needs-based benefits, like the pension we're discussing, or injury-based compensation.

It helps to see that the path to funding assisted living really depends on whether the veteran’s eligibility is based on their financial need or a disability connected to their service.

Tackling the paperwork for a VA benefits application can feel overwhelming, but a checklist makes it manageable. Here’s a breakdown of the must-have documents to get you started.

| Document Category | Specific Items Needed | Pro Tip |

|---|---|---|

| Military Service | DD-214 (or equivalent discharge papers). This is non-negotiable. | If you can't find the original, you can request a copy from the National Archives. Start this process early as it can take time. |

| Personal Info | Veteran's birth certificate & Social Security number, marriage certificate (if applicable). | Keep these together in one folder so you're not scrambling to find them later. Make digital scans as backups. |

| Financials (Income) | Statements for Social Security, pensions, IRAs, annuities, or any other source of regular income. | The VA looks at gross income, so gather statements that clearly show the total amount before any deductions. |

| Financials (Assets) | Recent bank statements (checking & savings), records of stocks, bonds, mutual funds, and other investments. | Be thorough. The VA needs a complete financial picture to confirm eligibility. Don't leave anything out. |

| Medical Needs | A signed physician's statement detailing the medical conditions and confirming the need for daily assistance. | This is where VA Form 21-2680 comes in. Ask the doctor to be very specific about the need for help with bathing, dressing, eating, etc. |

| Medical Expenses | Receipts and records for all unreimbursed medical costs (assisted living fees, co-pays, prescriptions, home health care, etc.). | This is how you "spend down" income. Keep a running tally and save every single receipt—it all adds up. |

Having these documents organized before you begin the application will make the entire process smoother and can help avoid delays from the VA asking for more information.

Completing and Submitting the Application

With your documents in order, it's time to tackle the application itself. The main form is VA Form 21P-527EZ, which is the "Application for Pension." If you're also applying for the extra monthly payments for Aid & Attendance or Housebound, you'll need to include that physician's statement on VA Form 21-2680.

Pro Tip: Before you mail anything or hit "submit," make copies of every single page. All of them. Keep a physical or digital copy of the entire package you send to the VA. This is your personal backup and an easy way to reference things if the VA calls with a question.

You’ve got a few ways to get your application to the VA:

- Online: This is usually the fastest and most direct route.

- By Mail: You can mail the application to the Pension Management Center (PMC) that handles claims for your state.

- In Person: A visit to a local VA regional office is another option.

- With Help: An accredited Veterans Service Officer (VSO) can help you prepare and file the application, and their services are completely free.

Managing Expectations During the Waiting Period

Once you've submitted the application, the waiting begins. Be prepared for this part to take a while. VA processing times can stretch for several months. It’s a good idea to keep a simple log of any calls or letters to and from the VA—just note the date and what was discussed.

If the claim is approved, there’s a silver lining to the wait. Payments are often retroactive to the month after you filed. That means you could get a lump-sum payment to cover the months you were waiting for the decision.

What if the claim is denied? Don't give up. It’s common for initial applications to be denied, often for something as simple as a missing document. You have the right to appeal. This is where having an expert in your corner can make all the difference.

At Forest Cottage Senior Care, we help families find the right people to navigate the VA system and can even help cover legal fees. We believe every veteran in our community deserves the benefits they've earned. To learn about other ways we help our families, check out our resident resource center.

How to Avoid Common Application Mistakes

Knowing the steps to apply for veterans benefits for assisted living is a great start, but steering clear of the common pitfalls is what truly separates an approved claim from a denied one. The application process is packed with details, and even small errors can lead to frustrating delays or an outright rejection.

Think of it like filing your taxes. A simple miscalculation or a forgotten document can create major headaches down the road. By understanding where others have stumbled, you can put together a much stronger, cleaner application that sails through the system.

Misunderstanding Financial Eligibility

One of the biggest hurdles families run into is misinterpreting the VA’s financial rules, especially the limits on income and net worth. A lot of people mistakenly assume a veteran has to be nearly penniless to qualify, but that’s just not true.

The most common mistake? Not deducting all allowable medical expenses from the veteran's income. The VA lets you subtract unreimbursed medical costs—and the monthly bill for assisted living is a huge one—from your gross income. This simple calculation is the key that unlocks eligibility for so many veterans who would otherwise be over the income limit.

Another frequent trip-up involves asset transfers. The VA has a three-year look-back period for any assets that were gifted or sold for less than they were worth. Giving away money or property to family to try and get under the net worth limit can trigger a penalty period, making the veteran ineligible for benefits for a length of time.

Submitting Insufficient Medical Evidence

The second major pitfall is failing to provide strong enough medical proof that the veteran actually needs daily assistance. Just saying your loved one needs care won't cut it; you have to back it up with clear, detailed evidence from a doctor.

The success of your application often hangs on the quality of VA Form 21-2680, the Physician’s Statement. A vague or incomplete form is an immediate red flag for the VA.

To avoid this, make sure the doctor:

- Is specific about ADLs: The form needs to spell out which Activities of Daily Living (ADLs)—like bathing, dressing, eating, or getting around—the veteran can't manage without help.

- Connects conditions to care needs: It should draw a direct line from the veteran's medical diagnoses to why they need a protected environment like assisted living.

- Uses clear language: Medical jargon should be avoided when possible. The statement needs to be easy for a VA reviewer to understand at a glance.

An application without a detailed, compelling physician's statement is like a ship without a rudder. It lacks the direction and proof needed to reach its destination—an approved claim for benefits.

Preparing a Well-Developed Claim

The single best way to sidestep these mistakes is to submit what the VA calls a "fully developed claim." This just means you provide all the necessary evidence right from the start, leaving no questions for the reviewer to ask.

- Don't hide assets: Be completely transparent about all income and assets. The VA will verify this information anyway, and finding discrepancies will only slow things down.

- Document everything: Keep meticulous records of all medical expenses. Every co-pay, prescription, and assisted living invoice helps build your case and justify your deductions.

- Seek expert guidance: You don't have to go it alone. Accredited Veterans Service Officers (VSOs) offer free, expert assistance. An elder law attorney can also be invaluable for navigating complex financial situations.

At Forest Cottage Senior Care, we understand just how vital these benefits are. That’s why we help our residents connect with professionals and can even cover the legal fees associated with securing the VA support they’ve rightfully earned.

Exploring State Veteran Programs and Other Financial Aid

While federal VA benefits like Aid & Attendance are a powerful resource, they're often just one piece of the financial puzzle. Many families don’t realize that veterans benefits for assisted living extend far beyond Washington D.C. A variety of state-level programs exist, offering a crucial layer of support that can make a huge difference.

Federal benefits are designed to be the same no matter where you live, but state-sponsored assistance can vary wildly from one state to another. It's always worth digging into what your specific state offers. This extra bit of research can uncover some incredibly valuable resources that fit perfectly with your federal aid.

State-Specific Financial Assistance

Many states run their own programs specifically to support the veterans living within their borders. This help comes in all sorts of forms, and while some programs might not pay for assisted living directly, they can free up a family's funds that can then be used for care.

These programs often include things like:

- State-Run Veterans Homes: Some states manage their own long-term care facilities for veterans. These homes frequently offer skilled nursing or assisted living services at a cost that’s significantly lower than private options.

- Property Tax Exemptions: A lot of states provide property tax waivers or reductions for veterans, especially those with disabilities. This can easily save a family thousands of dollars every year.

- Grants and Special Funds: You might find that a state has special grants available for veterans facing financial hardship. These funds can often be applied toward essential needs like housing and healthcare.

Think of building a financial plan like making a layer cake. Federal VA benefits are the strong base, state programs are the substantial second layer, and other aid like Medicaid forms the final tier, all working together to create a complete support system.

Combining VA Benefits with Medicaid

For some veterans, even with the help of a VA Pension, the cost of assisted living can still feel out of reach. This is where other programs, like Medicaid, can step in to fill the remaining financial gap. Layering benefits is a common and surprisingly effective strategy.

A veteran can often receive both a VA Pension and Medicaid benefits at the same time, but the rules for how they interact are tricky. Typically, the VA Pension is counted as income by Medicaid, which can impact eligibility or how much assistance you receive. Understanding how to coordinate these two powerful programs is the key. To get a better sense of how this works, you can learn more about how Medicaid covers assisted living costs in our detailed guide. With the right planning, you can make sure you're maximizing every available resource without accidentally jeopardizing your eligibility for another.

We Get a Lot of Questions About VA Benefits

When you start digging into veterans benefits for assisted living, it's natural for a lot of questions to pop up. Getting clear, honest answers is the first step toward feeling confident about your decisions. Let's tackle some of the most common things families ask when they're planning for senior care.

Can a Veteran Receive Both VA Pension and Disability?

This is a big point of confusion for many families, and the short answer is usually no. A veteran can't draw from both VA Disability Compensation and a VA Pension at the same time. Think of them as two different tools for two different jobs—one is for injuries connected to service, and the other is for financial need.

If a veteran happens to qualify for both, the Department of Veterans Affairs will simply pay out whichever benefit gives them the higher monthly amount. For veterans with a significant disability rating, that's almost always going to be their disability compensation.

Does the Assisted Living Community Have to Be a VA Facility?

Not at all. The assisted living community doesn't need any special VA affiliation. The money from a VA Pension with Aid & Attendance is paid directly to the veteran or their surviving spouse. You're then free to use those funds to pay for any licensed assisted living community you choose.

This is a huge advantage. It gives veterans and their families the power to pick a community that truly fits their needs, location, and personal preferences, rather than being stuck with a limited list of providers.

How Long Does the VA Application Process Take?

This is where you'll need some patience. The application process can take several months, and the timeline really depends on how complex the case is and what the VA's current backlog looks like. It’s smart to plan for a wait of anywhere from three to nine months, although sometimes it moves faster.

The good news? If your claim is approved, the payments are typically retroactive. That means you'll get a lump-sum payment to cover all the months you were waiting, going back to the month after you first filed your application.

What Happens to the Benefits if the Veteran Passes Away?

If a veteran who is receiving benefits passes away, their surviving spouse might be able to continue receiving a benefit known as the Survivors Pension. To qualify, the spouse needs to meet certain income and asset limits and must have been married to the veteran when they died.

If the surviving spouse also needs help with daily activities, they can apply for Aid & Attendance to add to their pension. This can make a huge difference in helping them afford their own care.

At Forest Cottage Senior Care, we believe in honoring our veterans by making the move to assisted living as seamless as possible. We connect our families with accredited professionals and even cover legal fees to make sure they get every benefit they've rightfully earned. To learn more about how our community supports veterans, visit us at https://www.forestcottageseniorcare.com.